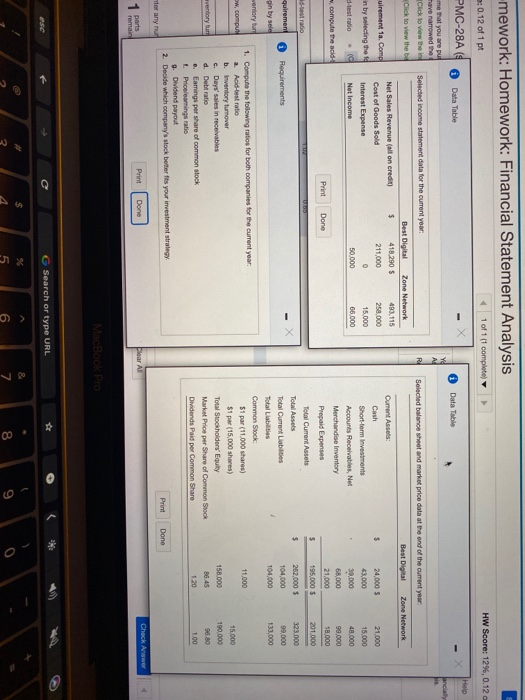

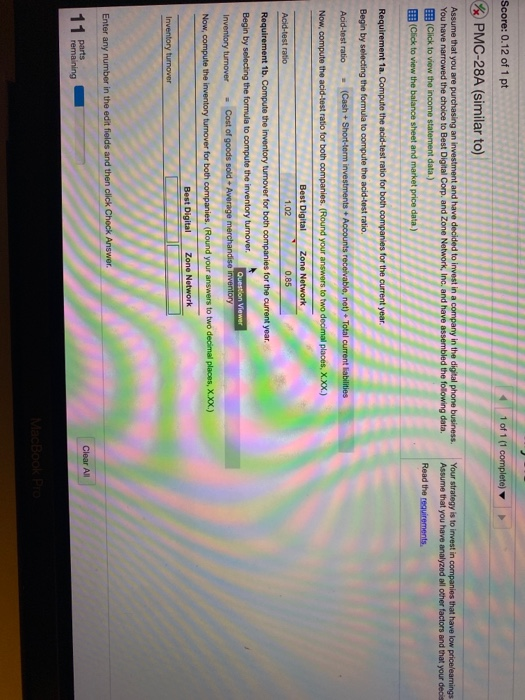

-mework: Homework: Financial Statement Analysis : 0.12 of 1 pt 1 of 1 1 complete HW Score: 12%, 0.12 Help PMC-28A Data Table Data Table fancialy me that you are put mave narrowed the Click to view the in Click to view the Selected income statement data for the current year: R Selected balance sheet and market price data at the end of the current year Best Digital Zone Network uirement 1a. Como in by selecting the $ Net Sales Revenue (all on credit) Cost of Goods Sold Interest Expense Net Income Best Digital Zone Network 418.290 S 493, 115 211,000 258,000 0 15.000 50.000 66,000 24,000 $ 43.000 21,000 15,000 48,000 -test ratio compute the acid 30.000 68,000 21,000 195,000 $ 99,000 18,000 Print Done s 201.000 -test ratio $ 323.000 quirement Current Assets Cash Short-term Investments Accounts Receivables, Net Merchandise Inventory Prepaid Expenses Total Current Assets Total Assets Total Current Liabilities Total Liabilities Common Stock $1 par (11.000 shares) $1 par (15,000 shares) Total Stockholders' Equity Market Price per Share of Common Stock Dividends Paid per Common Share Requirements 262,000 $ 104.000 104.000 99,000 133,000 in by sele wentorytur 11.000 ow, comput 2 15.000 verlorytur 1. Compute the following ratios for both companies for the current year Asbest ratio b. Inventory turnover c. Duys' sales in receivables d. Debratio e. Earings per share of common stock Pricelarnings ratio 9. Dividend payout 2. Decide which company's stock better fits your investment strategy 158.000 86.45 1.20 190.000 90.80 100 Print Done for any nu Check Answer 1 Done Print Clear A remain MacBook Pro G Search or type URL & 5. 6 7 8 9 Score: 0.12 of 1 pt 1 of 1 (1 complete) PMC-28A (similar to) Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business You have narrowed the choice to Best Digital Corp. and Zone Network, Inc. and have assembled the following data. EFE (Click to view the income statement data) (Click to view the balance sheet and market price data) Your strategy is to invest in companies that have low pricelearnings Assume that you have analyzed all other factors and that your decis Read the requirements Requirement 1a. Compute the acid-test ratio for both companies for the current year, Begin by selecting the formula to compute the acid-test ratio. Acid-test ratio (Cash + Short-term investments + Accounts receivable, not) - Total current liabilities Now, compute the acid-test ratio for both companies. (Round your answers to two decimal places, X.XX.) Best Digital Zone Network Acid-test ratio 1.02 0.85 Requirement 1b. Compute the inventory tumover for both companies for the current year. Begin by selecting the formula to compute the inventory turnover. Question Viewer Inventory turnover = Cost of goods sold Average merchandise inventory Now, compute the inventory turnover for both companies. (Round your answers to two decimal places, X.XX.) Best Digital Zone Network Inventory turnover Enter any number in the edit fields and then click Check Answer Clear All 11 parts remaining MacBook PC