Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Merivale is a U.S. corporation with operations throughout the United States. In addition to its U.S. operations, it has a sales office in Calgary. Canadian

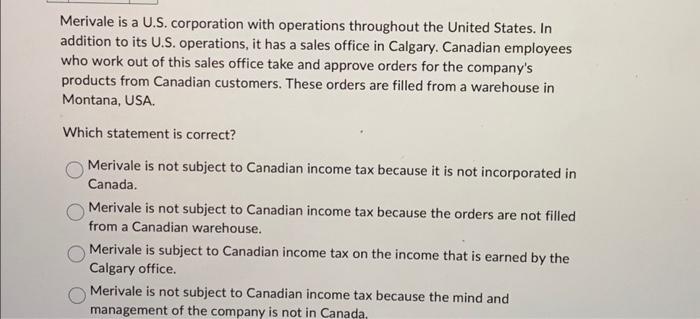

Merivale is a U.S. corporation with operations throughout the United States. In addition to its U.S. operations, it has a sales office in Calgary. Canadian employees who work out of this sales office take and approve orders for the company's products from Canadian customers. These orders are filled from a warehouse in Montana, USA. Which statement is correct? Merivale is not subject to Canadian income tax because it is not incorporated in Canada. Merivale is not subject to Canadian income tax because the orders are not filled from a Canadian warehouse. Merivale is subject to Canadian income tax on the income that is earned by the Calgary office. Merivale is not subject to Canadian income tax because the mind and management of the company is not in Canada,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started