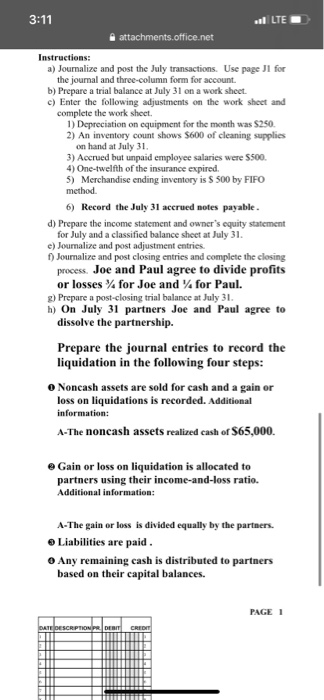

MERCHANDISING ACOUNTING Jos Blink an his brother opened in t hip Company Merchandising busines l y 1. The company applies the pipelinventory July Joe and Paul achieve 2000 china partnership 1 Purch d ie Bedie Coty for 5,000 under Credits of 11.00 single de July 2 Purchasedused truck free Care 5.30 paying S1000 cash and the balance 3.500 Rivera's Sold merchandise that Co for $9.000 de credit terms of FOB shipping p subject to a 9% estat e dated July 2 2 Received 59,054 in the formerchandise to take place July 12. 3 d Carter, Catowa 60-day 159 note to replace is esiting out page to Care 4 P512 foreiga be purchase of Moly Paid 2.800 cash o r poly effective July 4. Bink's moeda SI de 125 face value to Forest Hills Bank and received 150.000 cash. Ther e annual interest payments each there Bank's pays the bes t Carter Ar Bank Bir The te bars are 75. per X Sed merchandisha for $1.500 cash ping po r a 12 Sold merchandie Ca for 9.000 cash levske dated July 12 beta les 15 link's weekly payroll of t h te ELC.A. and Medicare (48%). federal (8.8%) and state (0%) tares, with income tax withholding S14 and union of dedected Jurnal entry to worries and was paid. 17 Biak's purchased a platfor 18 Per b and Cum for SA, der af 115.30. O ship dewly te 19. Hochd. in take place on August 10. Paid $100 asando Sold merchandise that Ca for $7.000 de credit forms of HOFOB shipping t subject to a 9% sales tax. Crack o dated July 31, 25. Beden Red 5100 credendum for the round part of the merchandise puede ser Check for the Read the balanced in vice died October 7.net of the Discount 3:02 el LTE attachments.office.net pun the then Joe and Parallagree to divide profits er les for Joe and for el July 1 pard Prepare the journal entries to record the liquidation is the following for p The cash astra .000 Ga s sgaldati allocated partners using th e me and less ruti L es are paid 3:11 I LIE attachments.office.net MERCHANDISING ACOUNTING Joe Blink an his brother Paul opened Blink's Partnership Company Merchandising business on July 1. The company applies the perpetual inventory system July 1 Joe and Paul each invest $70,000 cash in a new partnership 1 Purchased merchandise form Boden Company for $8,000 under credit terms of 1/15,n30, FOB shipping point, invoice dated July 2 Purchased used truck from Carter for $8,000, paying $3,000 cash and the balance On account Sold merchandise that cost $3.500 to Rivera's Co. for $9,000 under credit terms of 2/10, 11/60 FOB shipping point, Invoice dated July 2 subject to a 9% sales tax. 2 Received 89,054 in advance for merchandise to take place on July 12. 3 Bink's asked Carter, Co. to accept a 60-day, 15% note to replace its existing account payable to Carter. 4. Paid $125 cash for freight charges on the purchase of July 1 4. Paid $2,800 cash on one-year insurance policy effective July 1. 4- Bink's issued a $150,000, 4-year, 12% note at face value to Forest Hills Bank and received $150,000 cash. The note requires annual interest payments each December 31. 5. Bink's pays the note plus interest to Carter. (July 3) 6 Bink's borrows $75,000 from American Bank. The note bears interest at 9% per year. Principal and interest are due in 30 days. 8 Sold merchandise that cost $800 to customers for $1,500 cash, FOB shipping point Invoice dated July 12, subject to a 9% sales tax. Sold merchandise that cost $7,000 to Rivera's Co. for $9.000 cash received on July 2 Invoice dated July 12, subject to a 9% sales 15 Bink's weekly payroll of $30,000 entirely subject to F.L.C.A. and Medicare (7.65%), federal (0.8%) and state (4%) unemployment taxes, with income tax withholding of $1,420 and union dues of $99 deducted. Journal entry to record salaries and wages paid 3:11 I LIE attachments.office.net 17 Bink's purchased a patent for $20,000. 18 Purchased merchandise form Boden Company for 58,000 under credit terms of 1/15, 30, FOB shipping point, invoice dated July 19. Received $6,000 in advance merchandise to take place on August 10. 21 Paid $100 gas and oil for month. 21 Sold merchandise that cost $4,800 to Creek Co, for $7,000 under credit terms of 2/10, n/60 FOB shipping point, Invoice dated July 31, subject to a 9% sales tax. 25. Received a $300 credit memorandum form Boden Co. for the return of part of the merchandise purchased on October 18. 27. Received the balance due from Creek Co. for the invoice dated October 7, net of the Discount 30. $1,000 Paid part-time receptionist for two weeks 'salary, Bink's weekly payroll of $30,000 entirely subject to E.L.C.A. and Medicare (7.65%). federal (0.8%) and state (4%) unemployment taxes. Journal entry to record employer payroll taxes. 3 Each partner withdrew $800 cash for personal use. Instructions: a) Journalize and post the July transactions. Use page Jl for the journal and three-column form for account. b) Prepare a trial balance at July 31 on a work sheet. c) Enter the following adjustments on the work sheet and complete the work sheet. 1) Depreciation on equipment for the month was $250. 2) An inventos con sus se of cleaning supplies 3:11 l LTE attachments.office.net Instructions: a) Joumalize and post the July transactions. Use page Jl for the joumal and three-column form for account. b) Prepare a trial balance at July 31 on a worksheet. c) Enter the following adjustments on the work sheet and complete the work sheet. 1) Depreciation on equipment for the month was $250. 2) An inventory count shows $600 of cleaning supplies on hand at July 31 3) Accrued but unpaid employee salaries were $500. 4) One-twelfth of the insurance expired. 5) Merchandise ending inventory is S 500 by FIFO method. 6) Record the July 31 accrued notes payable. d) Prepare the income statement and owner's equity statement for July and a classified balance sheet at July 31. e) Journalize and post adjustment entries. f) Journalize and post closing entries and complete the closing process. Joe and Paul agree to divide profits or losses for Joe and 4 for Paul. g) Prepare a post-closing trial balance at July 31. h) On July 31 partners Joe and Paul agree to dissolve the partnership. Prepare the journal entries to record the liquidation in the following four steps: o Noncash assets are sold for cash and a gain or loss on liquidations is recorded. Additional information: A-The noncash assets realized cash of $65,000. e Gain or loss on liquidation is allocated to partners using their income-and-loss ratio. Additional information: A-The gain or loss is divided equally by the partners. Liabilities are paid. Any remaining cash is distributed to partners based on their capital balances. PAGE 1 MERCHANDISING ACOUNTING Jos Blink an his brother opened in t hip Company Merchandising busines l y 1. The company applies the pipelinventory July Joe and Paul achieve 2000 china partnership 1 Purch d ie Bedie Coty for 5,000 under Credits of 11.00 single de July 2 Purchasedused truck free Care 5.30 paying S1000 cash and the balance 3.500 Rivera's Sold merchandise that Co for $9.000 de credit terms of FOB shipping p subject to a 9% estat e dated July 2 2 Received 59,054 in the formerchandise to take place July 12. 3 d Carter, Catowa 60-day 159 note to replace is esiting out page to Care 4 P512 foreiga be purchase of Moly Paid 2.800 cash o r poly effective July 4. Bink's moeda SI de 125 face value to Forest Hills Bank and received 150.000 cash. Ther e annual interest payments each there Bank's pays the bes t Carter Ar Bank Bir The te bars are 75. per X Sed merchandisha for $1.500 cash ping po r a 12 Sold merchandie Ca for 9.000 cash levske dated July 12 beta les 15 link's weekly payroll of t h te ELC.A. and Medicare (48%). federal (8.8%) and state (0%) tares, with income tax withholding S14 and union of dedected Jurnal entry to worries and was paid. 17 Biak's purchased a platfor 18 Per b and Cum for SA, der af 115.30. O ship dewly te 19. Hochd. in take place on August 10. Paid $100 asando Sold merchandise that Ca for $7.000 de credit forms of HOFOB shipping t subject to a 9% sales tax. Crack o dated July 31, 25. Beden Red 5100 credendum for the round part of the merchandise puede ser Check for the Read the balanced in vice died October 7.net of the Discount 3:02 el LTE attachments.office.net pun the then Joe and Parallagree to divide profits er les for Joe and for el July 1 pard Prepare the journal entries to record the liquidation is the following for p The cash astra .000 Ga s sgaldati allocated partners using th e me and less ruti L es are paid 3:11 I LIE attachments.office.net MERCHANDISING ACOUNTING Joe Blink an his brother Paul opened Blink's Partnership Company Merchandising business on July 1. The company applies the perpetual inventory system July 1 Joe and Paul each invest $70,000 cash in a new partnership 1 Purchased merchandise form Boden Company for $8,000 under credit terms of 1/15,n30, FOB shipping point, invoice dated July 2 Purchased used truck from Carter for $8,000, paying $3,000 cash and the balance On account Sold merchandise that cost $3.500 to Rivera's Co. for $9,000 under credit terms of 2/10, 11/60 FOB shipping point, Invoice dated July 2 subject to a 9% sales tax. 2 Received 89,054 in advance for merchandise to take place on July 12. 3 Bink's asked Carter, Co. to accept a 60-day, 15% note to replace its existing account payable to Carter. 4. Paid $125 cash for freight charges on the purchase of July 1 4. Paid $2,800 cash on one-year insurance policy effective July 1. 4- Bink's issued a $150,000, 4-year, 12% note at face value to Forest Hills Bank and received $150,000 cash. The note requires annual interest payments each December 31. 5. Bink's pays the note plus interest to Carter. (July 3) 6 Bink's borrows $75,000 from American Bank. The note bears interest at 9% per year. Principal and interest are due in 30 days. 8 Sold merchandise that cost $800 to customers for $1,500 cash, FOB shipping point Invoice dated July 12, subject to a 9% sales tax. Sold merchandise that cost $7,000 to Rivera's Co. for $9.000 cash received on July 2 Invoice dated July 12, subject to a 9% sales 15 Bink's weekly payroll of $30,000 entirely subject to F.L.C.A. and Medicare (7.65%), federal (0.8%) and state (4%) unemployment taxes, with income tax withholding of $1,420 and union dues of $99 deducted. Journal entry to record salaries and wages paid 3:11 I LIE attachments.office.net 17 Bink's purchased a patent for $20,000. 18 Purchased merchandise form Boden Company for 58,000 under credit terms of 1/15, 30, FOB shipping point, invoice dated July 19. Received $6,000 in advance merchandise to take place on August 10. 21 Paid $100 gas and oil for month. 21 Sold merchandise that cost $4,800 to Creek Co, for $7,000 under credit terms of 2/10, n/60 FOB shipping point, Invoice dated July 31, subject to a 9% sales tax. 25. Received a $300 credit memorandum form Boden Co. for the return of part of the merchandise purchased on October 18. 27. Received the balance due from Creek Co. for the invoice dated October 7, net of the Discount 30. $1,000 Paid part-time receptionist for two weeks 'salary, Bink's weekly payroll of $30,000 entirely subject to E.L.C.A. and Medicare (7.65%). federal (0.8%) and state (4%) unemployment taxes. Journal entry to record employer payroll taxes. 3 Each partner withdrew $800 cash for personal use. Instructions: a) Journalize and post the July transactions. Use page Jl for the journal and three-column form for account. b) Prepare a trial balance at July 31 on a work sheet. c) Enter the following adjustments on the work sheet and complete the work sheet. 1) Depreciation on equipment for the month was $250. 2) An inventos con sus se of cleaning supplies 3:11 l LTE attachments.office.net Instructions: a) Joumalize and post the July transactions. Use page Jl for the joumal and three-column form for account. b) Prepare a trial balance at July 31 on a worksheet. c) Enter the following adjustments on the work sheet and complete the work sheet. 1) Depreciation on equipment for the month was $250. 2) An inventory count shows $600 of cleaning supplies on hand at July 31 3) Accrued but unpaid employee salaries were $500. 4) One-twelfth of the insurance expired. 5) Merchandise ending inventory is S 500 by FIFO method. 6) Record the July 31 accrued notes payable. d) Prepare the income statement and owner's equity statement for July and a classified balance sheet at July 31. e) Journalize and post adjustment entries. f) Journalize and post closing entries and complete the closing process. Joe and Paul agree to divide profits or losses for Joe and 4 for Paul. g) Prepare a post-closing trial balance at July 31. h) On July 31 partners Joe and Paul agree to dissolve the partnership. Prepare the journal entries to record the liquidation in the following four steps: o Noncash assets are sold for cash and a gain or loss on liquidations is recorded. Additional information: A-The noncash assets realized cash of $65,000. e Gain or loss on liquidation is allocated to partners using their income-and-loss ratio. Additional information: A-The gain or loss is divided equally by the partners. Liabilities are paid. Any remaining cash is distributed to partners based on their capital balances. PAGE 1