Answered step by step

Verified Expert Solution

Question

1 Approved Answer

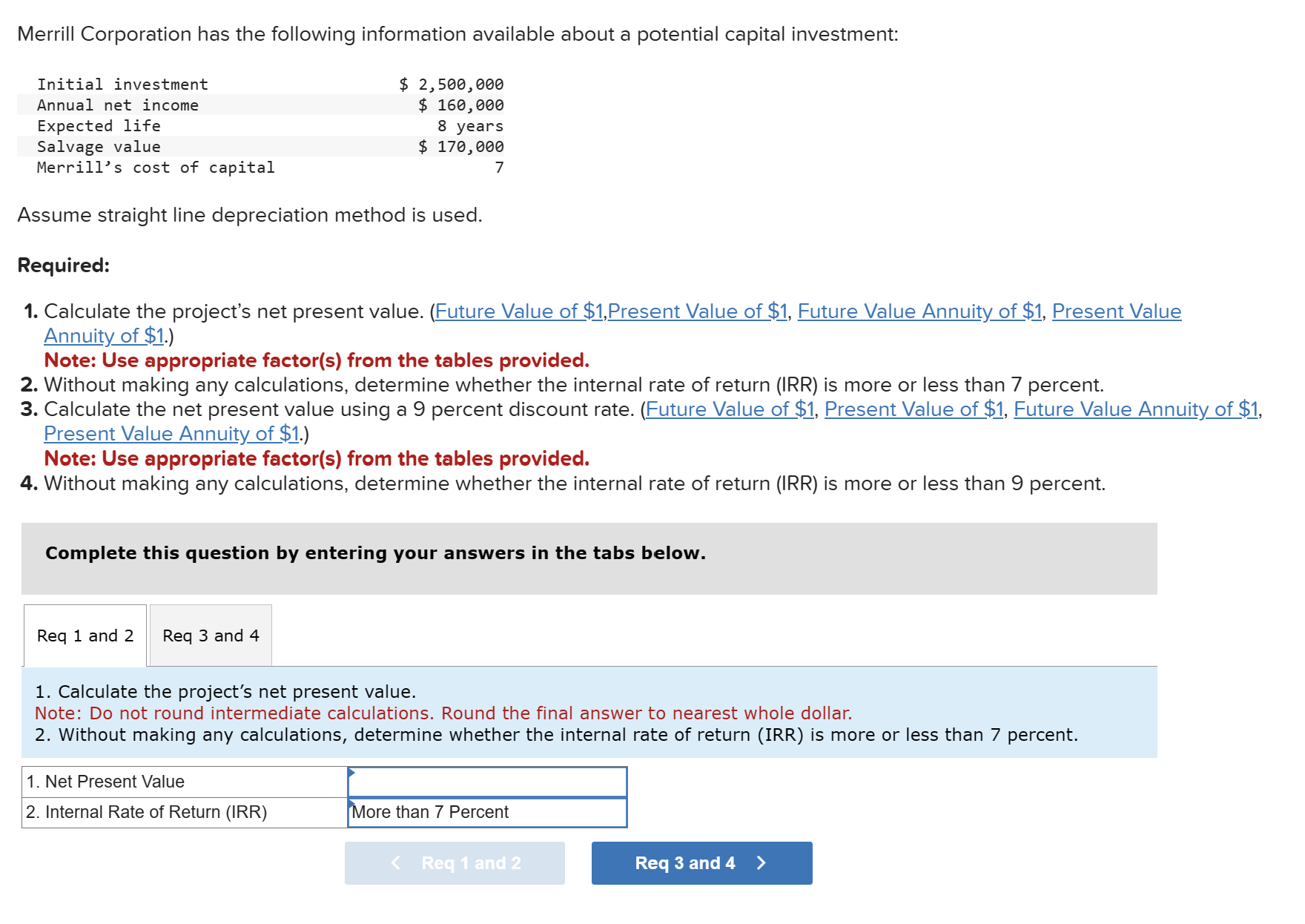

Merrill Corporation has the following information available about a potential capital investment: Assume straight line depreciation method is used. Required: 1. Calculate the project's net

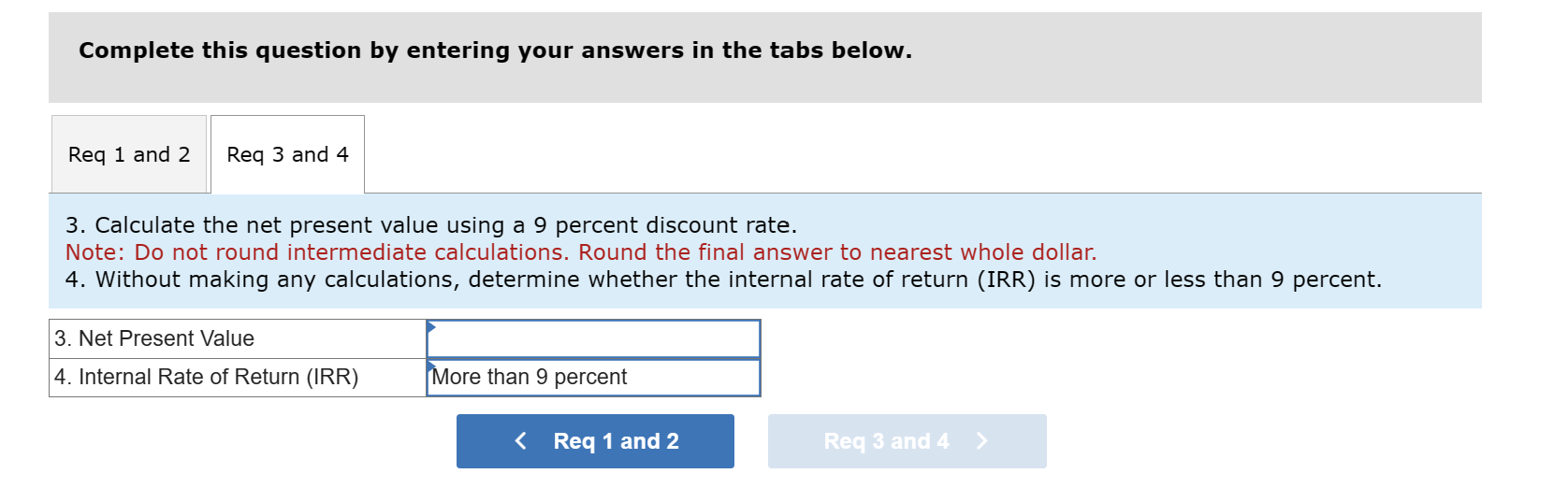

Merrill Corporation has the following information available about a potential capital investment: Assume straight line depreciation method is used. Required: 1. Calculate the project's net present value. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1. Note: Use appropriate factor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 7 percent. 3. Calculate the net present value using a 9 percent discount rate. (Future Value of $1, Present Value of $1, Future Value Annuity of $ Present Value Annuity of $1. Note: Use appropriate factor(s) from the tables provided. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 9 percent. Complete this question by entering your answers in the tabs below. 1. Calculate the project's net present value. Note: Do not round intermediate calculations. Round the final answer to nearest whole dollar. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 7 percent. 1. Net Present Value 2. Internal Rate of Return (IRR) Complete this question by entering your answers in the tabs below. 3. Calculate the net present value using a 9 percent discount rate. Note: Do not round intermediate calculations. Round the final answer to nearest whole dollar. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 9 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started