Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mercier Manufacturing produces a plastic part in three sequential departments: Extruding, Fabricating, and Packaging. Mercier uses the weighted-average process costing method to account for

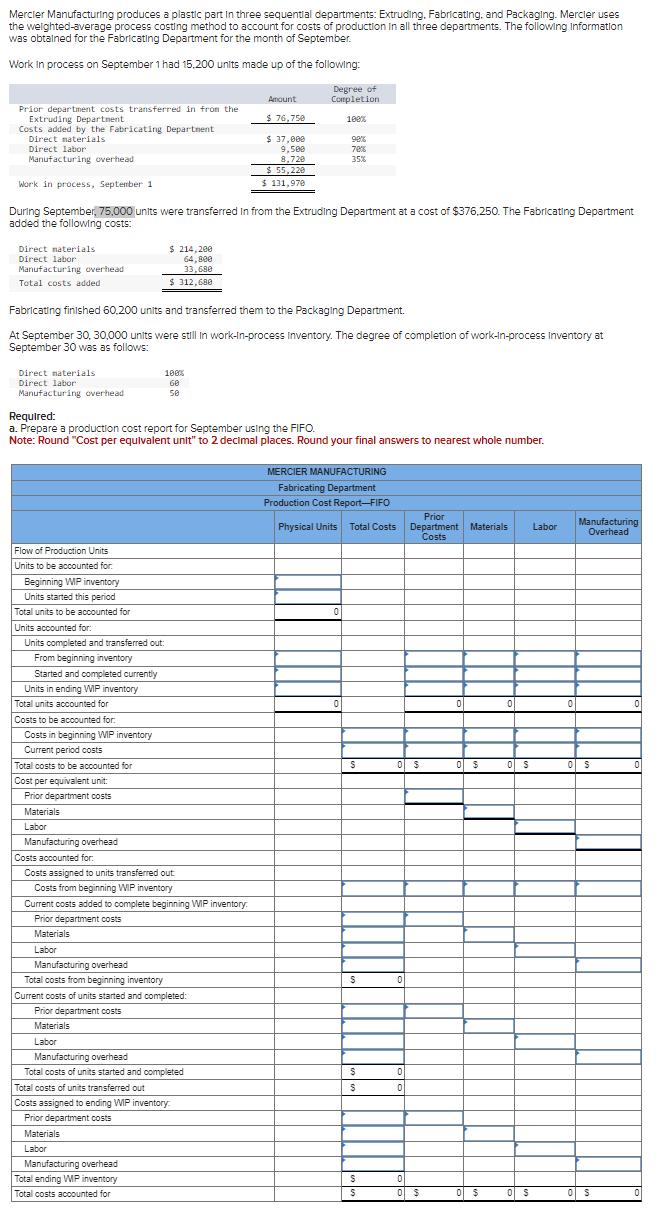

Mercier Manufacturing produces a plastic part in three sequential departments: Extruding, Fabricating, and Packaging. Mercier uses the weighted-average process costing method to account for costs of production in all three departments. The following Information was obtained for the Fabricating Department for the month of September. Work In process on September 1 had 15,200 units made up of the following: Prior department costs transferred in from the Extruding Department Costs added by the Fabricating Department Direct materials Direct labor Manufacturing overhead Work in process, September 1 Amount Degree of Completion $ 76,750 100% $ 37,000 98% 9,500 8,720 70% 35% $ 55,220 $ 131,970 During September, 75,000 units were transferred in from the Extruding Department at a cost of $376,250. The Fabricating Department added the following costs: Direct materials Direct labor Manufacturing overhead Total costs added $ 214,200 64,800 33,680 $ 312,680 Fabricating finished 60,200 units and transferred them to the Packaging Department. At September 30,30,000 units were still in work-in-process Inventory. The degree of completion of work-in-process Inventory at September 30 was as follows: Direct materials Direct labor 100% 60 Manufacturing overhead 50 Required: a. Prepare a production cost report for September using the FIFO. Note: Round "Cost per equivalent unit" to 2 decimal places. Round your final answers to nearest whole number. MERCIER MANUFACTURING Fabricating Department Production Cost Report-FIFO Flow of Production Units Units to be accounted for Beginning WIP inventory Units started this period Total units to be accounted for Units accounted for: Units completed and transferred out: From beginning inventory Started and completed currently Units in ending WIP inventory Total units accounted for Costs to be accounted for: Costs in beginning WIP inventory Current period costs Total costs to be accounted for Cost per equivalent unit: Prior department costs Materials Labor Manufacturing overhead Costs accounted for Costs assigned to units transferred out Costs from beginning WIP inventory Current costs added to complete beginning WIP inventory: Prior department costs Materials Labor Manufacturing overhead Total costs from beginning inventory Current costs of units started and completed: Prior department costs Materials Labor Manufacturing overhead Total costs of units started and completed Total costs of units transferred out Costs assigned to ending WIP inventory Prior department costs Materials Labor Manufacturing overhead Total ending WIP inventory Total costs accounted for Physical Units Total Costs Prior Department Materials Costs Labor Manufacturing Overhead 0 0 0 0 S 0 $ 0 $ 0 S 0 S S 0 $ 0 $ 0 S 0 S 0 $ $ 0 S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started