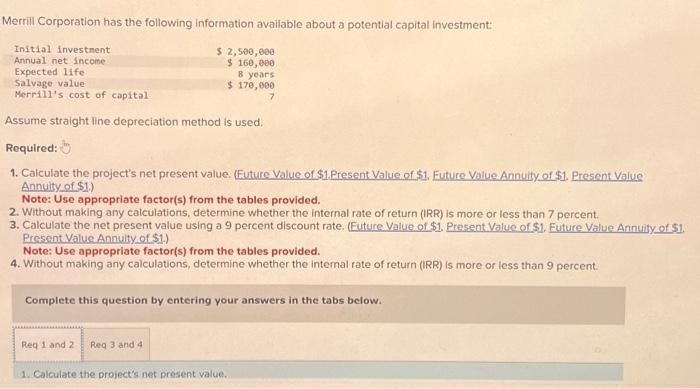

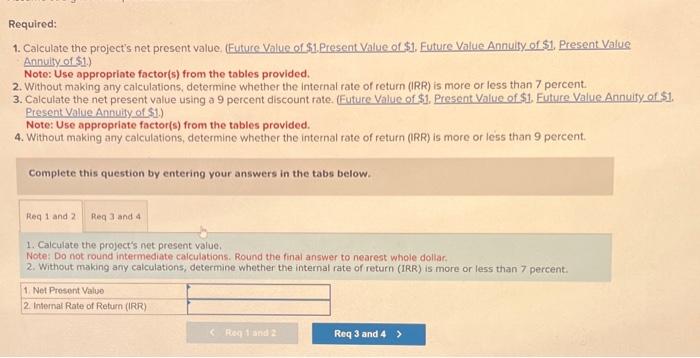

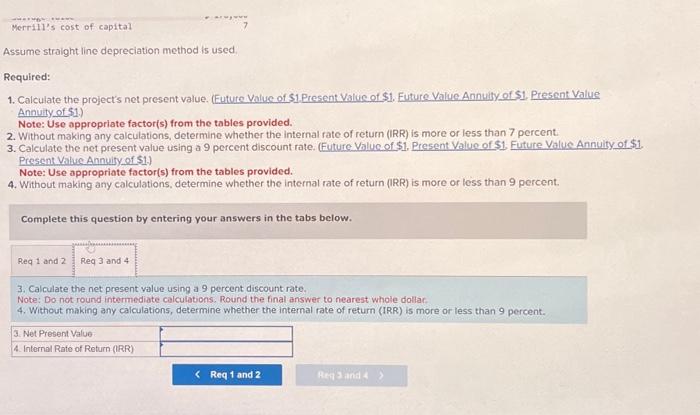

Merrill Corporation has the following information available about a potential capital investment: Assume straight line depreciation method is used. Required: 1. Calculate the project's net present value. (Euture Value of \$1. Present Value of $1. Euture Value Annuity of $1. Present Value Annulty of $1 ). Note: Use appropriate factor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 7 percent. 3. Calculate the net present value using a 9 percent discount rate. (Euture Value of $1. Present Value of $1. Euture Value Annuity of Present Value Annulty of \$1.) Note: Use appropriate factor(s) from the tables provided. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 9 percent. Complete this question by entering your answers in the tabs below. 1. Calculate the project's net present value. Required: 1. Calculate the project's net present value. Future Value of \$1. Present Value of $1. Euture Value Annuity of $1, Present Value Annuity of $1. Note: Use appropriate factor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 7 percent. 3. Calculate the net present value using a 9 percent discount rate. (Euture Value of $1. Present Value of $1, Future Value Annuity of $ Present Value Annuity of S1.) Note: Use appropriate factor(s) from the tables provided. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 9 percent. Complete this question by entering your answers in the tabs below. 1. Calculate the project's pet present value. Note: Do not round intermediate calculations. Round the final answer to nearest whole dollar. 2. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 7 percent. Assume straight line depreciation method is used: Required: 1. Calculate the project's net present value. Euture Value of \$1 Present Value of \$1. Euture Value Annuity of S1. Present Value Annuity of $1. Note: Use appropriate factor(s) from the tables provided. 2. Without making any calculations, determine whether the internal rate of retum (IRR) is more or less than 7 percent. 3. Calculate the net present value using a 9 percent discount rate. (Future Valuc of $1, Present Value of $1 Future Value Annuity of $1. Present Value Annuity of $1. Note: Use appropriate factor(s) from the tables provided. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 9 percent. Complete this question by entering your answers in the tabs below. 3. Calculate the net present value using a 9 percent discount rate. Note: Do not round intermediate calculations. Round the final answer to nearest whole dollar. 4. Without making any calculations, determine whether the internal rate of return (IRR) is more or less than 9 percent