Question

Metlock Co. sells product P-14 at a price of $52 a unit. The per-unit cost data are direct materials $16, direct labour $12, and

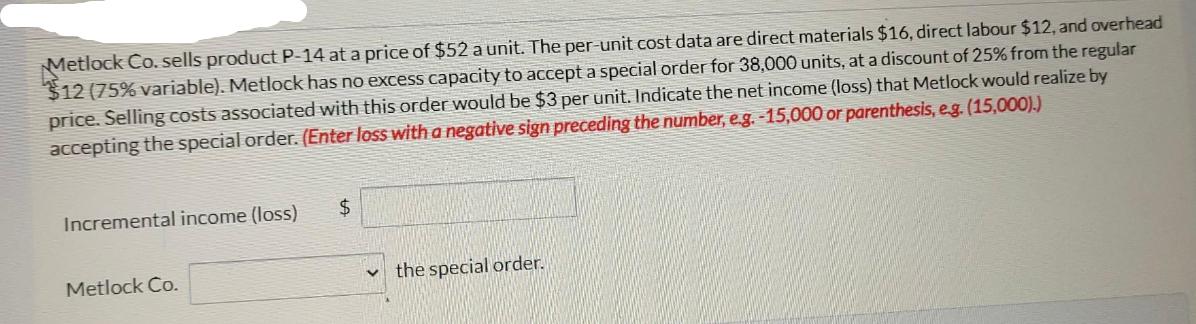

Metlock Co. sells product P-14 at a price of $52 a unit. The per-unit cost data are direct materials $16, direct labour $12, and overhead $12 (75% variable). Metlock has no excess capacity to accept a special order for 38,000 units, at a discount of 25% from the regular price. Selling costs associated with this order would be $3 per unit. Indicate the net income (loss) that Metlock would realize by accepting the special order. (Enter loss with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Incremental income (loss) Metlock Co. $ the special order.

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the incremental income loss for Metlock Co by accepting the spec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ

6th Canadian edition

978-0132893534, 9780133389401, 132893533, 133389405, 978-0133392883

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App