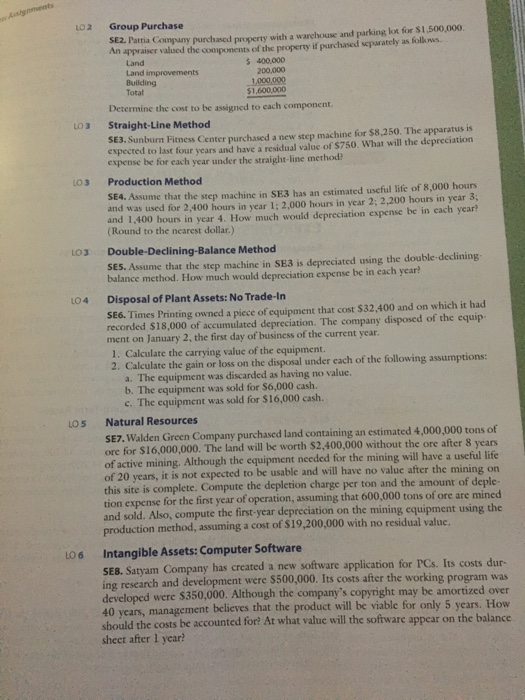

mets LO 2 Group Purchase SE2. Partia Company purchased property with a warehouse and parking lot for $1,500,000 An appraiser valued the components of the property if purchased separately as follows Land $ 400.000 Land improvements 200.000 Building 1.000.000 Total $1,600,000 Determine the cost to be assigned to each component LOS Straight-Line Method SE3. Sunburn Fitness Center purchased a new step machine for $8,250. The apparatus is expected to last four years and have a residual value of $750. What will the depreciation expense be for each year under the straight-line method LO3 Production Method SE4. Assume that the step machine in SE3 has an estimated useful life of 8,000 hours and was used for 2,400 hours in year 1:2,000 hours in year 2; 2,200 hours in year 3, and 1,400 hours in year 4. How much would depreciation expense be in each year! (Round the nearest dollar.) LO Double-Declining-Balance Method SES. Assume that the step machine in SE3 is depreciated using the double-declining balance method. How much would depreciation expense be in each year? LO4 Disposal of Plant Assets: No Trade-In SE6. Times Printing owned a piece of equipment that cost $32,400 and on which it had recorded $18,000 of accumulated depreciation. The company disposed of the equip ment on January 2, the first day of business of the current year. 1. Calculate the carrying value of the equipment, 2. Calculate the gain or loss on the disposal under each of the following assumptions: a. The equipment was discarded as having no value, b. The equipment was sold for $6,000 cash. c. The equipment was sold for $16,000 cash. LO5 Natural Resources SEZ. Walden Green Company purchased land containing an estimated 4,000,000 tons of ore for $16,000,000. The land will be worth $2,400,000 without the ore after 8 years of active mining. Although the equipment needed for the mining will have a useful life of 20 years, it is not expected to be usable and will have no value after the mining on this site is complete. Compute the depletion charge per ton and the amount of deple- tion expense for the first year of operation, assuming that 600,000 tons of ore are mined and sold. Also, compute the first-year depreciation on the mining equipment using the production method, assuming a cost of $19,200,000 with no residual value. L06 Intangible Assets: Computer Software SEB. Satyam Company has created a new software application for PCs. Its costs dur- ing research and development were $500,000. Its costs after the working program was developed were $350,000. Although the company's copyright may be amortized over 40 years, management believes that the product will be viable for only 5 years. How should the costs be accounted for? At what value will the software appear on the balance sheet after 1 year