Answered step by step

Verified Expert Solution

Question

1 Approved Answer

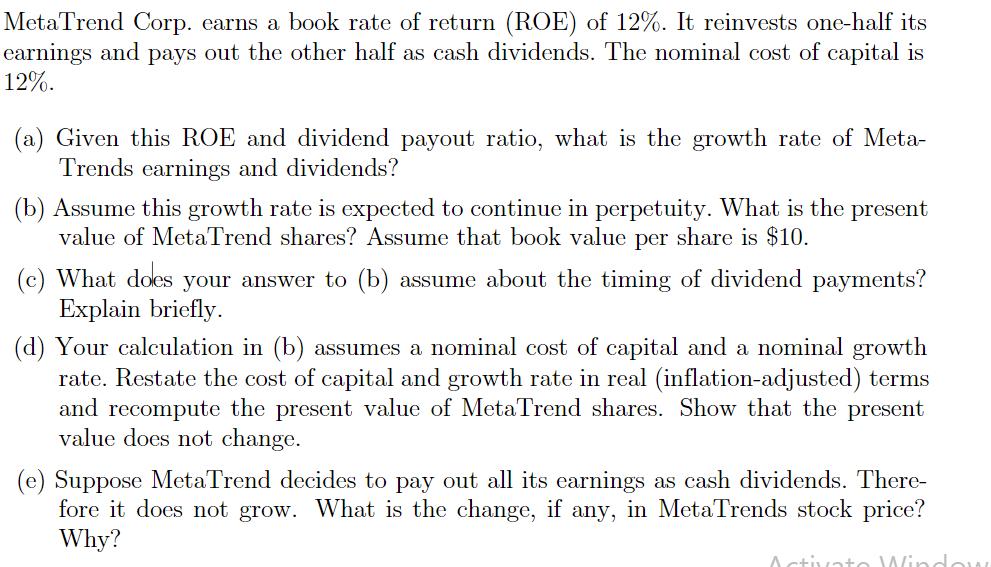

MetaTrend Corp. earns a book rate of return (ROE) of 12%. It reinvests one-half its earnings and pays out the other half as cash

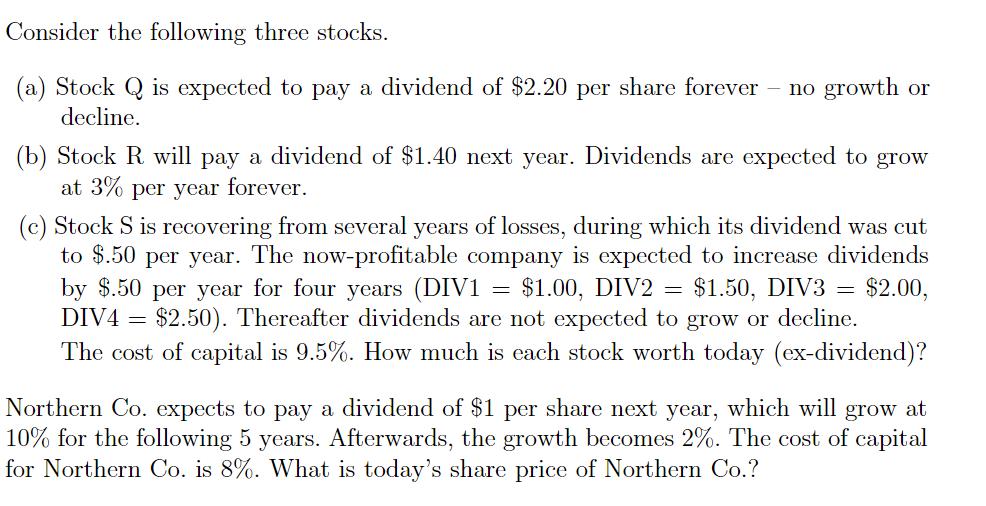

MetaTrend Corp. earns a book rate of return (ROE) of 12%. It reinvests one-half its earnings and pays out the other half as cash dividends. The nominal cost of capital is 12%. (a) Given this ROE and dividend payout ratio, what is the growth rate of Meta- Trends earnings and dividends? (b) Assume this growth rate is expected to continue in perpetuity. What is the present value of MetaTrend shares? Assume that book value per share is $10. (c) What does your answer to (b) assume about the timing of dividend payments? Explain briefly. (d) Your calculation in (b) assumes a nominal cost of capital and a nominal growth rate. Restate the cost of capital and growth rate in real (inflation-adjusted) terms and recompute the present value of MetaTrend shares. Show that the present value does not change. (e) Suppose MetaTrend decides to pay out all its earnings as cash dividends. There- fore it does not grow. What is the change, if any, in MetaTrends stock price? Why? Activate Wind. Consider the following three stocks. (a) Stock Q is expected to pay a dividend of $2.20 per share forever - no growth or decline. (b) Stock R will pay a dividend of $1.40 next year. Dividends are expected to grow at 3% per year forever. $1.00, DIV2 == $2.00, (c) Stock S is recovering from several years of losses, during which its dividend was cut to $.50 per year. The now-profitable company is expected to increase dividends by $.50 per year for four years (DIV1 $1.50, DIV3 DIV4 $2.50). Thereafter dividends are not expected to grow or decline. The cost of capital is 9.5%. How much is each stock worth today (ex-dividend)? = = = Northern Co. expects to pay a dividend of $1 per share next year, which will grow at 10% for the following 5 years. Afterwards, the growth becomes 2%. The cost of capital for Northern Co. is 8%. What is today's share price of Northern Co.?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started