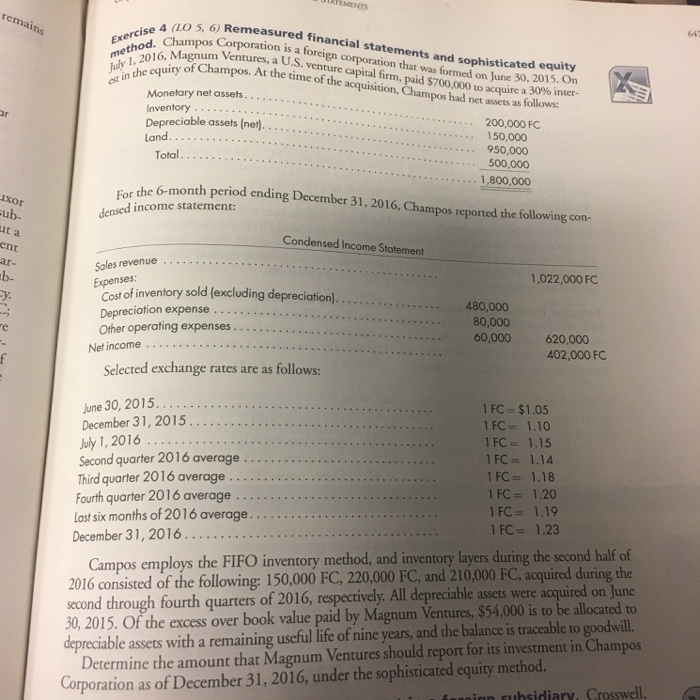

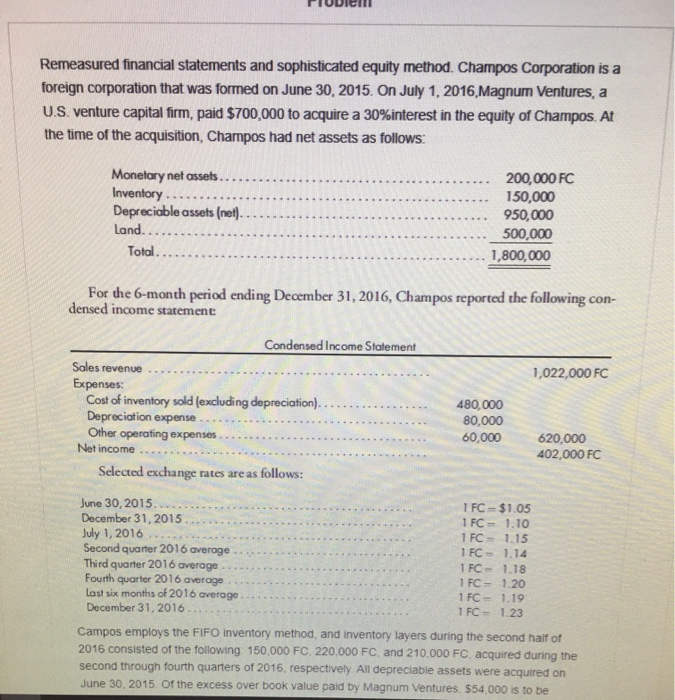

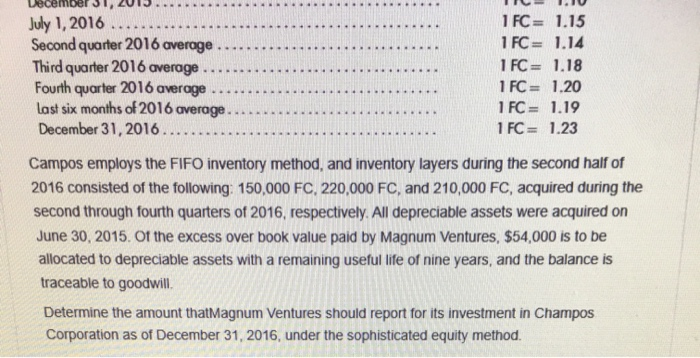

method. Champos Corporation is a foreign corporation that was formed on June 30, 2015. On Exercise 4 (LO 5, 6) Remeasured financial statements and sophisticated equity or in the equity of Champos. At the time of the acquisition, Champos had net assets as follows: July 1, 2016, Magnum Ventures, a U.S. venture capital firm, paid $700,000 to acquire a 30% inter- MENTS remains 641 X Or Monetary net assets. Inventory Depreciable assets (net). Land Total. 200,000 FC 150,000 950,000 500,000 1,800,000 For the 6-month period ending December 31, 2016, Champos reported the following con- xor ub- ut a ent densed income statement: Condensed Income Statement ar- eb- Sales revenue Expenses: "e Net income f 1,022,000 FC Cost of inventory sold (excluding depreciation). Depreciation expense.... 480,000 Other operating expenses. 80,000 60,000 620,000 402,000 FC Selected exchange rates are as follows: June 30, 2015. 1 FC - $1.05 December 31, 2015 1 FC = 1.10 July 1, 2016 1 FC = 1.15 Second quarter 2016 average 1 FC = 1.14 Third quarter 2016 average. 1 FC = 1.18 Fourth quarter 2016 average 1 FC = 1.20 Last six months of 2016 average. 1 FC = 1.19 December 31, 2016..... 1 FC = 1.23 Campos employs the FIFO inventory method, and inventory layers during the second half of 2016 consisted of the following: 150,000 FC, 220,000 FC, and 210,000 FC, acquired during the second through fourth quarters of 2016, respectively. All depreciable assets were acquired on June 30, 2015. Of the excess over book value paid by Magnum Ventures, $54,000 is to be allocated to depreciable assets with a remaining useful life of nine years, and the balance is traceable to goodwill. Determine the amount that Magnum Ventures should report for its investment in Champos Corporation as of December 31, 2016, under the sophisticated equity method. fnuninn subsidiary. Crosswell, Remeasured financial statements and sophisticated equity method. Champos Corporation is a foreign corporation that was formed on June 30, 2015. On July 1, 2016, Magnum Ventures, a U.S. venture capital firm, paid $700,000 to acquire a 30%interest in the equity of Champos. At the time of the acquisition, Champos had net assets as follows: Monetary net assets.. Inventory Depreciable assets (net). Land.. Total. 200,000 FC 150,000 950,000 500,000 1,800,000 For the 6-month period ending December 31, 2016, Champos reported the following con- densed income statement Condensed Income Statement Sales revenue 1,022,000 FC Expenses: Cost of inventory sold (excluding depreciation)... 480,000 Depreciation expense 80,000 Other operating expenses 60,000 620,000 402,000 FC Selected exchange rates are as follows: Net income June 30, 2015 1 FC - $1.05 December 31, 2015 1 FC - 1.10 July 1, 2016 1 FC 1.15 Second quarter 2016 overage 1 FC - 1.14 Third quarter 2016 average 1 FC - 1.18 Fourth quarter 2016 average 1 FC - 1.20 Last six months of 2016 average 1 FC - 1.19 December 31, 2016 1 FC - 1.23 Campos employs the FIFO inventory method, and inventory layers during the second half of 2016 consisted of the following 150,000 FC, 220,000 FC and 210.000 FC. acquired during the second through fourth quarters of 2016, respectively. All depreciable assets were acquired on June 30, 2015. Of the excess over book value paid by Magnum Ventures. $54.000 is to be Weceme --- July 1, 2016 1 FC = 1.15 Second quarter 2016 average 1 FC = 1.14 Third quarter 2016 average 1 FC = 1.18 Fourth quarter 2016 average 1 FC = 1.20 Last six months of 2016 average. 1 FC = 1.19 December 31, 2016..... 1 FC = 1.23 Campos employs the FIFO inventory method, and inventory layers during the second half of 2016 consisted of the following: 150,000 FC, 220,000 FC, and 210,000 FC, acquired during the second through fourth quarters of 2016, respectively. All depreciable assets were acquired on June 30, 2015. Of the excess over book value paid by Magnum Ventures, $54,000 is to be allocated to depreciable assets with a remaining useful life of nine years, and the balance is traceable to goodwill Determine the amount thatMagnum Ventures should report for its investment in Champos Corporation as of December 31, 2016, under the sophisticated equity method