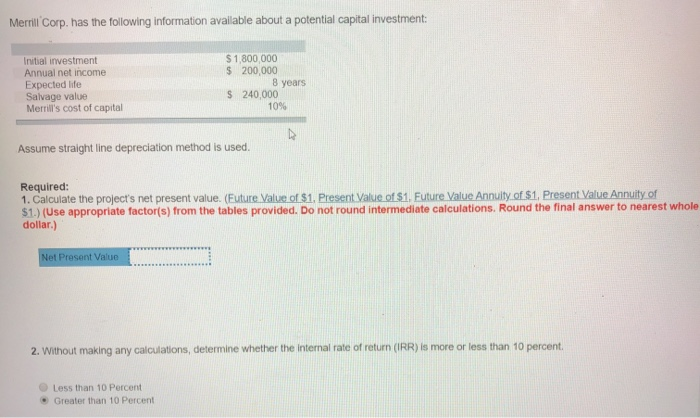

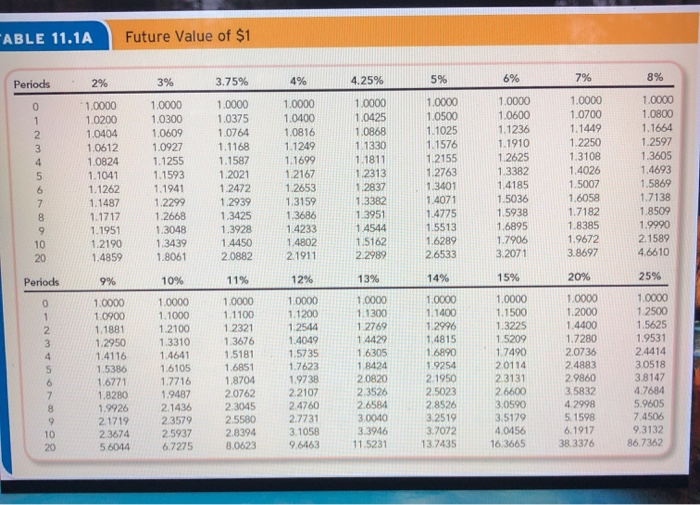

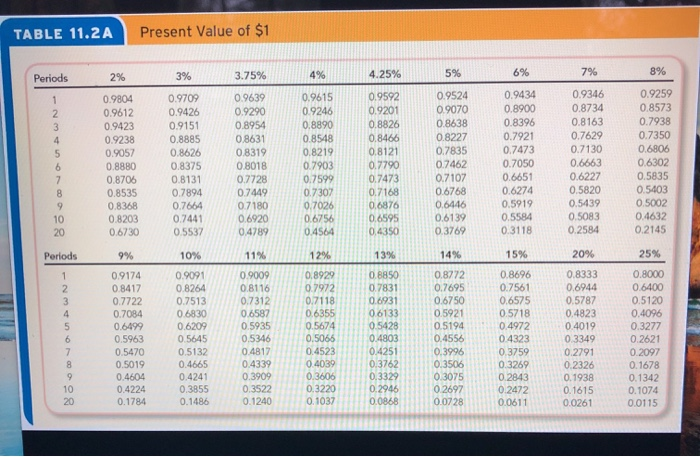

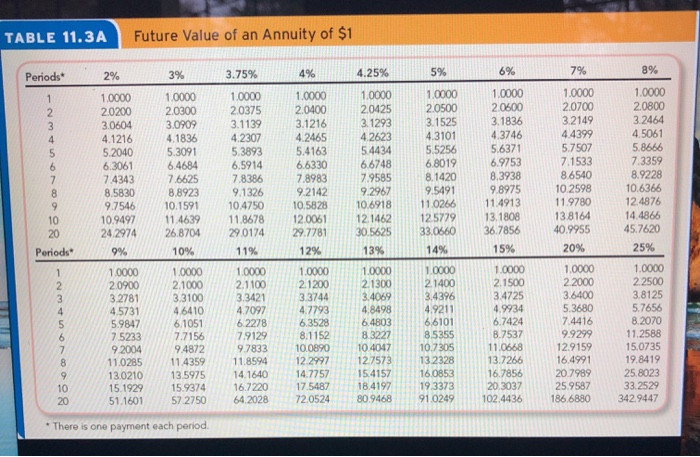

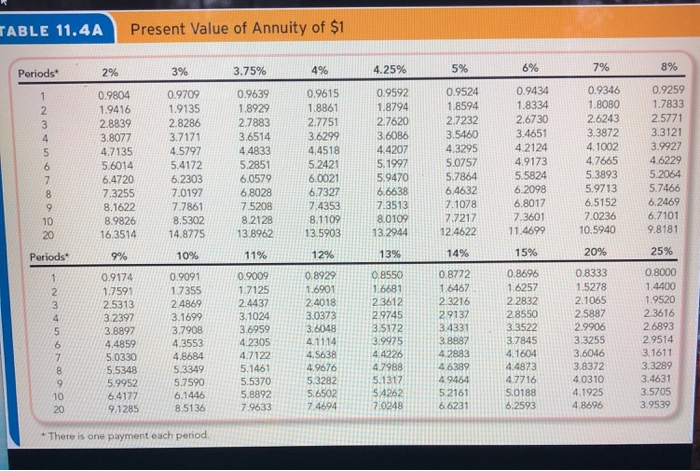

Merrill Corp. has the following information available about a potential capital investment: Initial investment Annual net income Expected life Salvage value Merrill's cost of capital $1,800 000 $ 200,000 8 years $ 240,000 10% Assume straight line depreciation method is used. Required: 1. Calculate the project's net present value. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Net Present Value 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 10 percent. Less than 10 Percent Greater than 10 Percent 3. Calculate the net present value using a 15 percent discount rate. Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Net Present Value ABLE 11.1A Future Value of $1 Periods 3% 4.25% 69 89 vaWN-O 2% 1.0000 1.0200 1.0404 1.0612 1.0824 1.1041 1.1262 1.1487 1.1717 1.1951 1.2190 1.4859 1.0000 1.0300 1.0609 1.0927 1.1255 1.1593 1.1941 1.2299 1.2668 1.3048 1.3439 1.8061 3.75% 1.0000 1.0375 1.0764 1.1168 1.1587 1.2021 1.2472 1.2939 1.3425 1.3928 1.4450 2.0882 1.0000 1.0400 1.0816 1.1249 1.1699 1.2167 1.2653 1.3159 1.3686 1.4233 1.4802 2.1911 1.0000 1.0425 1.0868 1.1330 1.1811 1.2313 1.2837 1.3382 1.3951 14544 1.5162 2.2989 1.0000 1.0500 1.1025 1.1576 1.2155 1.2763 1.3401 1.4071 1.4775 1.5513 1.6289 2.6533 1.0000 1.0600 1.1236 1.1910 1.2625 1.3382 1.4185 1.5036 1.5938 1.6895 1.7906 3.2071 1.0000 1.0700 1.1449 1.2250 1.3108 1.4026 1.5007 1.6058 1.7182 1.8385 1.9672 3.8697 1.0000 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 4,6610 Periods 9% 10% 11% 12% 13% 14% 15% 20% 25% 1.0000 1.0900 1.1881 1.2950 1.4116 1.5386 1.6771 1.8280 1.9926 21719 23674 5.6044 1.0000 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 21436 23579 25937 6.7275 1.0000 1.1100 1.2321 1.3676 1.5181 1.6851 1.8704 20762 2 3045 2.5580 2.8394 8.0623 1.0000 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 22107 24760 27731 3.1058 9.6463 1.0000 1.1300 1.2769 14429 1.6305 1 8424 2.0820 2.3526 26584 3.0040 3.3946 11.5231 1.0000 1.1400 1.2996 1.4815 1.6890 1.9254 2. 1950 2.5023 28526 3.2519 3.7072 13.7435 1.0000 1.1500 1.3225 1.5209 1.7490 20114 2.3131 26600 3.0590 3.5179 4.0456 16.3665 1.0000 1.2000 1.4400 1.7280 2.0736 2.4883 2.9860 3.5832 4.2998 5.1598 6.1917 38.3376 1.0000 12500 1.5625 1.9531 2.4414 3.0518 3.8147 4.7684 5.9605 7.4506 9.3132 86.7362 TABLE 11.2 A Present Value of $1 2% Periods .25% 5% 8% 6% 7% 0.9804 0.9612 0.9423 0.9238 0.9057 0.8880 0.8706 0.8535 0.8368 0.8203 0.6730 3% 0.9709 0.9426 0.9151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.5537 3.75% 0.9639 0.9290 0.8954 0.8631 0.8319 0.8018 0.7728 0.7449 0.7180 0.6920 0,4789 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.4564 0.9592 0.9201 0.8826 0.8466 0.8121 0.7790 0.7473 0.7168 0.6876 0.6595 0,4350 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.3769 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 0.5584 0.3118 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 0.2584 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.2145 20 Periods 9% 10% 11% 12% 13% 14% 15% 20% 08850 0.9174 0.8417 0.7722 0.7084 0.6499 0.5963 0.5470 0.5019 0.4604 0.4224 0.1784 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.1486 0.9009 0.8116 0.7312 0.6587 0.5935 0.5346 0.4817 0.4339 0.3909 0.3522 0.1240 0.8929 0.7972 07118 0.6355 0.5674 0.5065 0.4523 0.4039 0.3606 0.3220 0.1037 0.7831 0.6931 0.6133 0.5428 0.4803 0.4251 0.3762 0.3329 0.2945 0.0868 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 0.0728 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.0611 0.8333 0.6944 0.5787 0.4823 0.4019 0.3349 0.2791 0.2326 0.1938 0.1615 0.0261 25% 0.8000 0.6400 0.5120 0.4096 0.3277 0.2621 0.2097 0.1678 0.1342 0.1074 0.0115 TABLE 11.3A Future Value of an Annuity of $1 Periods 2% 4% 5% 8% 1.0000 2.0200 3.0604 4.1216 5.2040 6.3061 74343 8.5830 9.7546 10.9497 24.2974 9% 1.0000 20900 32781 4.5731 3% 1.0000 2.0300 3.0909 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 26.8704 10% 3.75% 1.0000 20375 3.1139 4.2307 5.3893 6.5914 7.8386 9.1326 10.4750 11.8678 29.0174 11% 1.0000 2.1100 3.3421 4.7097 6.2278 7.9129 9.7833 11.8594 14.1640 16.7220 64.2028 4.25% 1.0000 20425 3.1293 4.2623 5.4434 6.6748 7.9585 9.2967 10.6918 12.1462 30.5625 13% 1.0000 2.1300 3.4069 4,8498 6.4803 8.3227 10.4047 127573 15.4157 18.4197 80.9468 1.0000 2.0400 3.1216 4.2465 5,4163 6.6330 7.8983 9.2142 10.5828 12.0061 29.7781 12% 1.0000 21200 33744 4.7793 6:3528 8.1152 10.0890 12.2997 14.7757 17.5487 72.0524 1.0000 2.0500 3.1525 4.3101 5.5256 6.8019 8.1420 9.5491 11.0266 12.5779 33.0660 14% 1.0000 2.1400 3.4396 4.9211 66101 8.5355 10.7305 132328 16.0853 193373 91.0249 1.0000 20600 3.1836 4.3746 5.6371 6.9753 8.3938 9.8975 11.4913 13.1808 36.7856 15% Periods 1.0000 2.0700 3.2149 44399 5.7507 7.1533 8.6540 10.2598 11.9780 13.8164 40.9955 20% 1.0000 2 2000 3.6400 5.3680 7.4416 9.9299 12.9159 16.4991 20.7989 25.9587 186 6880 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 14.4866 45.7620 25% 59847 ROWN 75233 9.2004 11.0285 13.0210 15.1929 51.1601 1.0000 2.1000 3.3100 46410 6.1051 7.7156 9.4872 11.4359 13.5975 15.9374 57 2750 1.0000 2.1500 3.4725 4.9934 6.7424 8.7537 11.0668 13.7266 16.7856 20.3037 102.4436 1.0000 2 2500 3.8125 5.7656 8.2070 11.2588 15.0735 19.8419 25.8023 33.2529 342.9447 * There is one payment each period TABLE 11,4 A Present Value of Annuity of $1 Periods 3% 4.25% 5% 6% 8% 2% 0.9804 1.9416 2.8839 3.8077 4.7135 5.6014 6.4720 7.3255 8.1622 8.9826 16.3514 0.9709 1.9135 2.8286 3.7171 4.5797 5.4172 6.2303 7.0197 7.7861 8.5302 14.8775 3.75% 0.9639 1.8929 2.7883 3.6514 4.4833 5.2851 6.0579 6.8028 7.5208 8.2128 13.8962 4% 0.9615 1.8861 2.7751 3.6299 4,4518 5.2421 6.0021 0.9592 1.8794 2.7620 3.6086 4.4207 5.1997 5.9470 6,6638 7.3513 8.0109 13.2944 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217 12.4622 0.9434 1.8334 2.6730 3.4651 4.2124 4.9173 5.5824 6.2098 6.8017 7.3601 11.4699 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 10.5940 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 9.8181 6.7327 7.4353 8.1109 13.5903 Periods 9% 10% 11% 12% 13% 14% 15% 25% OWN 0.9174 1.7591 2.5313 3.2397 3.8897 4,4859 5.0330 5.5348 5.9952 6.4177 9.1285 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 8.5136 0.9009 1.7125 2.4437 3.1024 3.6959 4.2305 4.7122 5.1461 5.5370 5.8892 7.9633 0.8929 1.6901 2.4018 3.0373 3.6048 4. 1114 4.5638 49676 5.3282 5.6502 74694 0.8550 1.6681 23612 2.9745 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 7.0248 0.8772 1.6467 23216 29137 3.4331 3.8887 4.2883 4.6389 49464 52161 66231 0.8696 1.6257 2 2832 2.8550 3.3522 3.7845 4.1604 4.4873 47716 5.0188 6.2593 20% 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.8696 0.8000 1.4400 1.9520 23616 2.6893 2.9514 3.1611 3.3289 3.4631 3.5705 3.9539 * There is one payment each period