Answered step by step

Verified Expert Solution

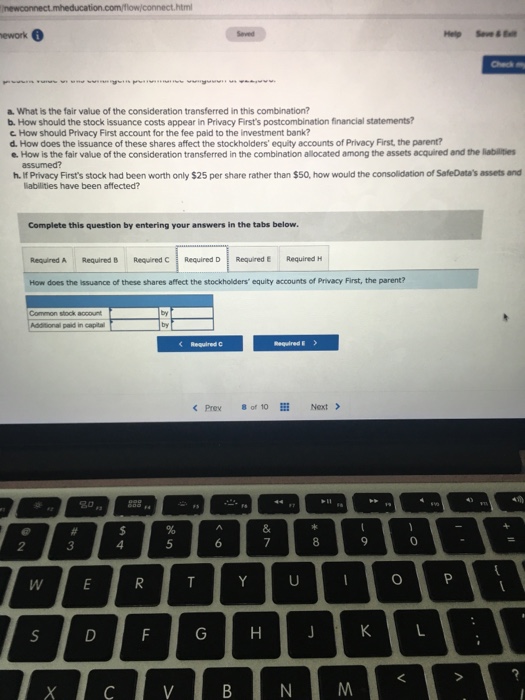

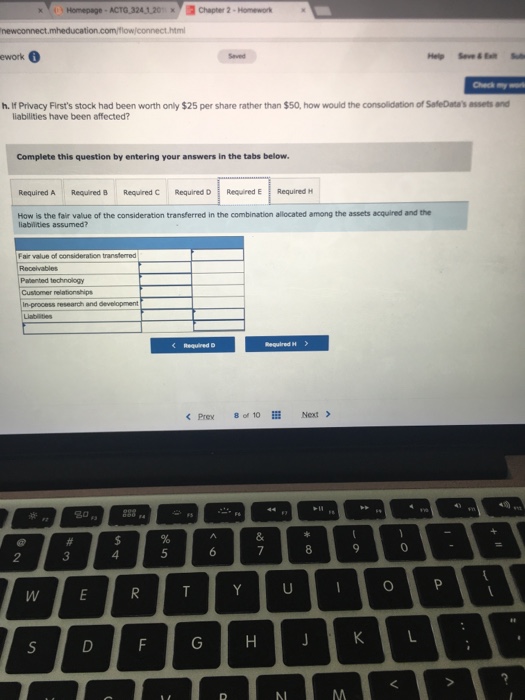

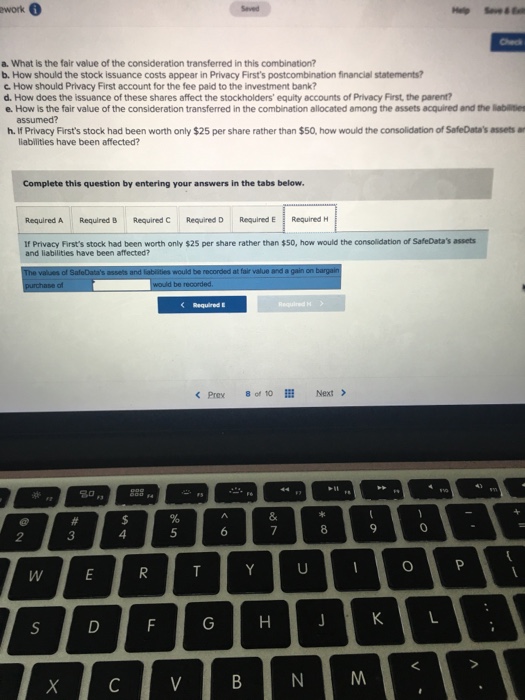

Question

1 Approved Answer

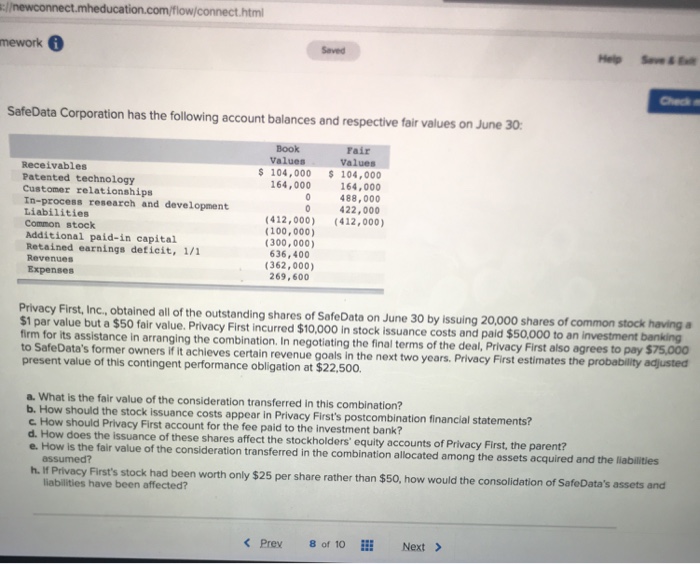

mework Seved Check SafeData Corporation has the following account balances and respective fair values on June 30 Book Values Fair Values Receivables Patented technology Customer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started