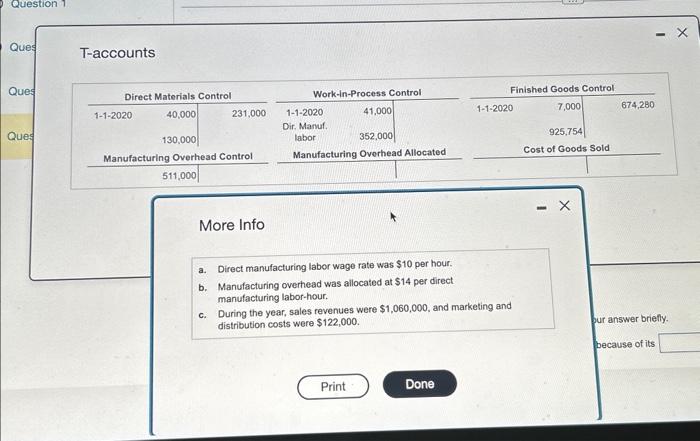

Merideth Company uses normal costing in its job-costing system. Partially completed T-accounts and additional information for Merideth for 2020 are as followeds:

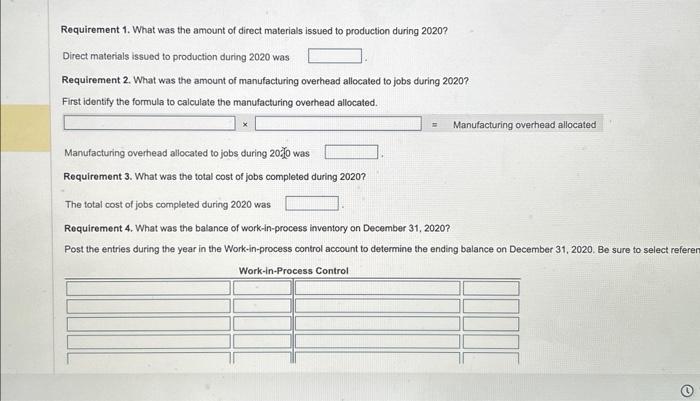

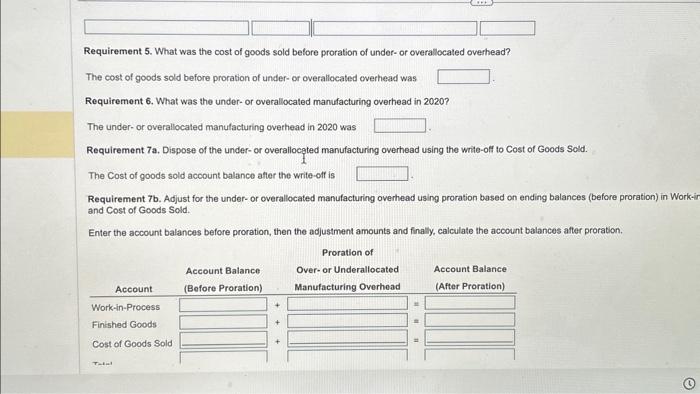

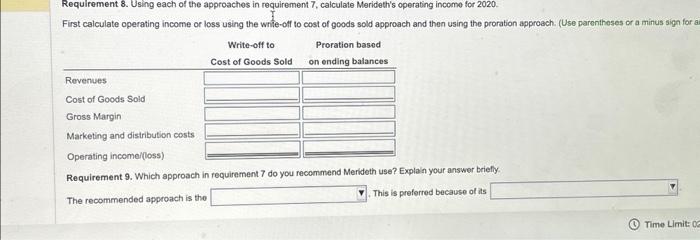

Requirement 1. What was the amount of direct materials issued to production during 2020 ? Direct materials issued to production during 2020 was Requirement 2. What was the amount of manufacturing overhead allocated to jobs during 2020 ? First identify the formula to calculate the manufacturing overhead allocated. Marnufacturing overhead allocated to jobs during 20%20 was Requirement 3. What was the total cost of jobs completed during 2020 ? The total cost of jobs completed during 2020 was Requirement 4. What was the balance of work-in-process inventory on December 31, 2020? Post the entries during the year in the Work-in-process control account to determine the ending balance on December 31,2020 , Be sure to select refere Requirement 5. What was the cost of goods sold before proration of under- or overallocated overhead? The cost of goods sold before proration of under- or overallocated overhead was Requirement 6 . What was the under- or overallocated manufacturing overhead in 2020 ? The under- or overallocated manufacturing overhead in 2020 was Requirement 7a. Dispose of the under- or overallocgted manufacturing overhead using the write-off to Cost of Goods Scid. The Cost of goods sold acoount balance atter the write-off is Requirement 7b. Adjust for the under- or overallocated manufacturing overhead using proration based on ending balances (before proration) in W. and Cost of Goods Sold. Enter the account balances before proration, then the adjustment amounts and finally, calculate the account balances after proration. Requirement 8. Using each of the approaches in requirement 7, calculate Merideth's operating income for 2020 . First calculate operating income or loss using the wrife-off to cost of goods sold approach and then using the proration approach. (Use parentheses or a minus sign for a Requirement 9. Which approach in requirement 7 do you recommend Merideth use? Explain your answer briefly The recommended approach is the This is preferred because of its T-accounts More Info a. Direct manufacturing labor wage rate was $10 per hour. b. Manufacturing overhead was allocated at $14 per direct manufacturing labor-hour. c. During the year, sales revenues were $1,060,000, and marketing and distribution costs were $122,000. Requirement 1. What was the amount of direct materials issued to production during 2020 ? Direct materials issued to production during 2020 was Requirement 2. What was the amount of manufacturing overhead allocated to jobs during 2020 ? First identify the formula to calculate the manufacturing overhead allocated. Marnufacturing overhead allocated to jobs during 20%20 was Requirement 3. What was the total cost of jobs completed during 2020 ? The total cost of jobs completed during 2020 was Requirement 4. What was the balance of work-in-process inventory on December 31, 2020? Post the entries during the year in the Work-in-process control account to determine the ending balance on December 31,2020 , Be sure to select refere Requirement 5. What was the cost of goods sold before proration of under- or overallocated overhead? The cost of goods sold before proration of under- or overallocated overhead was Requirement 6 . What was the under- or overallocated manufacturing overhead in 2020 ? The under- or overallocated manufacturing overhead in 2020 was Requirement 7a. Dispose of the under- or overallocgted manufacturing overhead using the write-off to Cost of Goods Scid. The Cost of goods sold acoount balance atter the write-off is Requirement 7b. Adjust for the under- or overallocated manufacturing overhead using proration based on ending balances (before proration) in W. and Cost of Goods Sold. Enter the account balances before proration, then the adjustment amounts and finally, calculate the account balances after proration. Requirement 8. Using each of the approaches in requirement 7, calculate Merideth's operating income for 2020 . First calculate operating income or loss using the wrife-off to cost of goods sold approach and then using the proration approach. (Use parentheses or a minus sign for a Requirement 9. Which approach in requirement 7 do you recommend Merideth use? Explain your answer briefly The recommended approach is the This is preferred because of its T-accounts More Info a. Direct manufacturing labor wage rate was $10 per hour. b. Manufacturing overhead was allocated at $14 per direct manufacturing labor-hour. c. During the year, sales revenues were $1,060,000, and marketing and distribution costs were $122,000