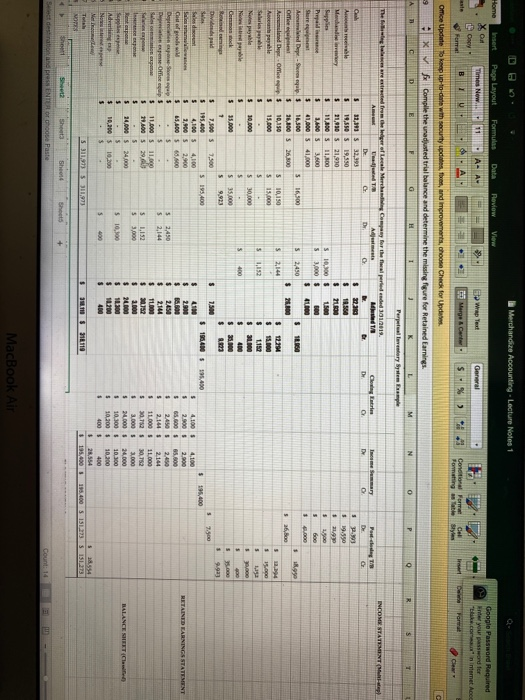

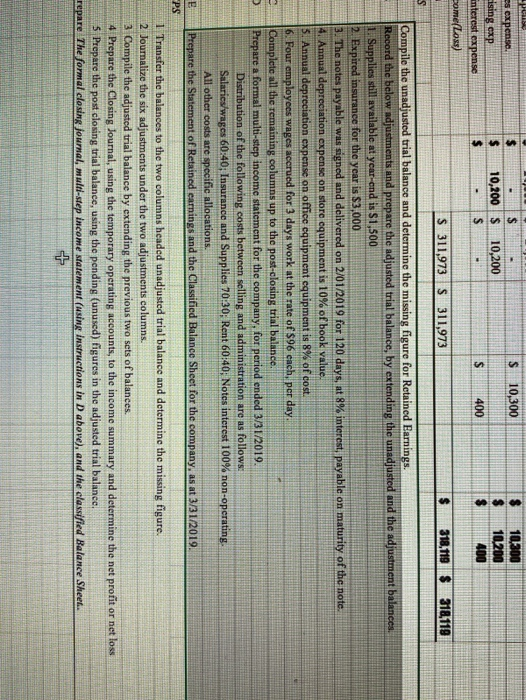

Merchandize Accounting - Lecture Notes 1 Page Layout Times New Formulas Data . A- AL Review View - 2 . Google Password Required Enter your password for Lo remet Acco Wap Test General Coy Format Merge Center 51% office Update ke up to me wh y es, and improvement, those check for Updates X x Compile the adjusted trial balance and determine the missing figure for Retained Earnings. DOHT her of Lale Merch wada Company for the fol d ed 1012019 Closing the 196,400. 195,400 4.100 S 4.100 RETAINED EARNINGS STATEMENT 5 5 $ 5 .00 24508 2.14 5.500 2.450 .725 0752 10.2003 10.200 S 31,3529 916119 $ 195,400 95.400 5 1233131273 2 Sheet She Sheets Count: 14 - MacBook Air es expense $ 10.300 10,300 10,200 ising exp $ 10.200 10,200 400 interCSExpense pome(Loss) S 311,973 S 311,973 $ 318,119 $ 318,119 Compile the unadjusted trial balance and determine the missing figure for Retained Earnings. Record the below adjustments and prepare the adjusted trial balance, by extending the unadjusted and the adjustment balai, 1. Supplies still available at year-end is S1,500 2. Expired insurance for the year is $3,000 3. The notes payable was signed and delivered on 2/01/2019 for 120 days, at 8% interest, payable on maturity of the note. 4. Annual depreciation expense on store equipment is 10% of book value. 5. Annual depreciation expense on office equipment equipment is 8% of cost. 6. Four employees wages accrued for 3 days work at the rate of $96 each, per day. Complete all the remaining columns up to the post-closing trial balance. Prepare a formal multi-step income statement for the company, for period ended 3/31/2019. Distribution of the following costs between selling and administration are as follows: Salaries/wages 60:40: Insurance and Supplies 70:30. Rent 60:40: Notes interest 100% non-operating All other costs are specific allocations. Prepare the Statement of Retained earnings and the Classified Balance Sheet for the company, as at 3/31/2019 "PS 1 Transfer the balances to the two columns headed unadjusted trial balance and determine the missing figure. 2 Journalize the six adjustments under the two adjustments columns 3. Compile the adjusted trial balance by extending the previous two sets of balances. 4 Prepare the closing Journal, using the temporary operating accounts, to the income summary and determine the net profit or net loss 5 Prepare the post closing trial balance, using the pending (unused) figures in the adjusted trial balance repare the formal closing journal, muld-step income statement (using instructions in D above), and the classified Balance Sheet Merchandize Accounting - Lecture Notes 1 Page Layout Times New Formulas Data . A- AL Review View - 2 . Google Password Required Enter your password for Lo remet Acco Wap Test General Coy Format Merge Center 51% office Update ke up to me wh y es, and improvement, those check for Updates X x Compile the adjusted trial balance and determine the missing figure for Retained Earnings. DOHT her of Lale Merch wada Company for the fol d ed 1012019 Closing the 196,400. 195,400 4.100 S 4.100 RETAINED EARNINGS STATEMENT 5 5 $ 5 .00 24508 2.14 5.500 2.450 .725 0752 10.2003 10.200 S 31,3529 916119 $ 195,400 95.400 5 1233131273 2 Sheet She Sheets Count: 14 - MacBook Air es expense $ 10.300 10,300 10,200 ising exp $ 10.200 10,200 400 interCSExpense pome(Loss) S 311,973 S 311,973 $ 318,119 $ 318,119 Compile the unadjusted trial balance and determine the missing figure for Retained Earnings. Record the below adjustments and prepare the adjusted trial balance, by extending the unadjusted and the adjustment balai, 1. Supplies still available at year-end is S1,500 2. Expired insurance for the year is $3,000 3. The notes payable was signed and delivered on 2/01/2019 for 120 days, at 8% interest, payable on maturity of the note. 4. Annual depreciation expense on store equipment is 10% of book value. 5. Annual depreciation expense on office equipment equipment is 8% of cost. 6. Four employees wages accrued for 3 days work at the rate of $96 each, per day. Complete all the remaining columns up to the post-closing trial balance. Prepare a formal multi-step income statement for the company, for period ended 3/31/2019. Distribution of the following costs between selling and administration are as follows: Salaries/wages 60:40: Insurance and Supplies 70:30. Rent 60:40: Notes interest 100% non-operating All other costs are specific allocations. Prepare the Statement of Retained earnings and the Classified Balance Sheet for the company, as at 3/31/2019 "PS 1 Transfer the balances to the two columns headed unadjusted trial balance and determine the missing figure. 2 Journalize the six adjustments under the two adjustments columns 3. Compile the adjusted trial balance by extending the previous two sets of balances. 4 Prepare the closing Journal, using the temporary operating accounts, to the income summary and determine the net profit or net loss 5 Prepare the post closing trial balance, using the pending (unused) figures in the adjusted trial balance repare the formal closing journal, muld-step income statement (using instructions in D above), and the classified Balance Sheet