Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Metagross Industries Ltd. reports the following transactions and events for fiscal 2020 and 2021. a. The allowance for doubtful accounts (ADA) was increased in

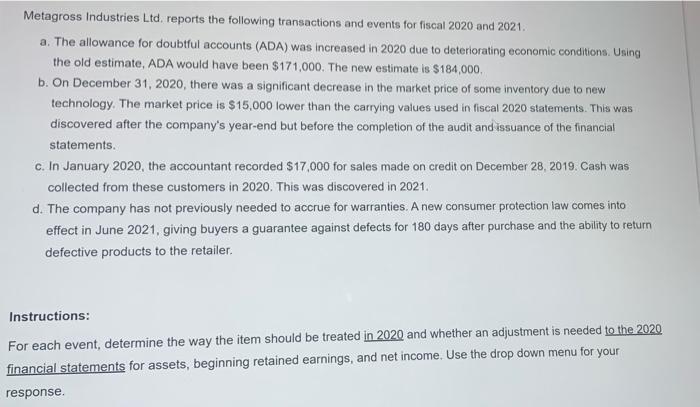

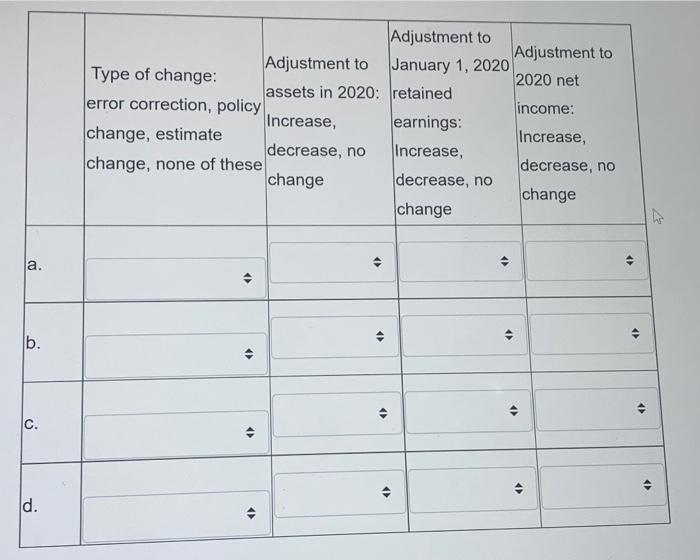

Metagross Industries Ltd. reports the following transactions and events for fiscal 2020 and 2021. a. The allowance for doubtful accounts (ADA) was increased in 2020 due to deteriorating economic conditions. Using the old estimate, ADA would have been $171,000. The new estimate is $184,000. b. On December 31, 2020, there was a significant decrease in the market price of some inventory due to new technology. The market price is $15,000 lower than the carrying values used in fiscal 2020 statements. This was discovered after the company's year-end but before the completion of the audit and issuance of the financial statements. c. In January 2020, the accountant recorded $17,000 for sales made on credit on December 28, 2019. Cash was collected from these customers in 2020. This was discovered in 2021. d. The company has not previously needed to accrue for warranties. A new consumer protection law comes into effect in June 2021, giving buyers a guarantee against defects for 180 days after purchase and the ability to return defective products to the retailer. Instructions: For each event, determine the way the item should be treated in 2020 and whether an adjustment is needed to the 2020 financial statements for assets, beginning retained earnings, and net income. Use the drop down menu for your response. a. b. C. d. Type of change: error correction, policy change, estimate change, none of these Adjustment to assets in 2020: Increase, decrease, no change + Adjustment to January 1, 2020 retained earnings: Increase, decrease, no change 4 Adjustment to 2020 net income: Increase, decrease, no change 4 4 4 (

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

TYPE OF CHANGE ADJ TO ASSETS ADJ TO RE ADJ TO NETINC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started