Answered step by step

Verified Expert Solution

Question

1 Approved Answer

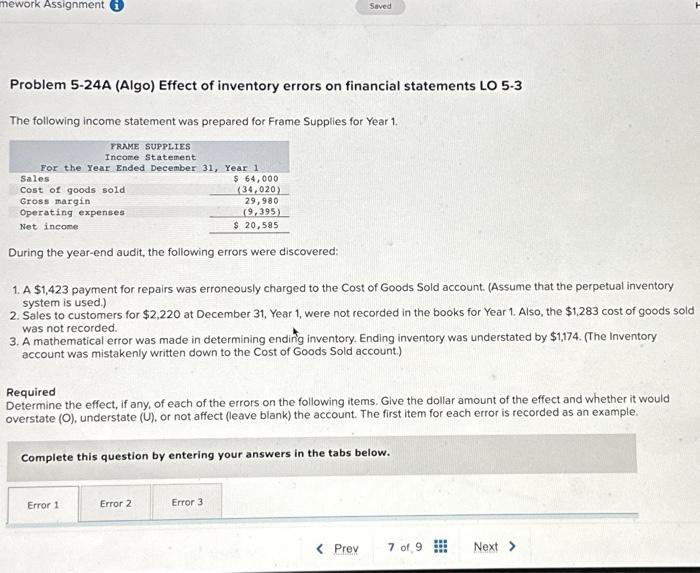

mework Assignment Problem 5-24A (Algo) Effect of inventory errors on financial statements LO 5-3 The following income statement was prepared for Frame Supplies for Year

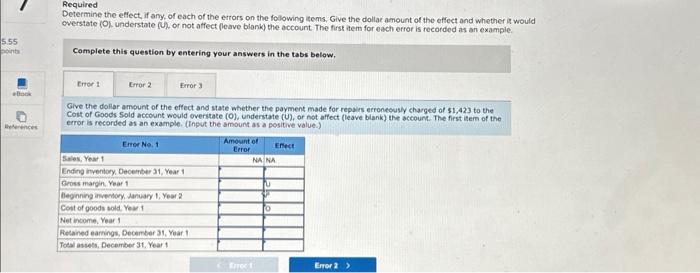

mework Assignment Problem 5-24A (Algo) Effect of inventory errors on financial statements LO 5-3 The following income statement was prepared for Frame Supplies for Year 1. FRAME SUPPLIES Income Statement For the Year Ended December 31, Year 1 $ 64,000 (34,020) 29,980 (9,395) $ 20,585 Sales Cost of goods sold Gross margin Operating expenses Net income During the year-end audit, the following errors were discovered: 1. A $1,423 payment for repairs was erroneously charged to the Cost of Goods Sold account. (Assume that the perpetual inventory system is used.) 2. Sales to customers for $2,220 at December 31, Year 1, were not recorded in the books for Year 1. Also, the $1,283 cost of goods sold was not recorded. 3. A mathematical error was made in determining ending inventory. Ending inventory was understated by $1,174. (The Inventory account was mistakenly written down to the Cost of Goods Sold account.) Saved Required Determine the effect, if any, of each of the errors on the following items. Give the dollar amount of the effect and whether it would overstate (O), understate (U), or not affect (leave blank) the account. The first item for each error is recorded as an example. Complete this question by entering your answers in the tabs below. Error 1 Error 2 Error 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started