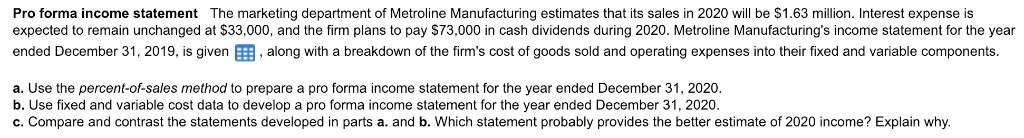

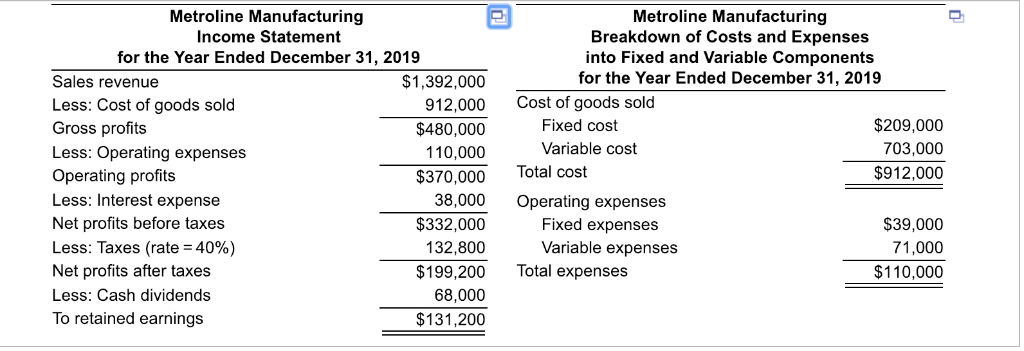

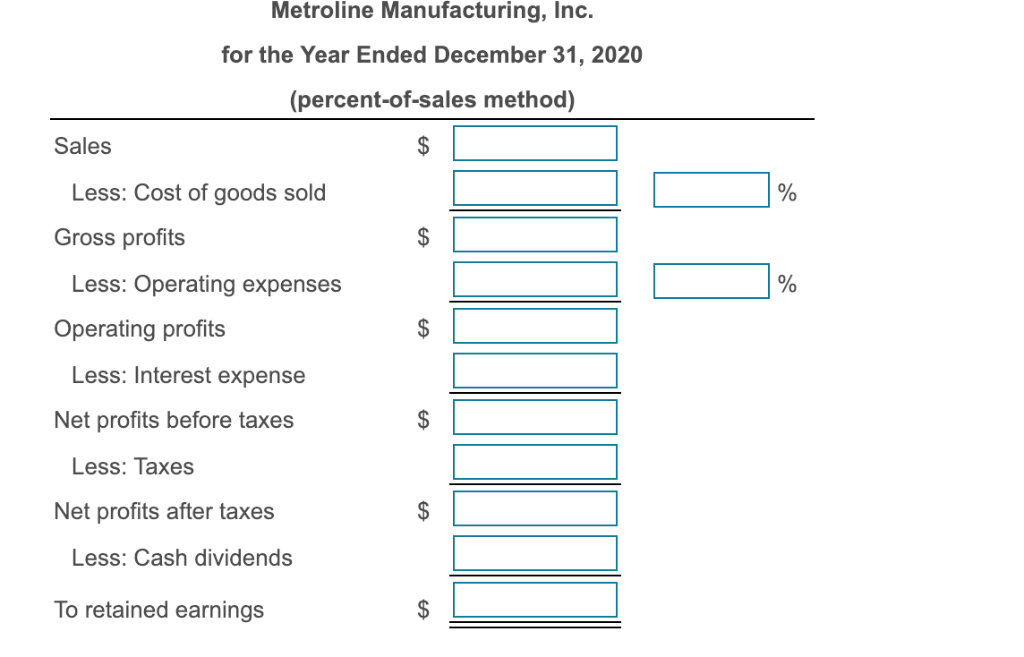

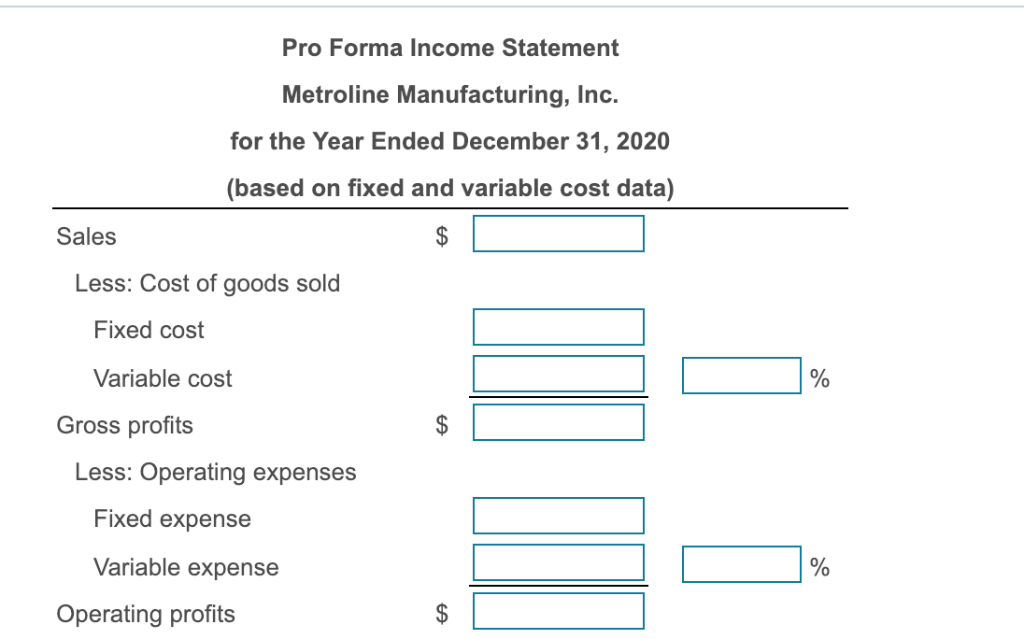

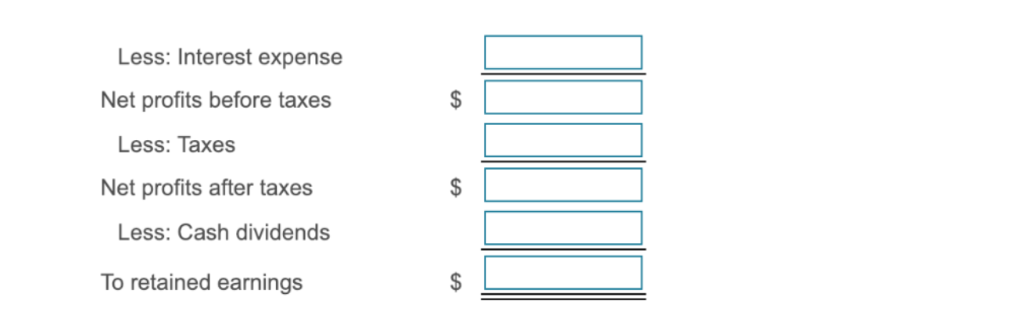

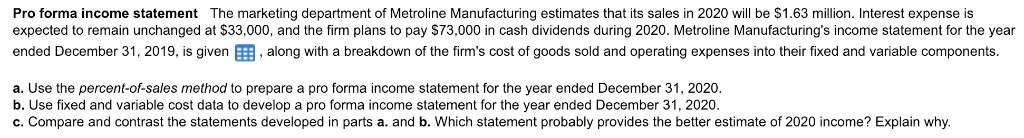

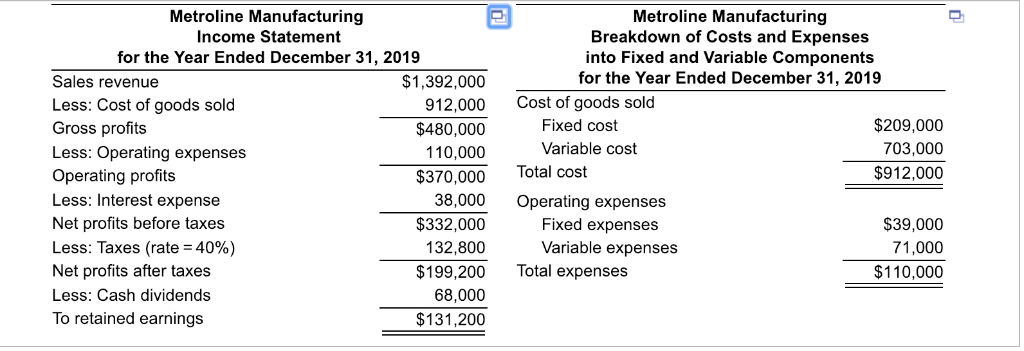

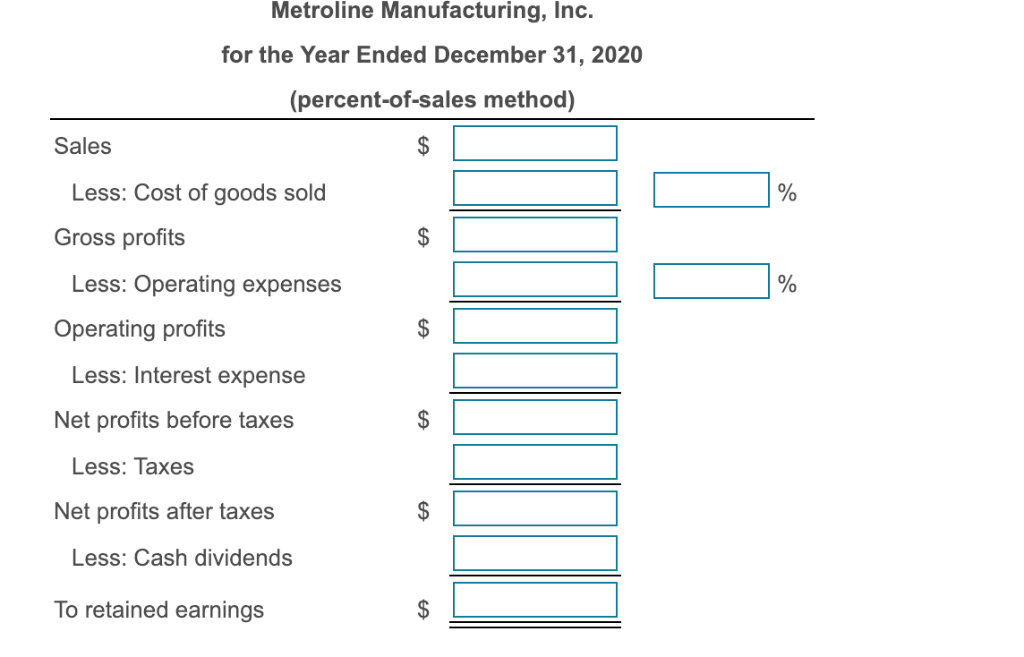

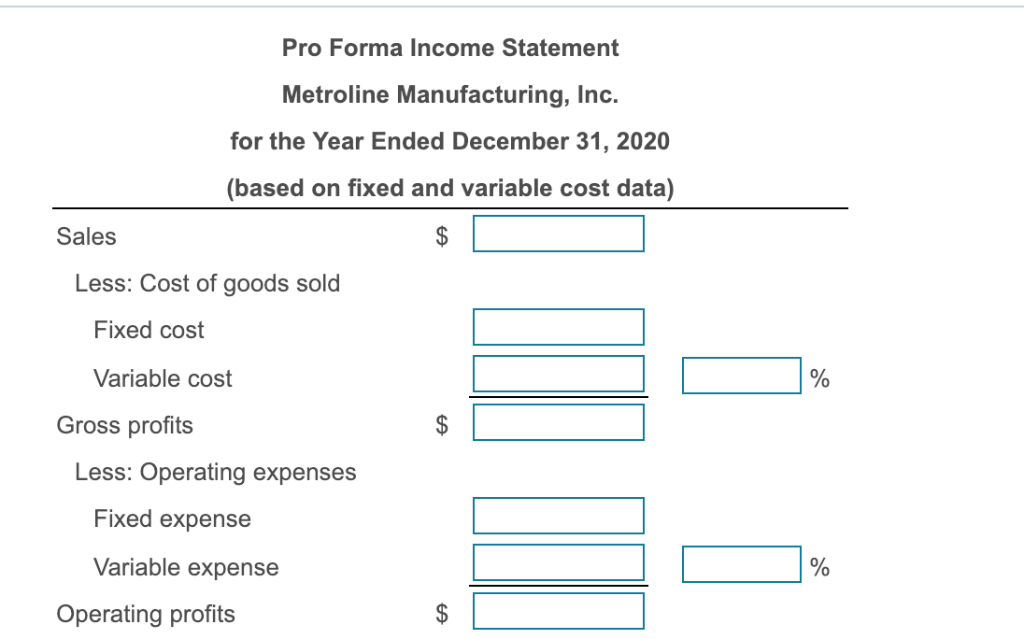

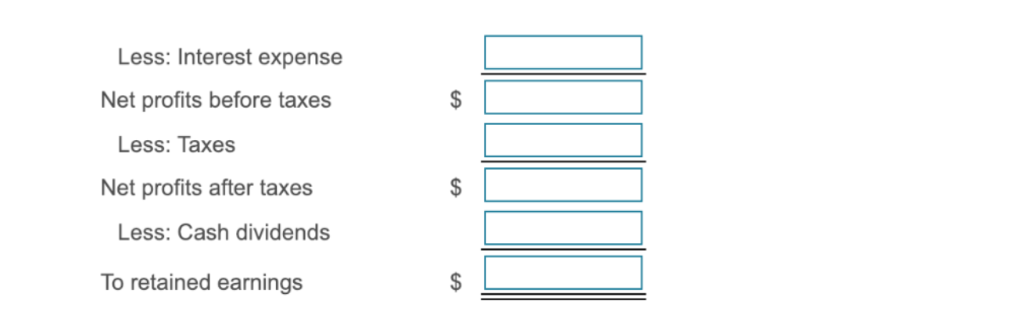

Metroline Manufacturing Income Statement for the Year Ended December 31, 2019 Metroline Manufacturing Breakdown of Costs and Expenses into Fixed and Variable Components for the Year Ended December 31, 2019 $1,392,000 912,000 $480,000 110,000 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate-40%) Net profits after taxes Less: Cash dividends To retained earnings Cost of goods sold Fixed cost Variable cost $209,000 703,000 $912,000 $370,000 Total cost 38,000Operating expenses $332,000 132,800 Fixed expenses Variable expenses $39,000 71,000 $110,000 $199,200 Total expenses 68,000 $131,200 Metroline Manufacturing, Inc. for the Year Ended December 31, 2020 (percent-of-sales method) Sales Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Cash dividends To retained earnings Pro Forma Income Statement Metroline Manufacturing, Inc. for the Year Ended December 31, 2020 (based on fixed and variable cost data) Sales Less: Cost of goods sold Fixed cost Variable cost Gross profits Less: Operating expenses Fixed expense Variable expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Cash dividends To retained earnings Metroline Manufacturing Income Statement for the Year Ended December 31, 2019 Metroline Manufacturing Breakdown of Costs and Expenses into Fixed and Variable Components for the Year Ended December 31, 2019 $1,392,000 912,000 $480,000 110,000 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate-40%) Net profits after taxes Less: Cash dividends To retained earnings Cost of goods sold Fixed cost Variable cost $209,000 703,000 $912,000 $370,000 Total cost 38,000Operating expenses $332,000 132,800 Fixed expenses Variable expenses $39,000 71,000 $110,000 $199,200 Total expenses 68,000 $131,200 Metroline Manufacturing, Inc. for the Year Ended December 31, 2020 (percent-of-sales method) Sales Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Cash dividends To retained earnings Pro Forma Income Statement Metroline Manufacturing, Inc. for the Year Ended December 31, 2020 (based on fixed and variable cost data) Sales Less: Cost of goods sold Fixed cost Variable cost Gross profits Less: Operating expenses Fixed expense Variable expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Cash dividends To retained earnings