Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mercy, Nelly and Olive are in partnership sharing profits and losses equally after allowing for interest on capital at the rates of 5% per

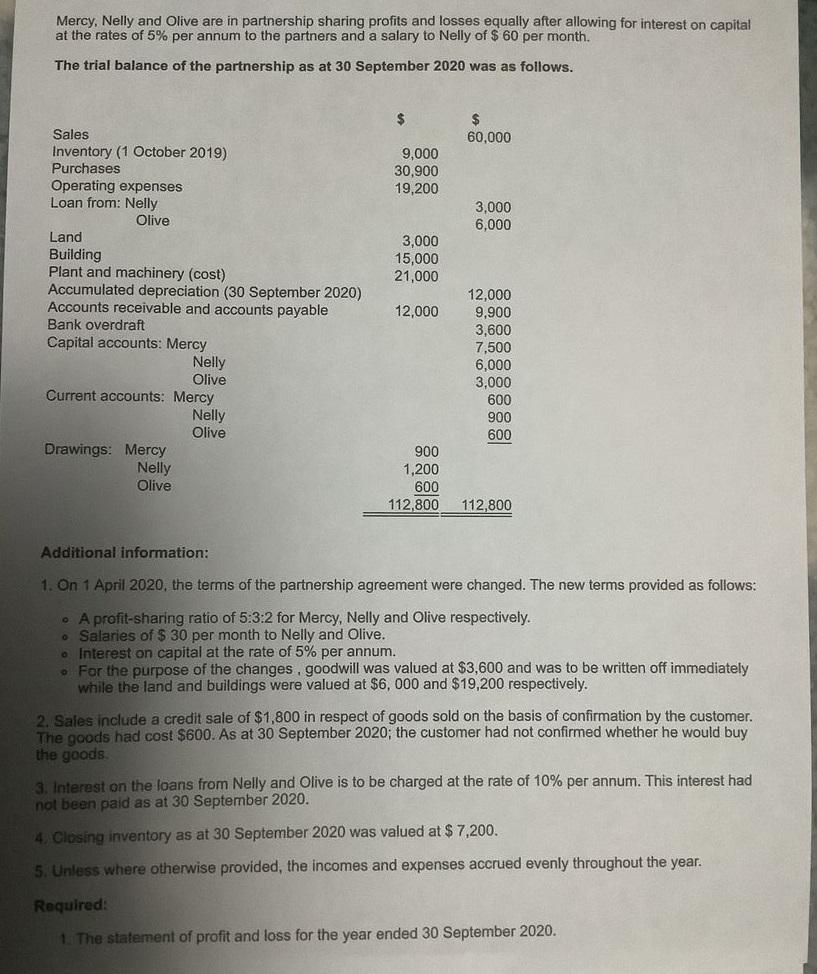

Mercy, Nelly and Olive are in partnership sharing profits and losses equally after allowing for interest on capital at the rates of 5% per annum to the partners and a salary to Nelly of $ 60 per month. The trial balance of the partnership as at 30 September 2020 was as follows. Sales Inventory (1 October 2019) Purchases Operating expenses Loan from: Nelly Olive Land Building Plant and machinery (cost) Accumulated depreciation (30 September 2020) Accounts receivable and accounts payable Bank overdraft Capital accounts: Mercy Nelly Olive Current accounts: Mercy Nelly Olive Drawings: Mercy Nelly Olive $ 9,000 30,900 19,200 3,000 15,000 21,000 12,000 900 1,200 600 112,800 $ 60,000 3,000 6,000 12,000 9,900 3,600 7,500 6,000 3,000 600 900 600 112,800 Additional information: 1. On 1 April 2020, the terms of the partnership agreement were changed. The new terms provided as follows: A profit-sharing ratio of 5:3:2 for Mercy, Nelly and Olive respectively. Salaries of $ 30 per month to Nelly and Olive. Interest on capital at the rate of 5% per annum. . For the purpose of the changes, goodwill was valued at $3,600 and was to be written off immediately while the land and buildings were valued at $6,000 and $19,200 respectively. 2. Sales include a credit sale of $1,800 in respect of goods sold on the basis of confirmation by the customer. The goods had cost $600. As at 30 September 2020; the customer had not confirmed whether he would buy the goods. 3. Interest on the loans from Nelly and Olive is to be charged at the rate of 10% per annum. This interest had not been paid as at 30 September 2020. 4. Closing inventory as at 30 September 2020 was valued at $ 7,200. 5. Unless where otherwise provided, the incomes and expenses accrued evenly throughout the year. Required: 1. The statement of profit and loss for the year ended 30 September 2020.

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the statement of profit and loss for the year ended September 30 2020 we can cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started