Answered step by step

Verified Expert Solution

Question

1 Approved Answer

met can cause unless you need to edit sales to stay in Proinded View Enable Editing 1. Peter took out a loan of $54,000 with

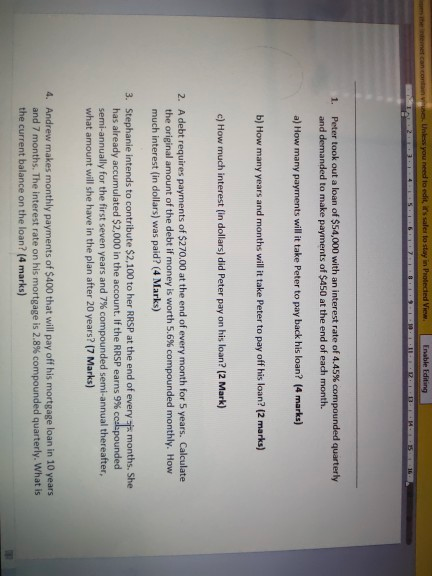

met can cause unless you need to edit sales to stay in Proinded View Enable Editing 1. Peter took out a loan of $54,000 with an interest rate of 4.45% compounded quarterly and demanded to make payments of $450 at the end of each month. a) How many payments will it take Peter to pay back his loan? (4 marks) b) How many years and months will it take Peter to pay off his loan? (2 marks) c) How much interest (in dollars) did Peter pay on his loan? (2 Mark) 2. A debt requires payments of $270.00 at the end of every month for 5 years. Calculate the original amount of the debt if money is worth 5.6% compounded monthly. How much interest (in dollars) was paid? (4 Marks) 3. Stephanie intends to contribute $2,100 to her RRSP at the end of every months. She has already accumulated $2,000 in the account. If the RRSP earns 9% ccelpounded semi-annually for the first seven years and 7% compounded semi-annual thereafter, what amount will she have in the plan after 20 years? (7 Marks) 4. Andrew makes monthly payments of $400 that will pay off his mortgage loan in 10 years and 7 months. The interest rate on his mortgage is 2.8% compounded quarterly. What is the current balance on the loan? (4 marks) met can cause unless you need to edit sales to stay in Proinded View Enable Editing 1. Peter took out a loan of $54,000 with an interest rate of 4.45% compounded quarterly and demanded to make payments of $450 at the end of each month. a) How many payments will it take Peter to pay back his loan? (4 marks) b) How many years and months will it take Peter to pay off his loan? (2 marks) c) How much interest (in dollars) did Peter pay on his loan? (2 Mark) 2. A debt requires payments of $270.00 at the end of every month for 5 years. Calculate the original amount of the debt if money is worth 5.6% compounded monthly. How much interest (in dollars) was paid? (4 Marks) 3. Stephanie intends to contribute $2,100 to her RRSP at the end of every months. She has already accumulated $2,000 in the account. If the RRSP earns 9% ccelpounded semi-annually for the first seven years and 7% compounded semi-annual thereafter, what amount will she have in the plan after 20 years? (7 Marks) 4. Andrew makes monthly payments of $400 that will pay off his mortgage loan in 10 years and 7 months. The interest rate on his mortgage is 2.8% compounded quarterly. What is the current balance on the loan? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started