Answered step by step

Verified Expert Solution

Question

1 Approved Answer

mework - Google Chrome JayerHomework.aspx?homeworkld = 6 7 8 9 4 6 1 2 0 &questionld = 1 9 &flushed = false&cld = 7 9

mework Google Chrome

JayerHomework.aspx?homeworkld&questionld&flushedfalse&clderwin yes

ine Fall G Johnson

Megan Eason

: PM

US:

Question C

HW Score: of

Part of

points

Points: of

One December, a yearold woman died and left $ million to a university. This fortune was accumulated through shrewd and patient investment of a $ nest egg over the course of years. In turning $ into $ million, what were the total and annual returns? How did her annual return compare to the average annual return for stocks?

Her total return on the investment was

Type a whole number.

omework Google Chrome

layerHomework.aspx?homeworkid&questionld&flushedfalse&clderwinyes

ne Fall G Johnson

Megan Eason

: PM

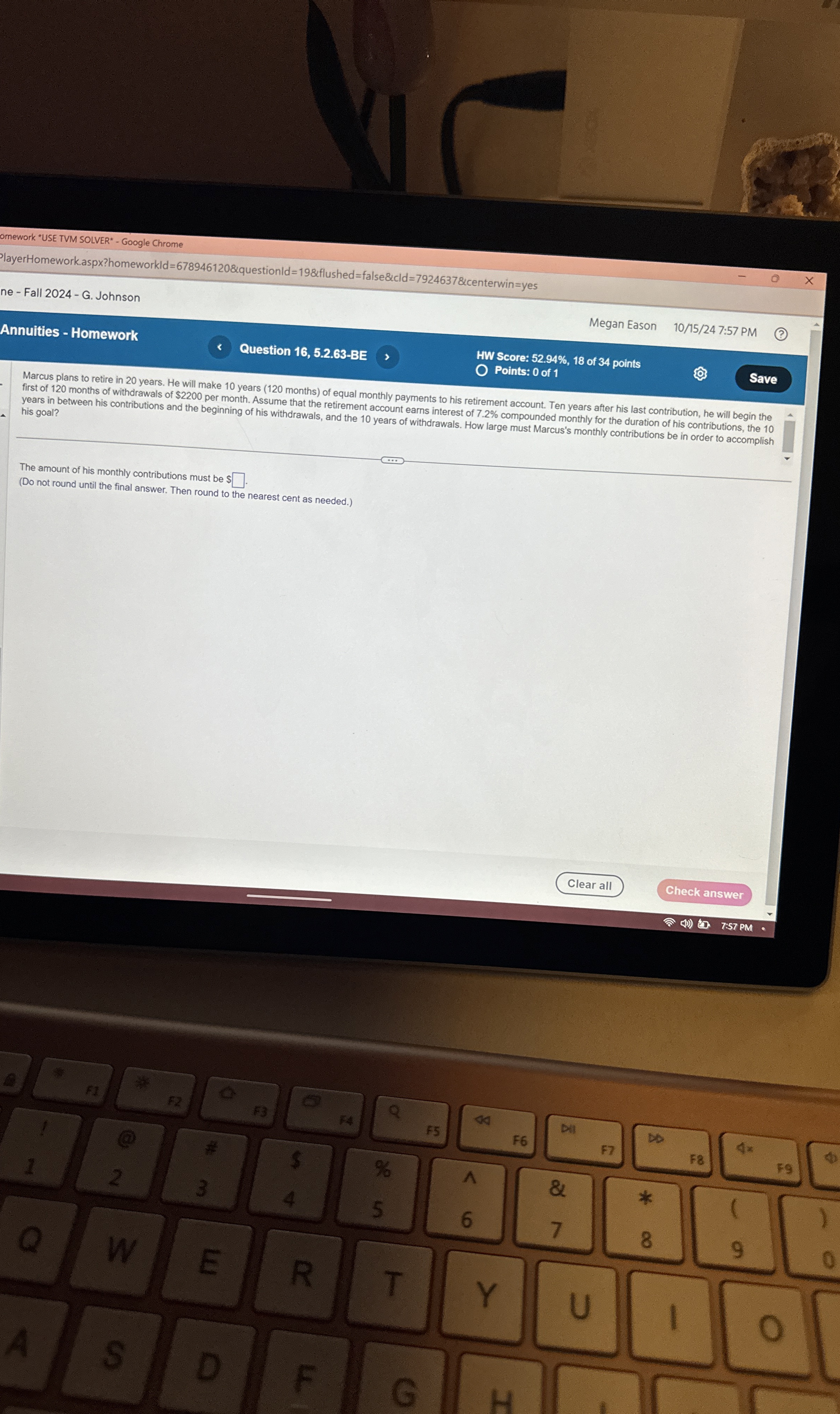

Annuities Homework

Question BE

HW Score: of points

Points: of

Marcus plans to retire in years. He will make years months of equal monthly payments to his retirement account. Ten years after his last contribution, he will begin the first of months of withdrawals of $ per month. Assume that the retirement account earns interest of compounded monthly for the duration of his contributions, the his goal?

The amount of his monthly contributions must be $

Do not round until the final answer. Then round to the nearest cent as needed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started