Question

Merline Manufacturing makes its product for $60 per unit and sells it for $130 per unit. The sales staff receives a 10% commission on the

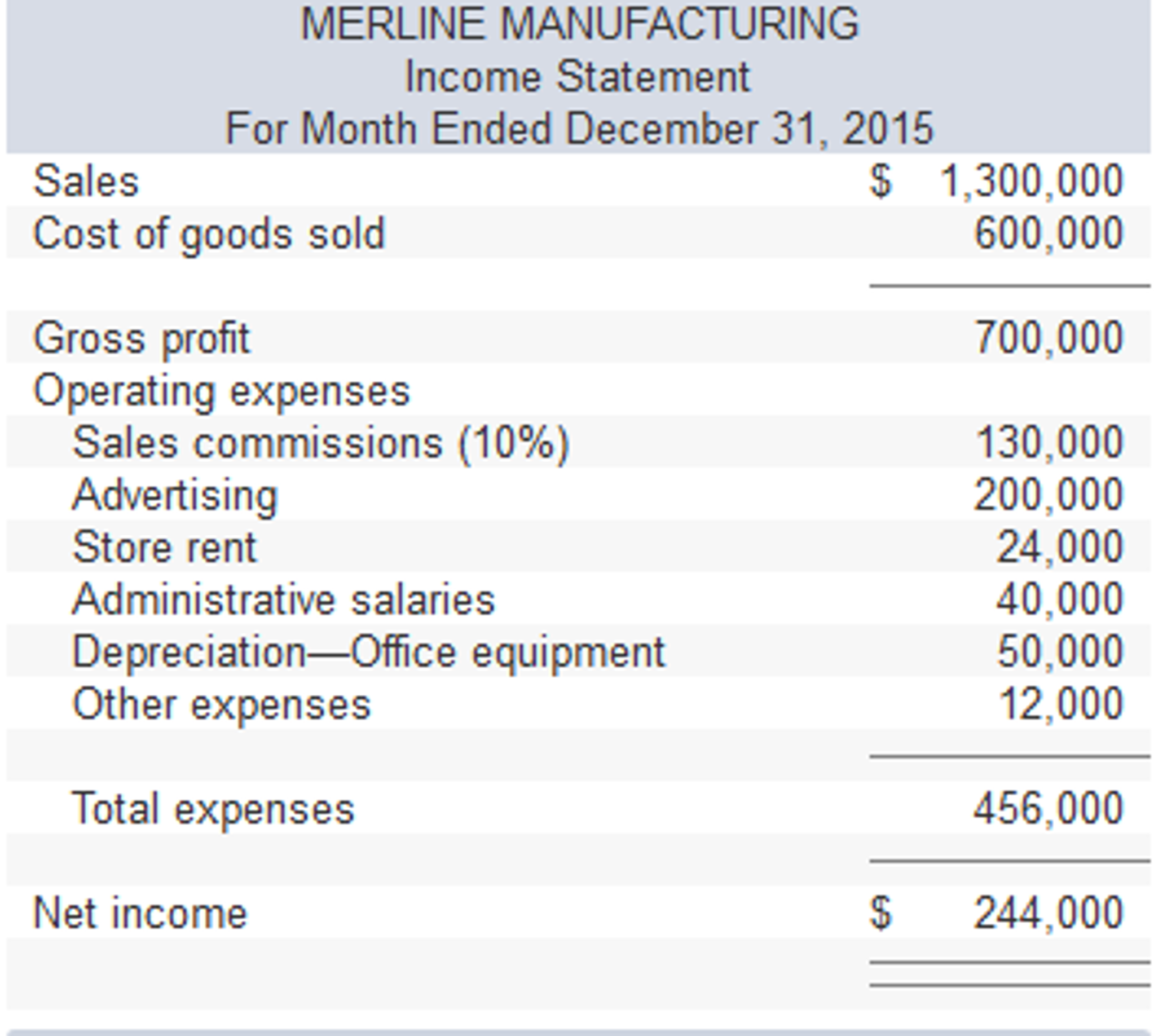

Merline Manufacturing makes its product for $60 per unit and sells it for $130 per unit. The sales staff receives a 10% commission on the sale of each unit. Its December income statement follows.

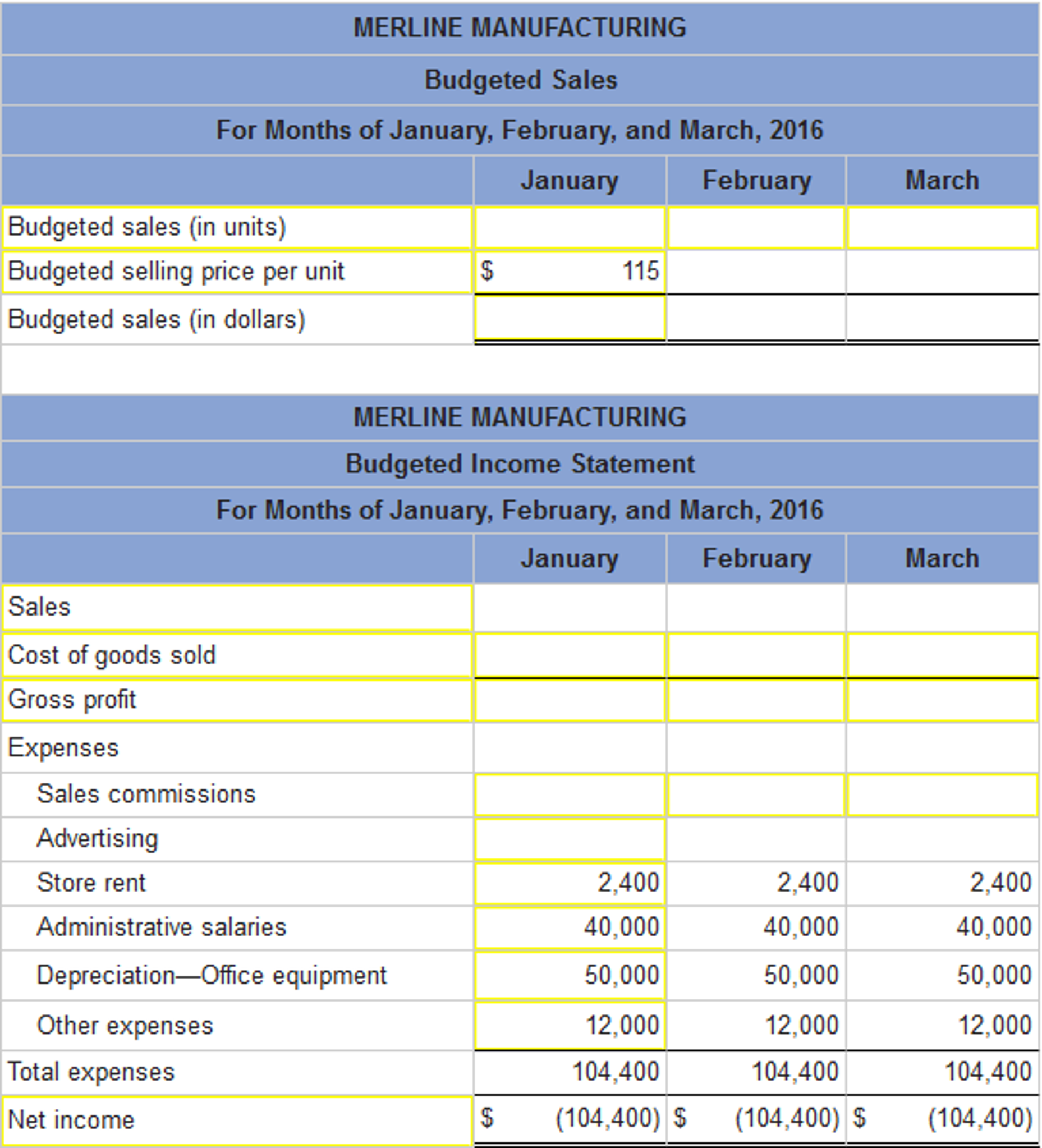

Management expects Decembers results to be repeated in January, February, and March of 2016 without any changes in strategy. Management, however, has an alternative plan. It believes that unit sales will increase at a rate of 10% each month for the next three months (beginning with January) if the item's selling price is reduced to $115 per unit and advertising expenses are increased by 25% and remain at that level for all three months. The cost of its product will remain at $60 per unit, the sales staff will continue to earn a 10% commission, and the remaining expenses will stay the same.

1.) Prepare budgeted income statements for each of the months of January, February, and March that show the expected results from implementing the proposed changes. (I have already filled some of it out but I can't figure out how to get the rest)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started