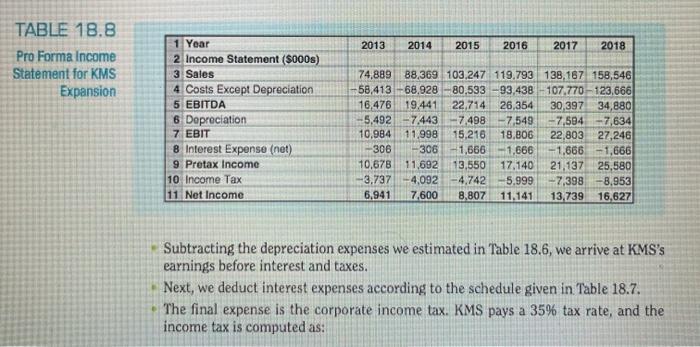

MFL 13. Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2015. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly, calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10-year bond and interest rates remain the same as in the chapter) through 2018. Chapter 18 Financial Modeling and Pro Forma Analysis 581 MER 14. Under the assumption that KMS's market share will increase by 0.25% per year (and the investment and financing will be adjusted as described in Problem 13), you project the following depreciation: Year 2013 2014 2015 2016 2017 2018 Depreciation 5,492 5,443 7,398 7.459 7,513 7,561 MF Using this information, project net income through 2018 (that is, reproduce Table 18.8 under the new assumptions 15. Assuming that KMS's market share will increase by 0.25% per year (implying that the investment, financing, and depreciation will be adjusted as described in Prob- lems 13 and 14), and that the working capital assumptions used in the chapter still hold, calculate KMS's working capital requirements through 2018 (that is, reproduce Table 18.9 under the new assumptions). 2013 2014 2015 2016 2017 2018 TABLE 18.8 Pro Forma Income Statement for KMS Expansion 1 Year 2 Income Statement ($000s) 3 Sales 4 Costs Except Depreciation 5 EBITDA 6 Depreciation 7 EBIT 8 Interest Expense (net) 9 Pretax Income 10 Income Tax 11 Net Income 74,889 88,369. 103,247 119.793 138,167 158,546 58,413 68.928 -80.533 -93,438 -107.770 -123,666 16,476 19.441 22,714 26,354 30,397 34,880 -5,492 -- 7.443 7.498 -7.549 -7,594 -7,634 10,984 11,998 15,216 19.306 22,803 27,246 -306 -306 -1,666 -1,666 -1.666 1,666 10,678 11.692 13,550 17,140 21,137 25,580 3,737 -4,092 -4.742 -5,999 -7,398 -8,953 6.941 7,600 8,807 11,141 13,739 16,627 Subtracting the depreciation expenses we estimated in Table 18.6, we arrive at KMS's earnings before interest and taxes. Next, we deduct interest expenses according to the schedule given in Table 18.7. The final expense is the corporate income tax. KMS pays a 35% tax rate, and the income tax is computed as: MFL 13. Under the assumption that KMS's market share will increase by 0.25% per year, you determine that the plant will require an expansion in 2015. The expansion will cost $20 million. Assuming that the financing of the expansion will be delayed accordingly, calculate the projected interest payments and the amount of the projected interest tax shields (assuming that KMS still uses a 10-year bond and interest rates remain the same as in the chapter) through 2018. Chapter 18 Financial Modeling and Pro Forma Analysis 581 MER 14. Under the assumption that KMS's market share will increase by 0.25% per year (and the investment and financing will be adjusted as described in Problem 13), you project the following depreciation: Year 2013 2014 2015 2016 2017 2018 Depreciation 5,492 5,443 7,398 7.459 7,513 7,561 MF Using this information, project net income through 2018 (that is, reproduce Table 18.8 under the new assumptions 15. Assuming that KMS's market share will increase by 0.25% per year (implying that the investment, financing, and depreciation will be adjusted as described in Prob- lems 13 and 14), and that the working capital assumptions used in the chapter still hold, calculate KMS's working capital requirements through 2018 (that is, reproduce Table 18.9 under the new assumptions). 2013 2014 2015 2016 2017 2018 TABLE 18.8 Pro Forma Income Statement for KMS Expansion 1 Year 2 Income Statement ($000s) 3 Sales 4 Costs Except Depreciation 5 EBITDA 6 Depreciation 7 EBIT 8 Interest Expense (net) 9 Pretax Income 10 Income Tax 11 Net Income 74,889 88,369. 103,247 119.793 138,167 158,546 58,413 68.928 -80.533 -93,438 -107.770 -123,666 16,476 19.441 22,714 26,354 30,397 34,880 -5,492 -- 7.443 7.498 -7.549 -7,594 -7,634 10,984 11,998 15,216 19.306 22,803 27,246 -306 -306 -1,666 -1,666 -1.666 1,666 10,678 11.692 13,550 17,140 21,137 25,580 3,737 -4,092 -4.742 -5,999 -7,398 -8,953 6.941 7,600 8,807 11,141 13,739 16,627 Subtracting the depreciation expenses we estimated in Table 18.6, we arrive at KMS's earnings before interest and taxes. Next, we deduct interest expenses according to the schedule given in Table 18.7. The final expense is the corporate income tax. KMS pays a 35% tax rate, and the income tax is computed as