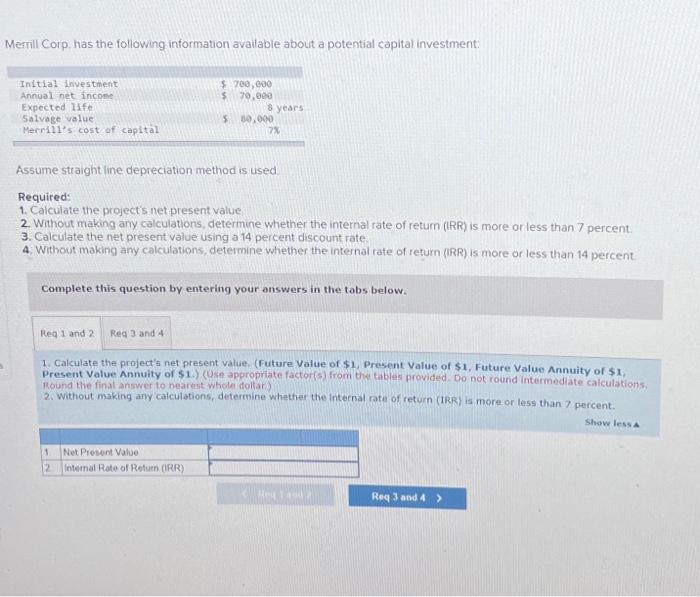

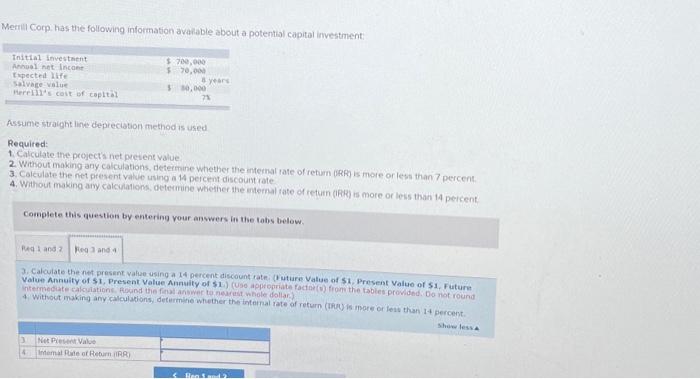

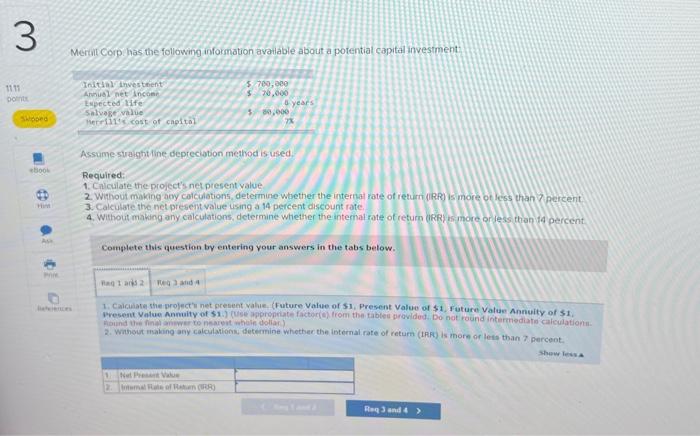

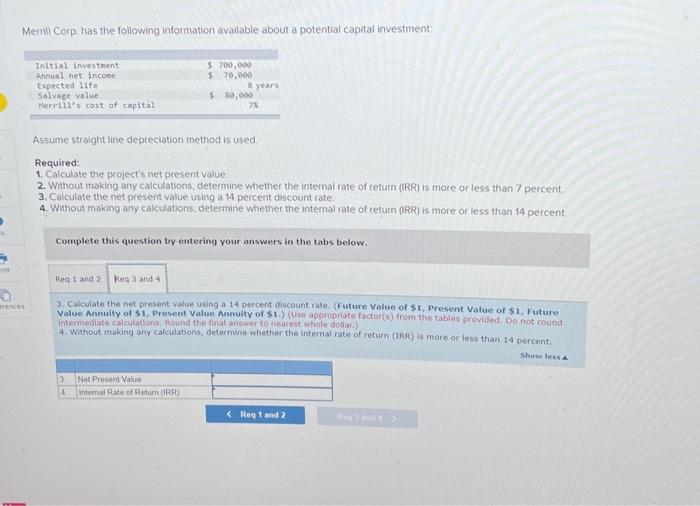

Merrill Corp, has the following information available about a potential capital investment: Assume straight ine depreciation method is used Required: 1. Calculate the project's net present value 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 7 percent. 3. Calculate the net present value using a 14 percent discount rate. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 14 percent. Complete this question by entering your answers in the tabs below. 1. Calculate the project's net present value. (Future Value of $1. Present Value of $1, Future Value Annuity of $1, Present Value Annuity of \$1.) (Use appropriate factor(s) from the tibles provided. Do not round intermediate calculations. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 7 percent. Merril Cocp. has the foliowing information avanable about a potential capital investment: Assune straight line depreciation method is used Required: 1 Calculate the projects net pretent value 2. Without making any calculations, determine whether the mntemal rate of rehum (IRR? is more or less than? percent 3. Calculate the riet present valie using a 14 percent discount rate 4. Without making amy calculations, detecmine whether the matermal rate of return (Ifte) is more or leis than 14 percent conplete this question by entering your answers an the labs below. 3. Calculate the net present vahue using a 14 percent discount rate, (I uture Vatue of 51 , Present Value of 51 . Future Volue Annuity of S1, Present Value Annuity of \$1.) (Uso appropriate factar (0) from the tables prowided oo not round Intempedate calcuiations, Angand the finat anower te nearest whote dollar.) 4 Wittoot making any calculabions, determitie whether the internal rate of return (they is msore or leas than 14 percent. Merint Corp has the following information avalable about a potential capital investment: Assumestraghtht line depreciabon method is used. Required: 1. Calculate the project's net present value 2. Without making any calculations, determine wbether the internat rate of return (iRR) is more of less than? percent 3. Calculate the net present value using a 14 percent discount rate 4. Without making any calculations, determine whether the internal rote of return (irR) is more ordess than id percent Complete this question by entering your answers in the tabs betow. 1. Caicilate the profectil net present valie. (Future Value of $1. Present Value of $1, Future Value Annuity of $1. Presem Yalue Anmuity of \$1.) (Use appreprate factor(o) from the tablee provided. Do not round initermediats calculationil- 2. Whtheut making any calculations, fetemine whether the ioternal rate of retum (IRA) is morn or lets than 7 perceot. Merrll Corp, has the following information available about a potential capital investment: Assume straight line depreciation method is used. Required: 1. Calculate the project's net present value 2. Without making any calculations, determine whether the internal rate of return (RRR) is more or less than 7 percent 3. Calculate the net present value using a 14 percent discount rate. 4. Without making ony calculations, determine whether the internal rate of return (IRR) is more or less than 14 percent: Complete this question by entering your answers in the tabs below. 7. Calculate the net present value ualng a 14 percent discount rate. (Future volue of $1, Present value of $1, Future Value Annuity of \$1, Present value Anmuity of $1.) (USe agpeopriate factor(1) from the tablas provided Do not round intermediate cialculations. Round the final answer to nearest whole dollar) 4. Without making any calculations, determine whether the internal rate of return (tixk) is more or less than i4 percent