Question

Metropolitan Financial Corporation operates securities trading operations outside the United States through two foreign corporations that are classified as disregarded entities (or branches). For the

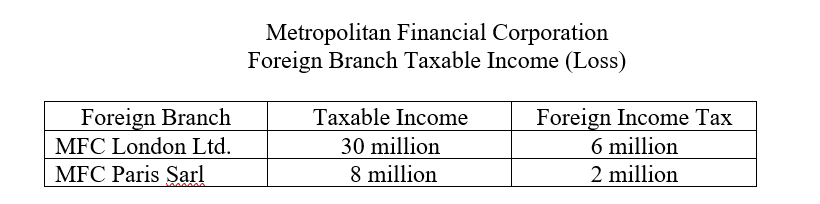

- Metropolitan Financial Corporation operates securities trading operations outside the United States through two foreign corporations that are classified as disregarded entities (or branches). For the current taxable year, the entities report the following financial results:

Foreign Branch MFC London Ltd. MFC Paris Sarl Metropolitan Financial Corporation Foreign Branch Taxable Income (Loss) Taxable Income 30 million 8 million Foreign Income Tax 6 million 2 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information Metropolitan Financial Corporation operates t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

8th Edition

1260247848, 978-1260247848

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App