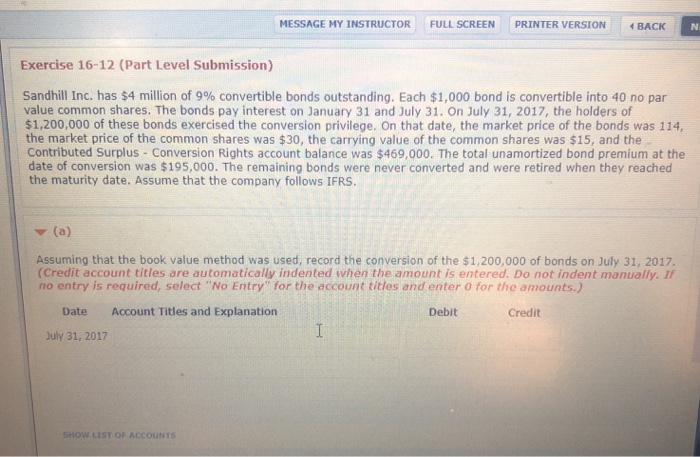

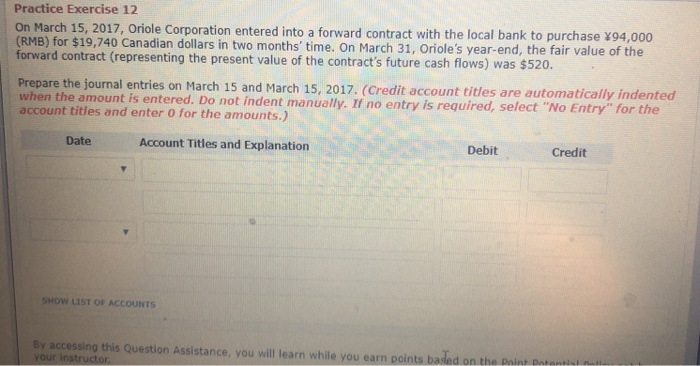

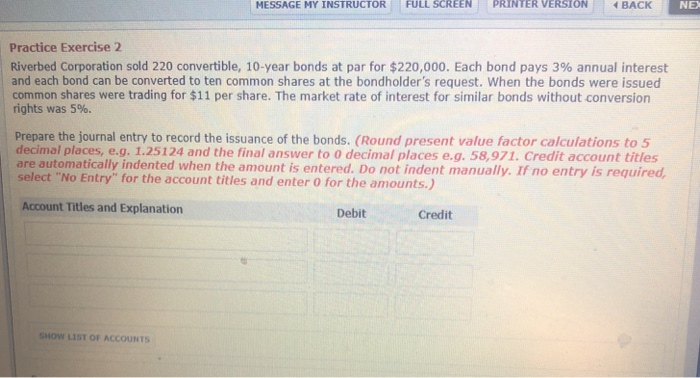

MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK Exercise 16-12 (Part Level Submission) Sandhill Inc. has $4 million of 9% convertible bonds outstanding. Each $1,000 bond is convertible into 40 no par value common shares. The bonds pay interest on January 31 and July 31. On July 31, 2017, the holders of $1,200,000 of these bonds exercised the conversion privilege. On that date, the market price of the bonds was 114, the market price of the common shares was $30, the carrying value of the common shares was $15, and the Contributed Surplus Conversion Rights account balance was $469,000. The total unamortized bond premium at the date of conversion was $195,000. The remaining bonds were never converted and were retired when they reached the maturity date. Assume that the company follows IFRS. Assuming that the book value method was used, record the conversion of the $1,200,000 of bonds on July 31, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts.,) Date Account Titles and Explanation Debit Credit July 31, 2017 SHOW LIST OF ACCOUNTS Practice Exercise 12 On March 15, 2017, Oriole Corporation entered into a forward contract with the local bank to purchase 94,000 B) for $19,740 Canadian dollars in two months' time. On March 31, Oriole's year-end, the fair value of the forward contract (representing the present value of the contract's future cash flows) was $520 Prepare the journal entries on March 15 and March 15, 2017. (Credit account titles are automatically when the amount is entered. Do not indent manually. If no entry is required, select "No Entry indented for the account titles and enter 0 for the amounts.) Debit redit Date Account Titles and Explanation SHow LST OF ACCOUNTS By accessing this Question Assistance, you will learn while you earn p oints based on the Doint Botens MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NE Practice Exercise 2 Riverbed Corporation sold 220 convertible, 10-year bonds at par for $220,000. Each bond pays 3% annual interest and each bond can be converted to ten common shares at the bondholder's request. When the bonds were issued common shares were trading for $11 per share. The market rate of interest for similar bonds without conversion rights was 596. Prepare the journal entry to record the issuance of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK Exercise 16-12 (Part Level Submission) Sandhill Inc. has $4 million of 9% convertible bonds outstanding. Each $1,000 bond is convertible into 40 no par value common shares. The bonds pay interest on January 31 and July 31. On July 31, 2017, the holders of $1,200,000 of these bonds exercised the conversion privilege. On that date, the market price of the bonds was 114, the market price of the common shares was $30, the carrying value of the common shares was $15, and the Contributed Surplus Conversion Rights account balance was $469,000. The total unamortized bond premium at the date of conversion was $195,000. The remaining bonds were never converted and were retired when they reached the maturity date. Assume that the company follows IFRS. Assuming that the book value method was used, record the conversion of the $1,200,000 of bonds on July 31, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts.,) Date Account Titles and Explanation Debit Credit July 31, 2017 SHOW LIST OF ACCOUNTS Practice Exercise 12 On March 15, 2017, Oriole Corporation entered into a forward contract with the local bank to purchase 94,000 B) for $19,740 Canadian dollars in two months' time. On March 31, Oriole's year-end, the fair value of the forward contract (representing the present value of the contract's future cash flows) was $520 Prepare the journal entries on March 15 and March 15, 2017. (Credit account titles are automatically when the amount is entered. Do not indent manually. If no entry is required, select "No Entry indented for the account titles and enter 0 for the amounts.) Debit redit Date Account Titles and Explanation SHow LST OF ACCOUNTS By accessing this Question Assistance, you will learn while you earn p oints based on the Doint Botens MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION BACK NE Practice Exercise 2 Riverbed Corporation sold 220 convertible, 10-year bonds at par for $220,000. Each bond pays 3% annual interest and each bond can be converted to ten common shares at the bondholder's request. When the bonds were issued common shares were trading for $11 per share. The market rate of interest for similar bonds without conversion rights was 596. Prepare the journal entry to record the issuance of the bonds. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS