Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PERFORMANCE GRAPH The following performance graph compares the cumulative five-year total return to shareholders on our common stock relative to the cumulative total returns

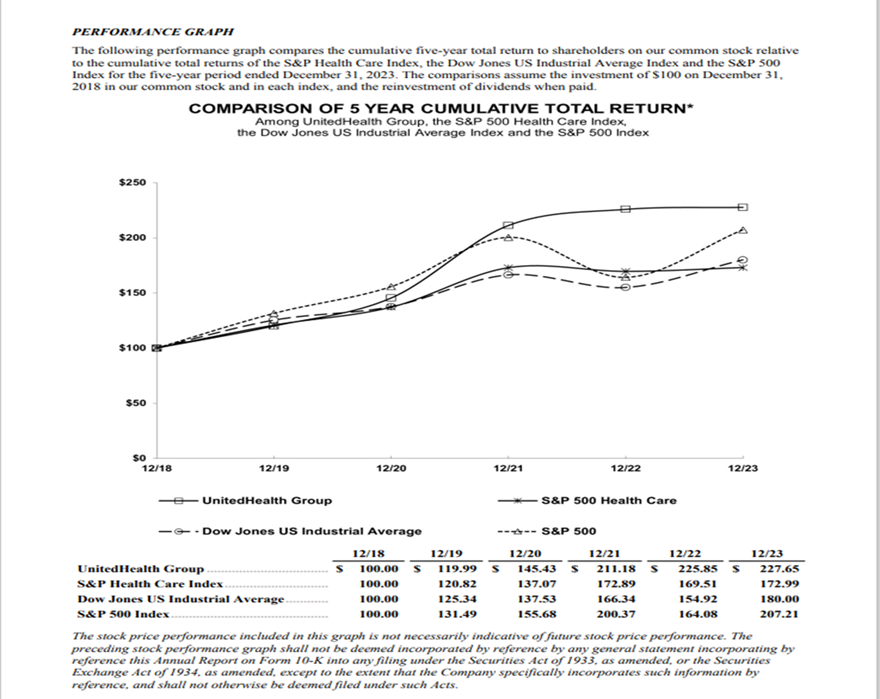

PERFORMANCE GRAPH The following performance graph compares the cumulative five-year total return to shareholders on our common stock relative to the cumulative total returns of the S&P Health Care Index, the Dow Jones US Industrial Average Index and the S&P 500 Index for the five-year period ended December 31, 2023. The comparisons assume the investment of $100 on December 31, 2018 in our common stock and in each index, and the reinvestment of dividends when paid. COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN* Among UnitedHealth Group, the S&P 500 Health Care Index, the Dow Jones US Industrial Average Index and the S&P 500 Index $250 $200 $150 $100 $50 $0 12/18 12/19 12/20 12/21 UnitedHealth Group Dow Jones US Industrial Average UnitedHealth Group. S&P Health Care Index Dow Jones US Industrial Average. S&P 500 Index. 12/22 S&P 500 Health Care - S&P 500 12/23 12/18 100.00 S 100.00 12/19 12/20 12/21 119.99 145.43 S 211.18 S 12/22 225.85 12/23 227.65 120.82 137.07 172.89 169.51 172.99 100.00 100.00 125.34 131.49 137.53 166.34 154.92 180.00 155.68 200.37 164.08 207.21 The stock price performance included in this graph is not necessarily indicative of future stock price performance. The preceding stock performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this Annual Report on Form 10-K into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates such information by reference, and shall not otherwise be deemed filed under such Acts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The performance graph provided compares the cumulative fiveyear total return to shareholders of Unit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started