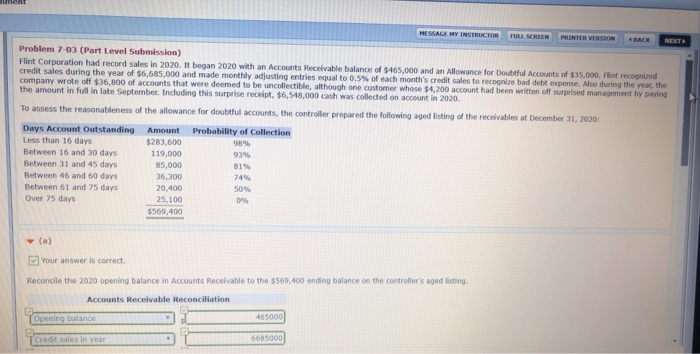

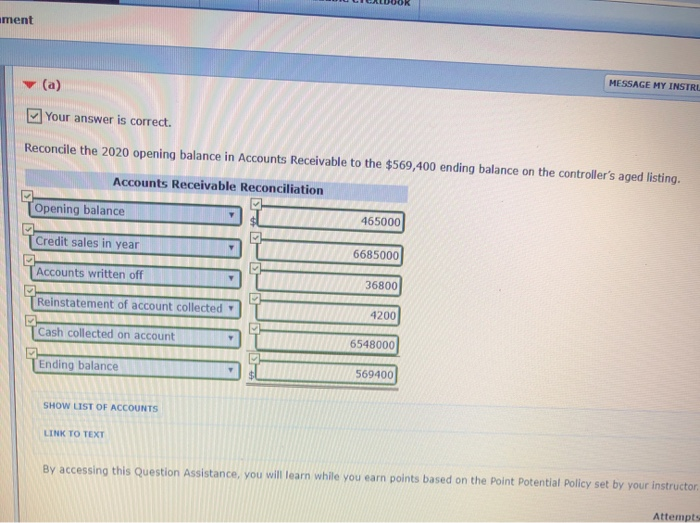

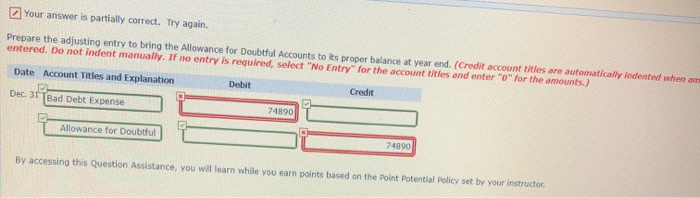

MESSAGE MY INSTRUCTOR PRINTER VERSION FULL SCREEN BACK NEXT Problem 7-03 (Part Level Submission) Flint Corporation had record sales in 2020. It began 2020 with an Accounts Receivable balance of $465,000 and an Allowance for Doubtful Accounts of $35,000. Flint recognized credit sales during the year of $6,685,000 and made monthly adjusting entries equal to 0.5% of each month's credit sales to recognize bad debt expense. Also during the year, the company wrote off $36,800 of accounts that were deemed to be uncollectible, although one customer whose $4,200 account had been written off surprised management by paying the amount in full in late September. Including this surprise receipt, $6,548,000 cash was collected on account in 2020. To assess the reasonableness of the allowance for doubtful accounts, the controller prepared the following aged listing of the receivables at December 31, 2020: Days Account Outstanding Amount Probability of Collection Less than 16 days $283,600 98% Between 16 and 30 days 119,000 93% Between 31 and 45 days 85,000 81% Between 46 and 60 days Between 61 and 75 days Over 75 days 36,300 74% 20,400 50% 25,100 0% $569,400 (a) Your answer is correct. Reconcile the 2020 opening balance in Accounts Receivable to the $569,400 ending balance on the controller's aged listing. Accounts Receivable Reconciliation 465000 Opening balance Credit sales in year 6685000 ment MESSAGE MY INSTRL (a) Your answer is correct. Reconcile the 2020 opening balance in Accounts Receivable to the $569,400 ending balance on the controller's aged listing. Accounts Receivable Reconciliation Opening balance 465000 Credit sales in year 6685000 Accounts written off 36800 Reinstatement of account collected 4200 Cash collected on account 6548000 Ending balance 569400 SHOW LIST OF ACCOUNTS LINK TO TEXT By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor Attempts Your answer is partially correct. Try again. Prepare the adjusting entry to bring the Allowance for Doubtful Accounts to its proper balance at year end. (Credit account titles are automatically indented when am entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter "0" for the amounts.) Account Titles and Explanation Credit Date Debit Dec. 31 TBad Debt Expense 74890 Allowance for Doubtful 74890 By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor