Answered step by step

Verified Expert Solution

Question

1 Approved Answer

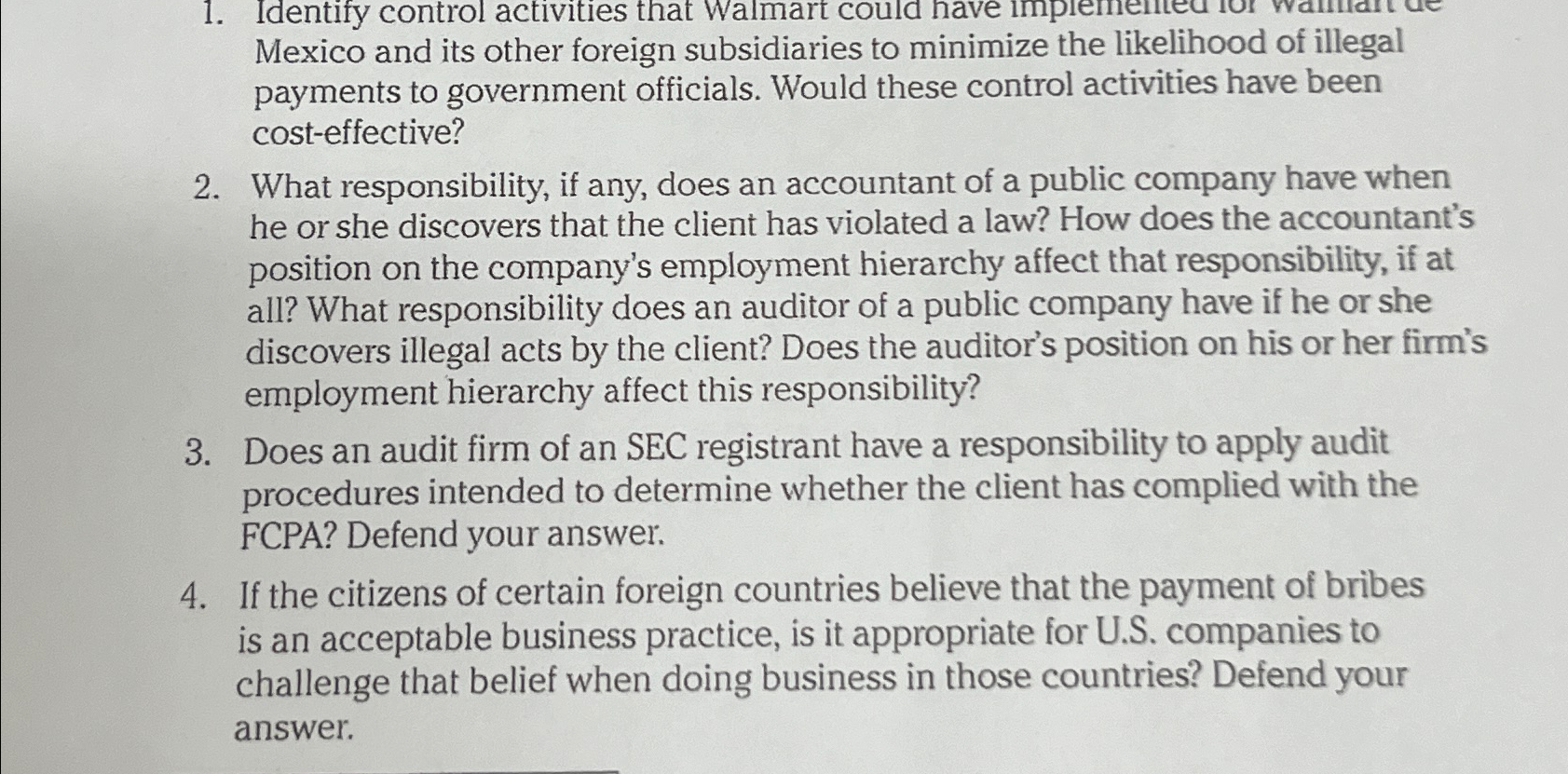

Mexico and its other foreign subsidiaries to minimize the likelihood of illegal payments to government officials. Would these control activities have been cost - effective?

Mexico and its other foreign subsidiaries to minimize the likelihood of illegal payments to government officials. Would these control activities have been costeffective?

What responsibility, if any, does an accountant of a public company have when he or she discovers that the client has violated a law? How does the accountant's position on the company's employment hierarchy affect that responsibility, if at all? What responsibility does an auditor of a public company have if he or she discovers illegal acts by the client? Does the auditor's position on his or her firm's employment hierarchy affect this responsibility?

Does an audit firm of an SEC registrant have a responsibility to apply audit procedures intended to determine whether the client has complied with the FCPA? Defend your answer:

If the citizens of certain foreign countries believe that the payment of bribes is an acceptable business practice, is it appropriate for US companies to challenge that belief when doing business in those countries? Defend your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started