Answered step by step

Verified Expert Solution

Question

1 Approved Answer

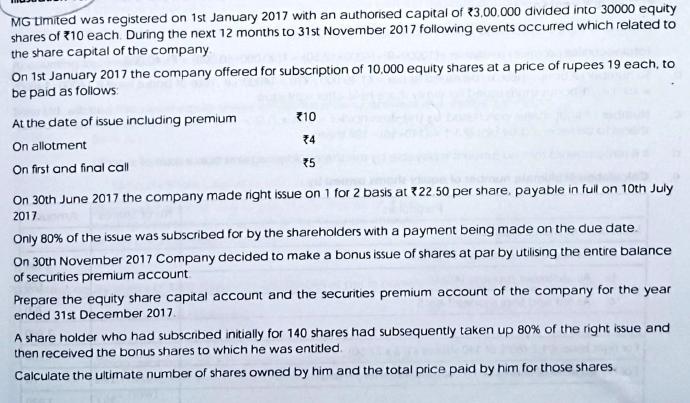

MG Limited was registered on 1st January 2017 with an authorised capital of 23,00.000 divided into 30000 equity shares of 10 each. During the

MG Limited was registered on 1st January 2017 with an authorised capital of 23,00.000 divided into 30000 equity shares of 10 each. During the next 12 months to 31st November 2017 following events occurred which related to the share capital of the company On 1st January 2017 the company offered for subscription of 10.000 equity shares at a price of rupees 19 each, to be paid as follows: At the date of issue including premium On allotment On first and final call *10 *4 75 On 30th June 2017 the company made right issue on 1 for 2 basis at 22.50 per share, payable in full on 10th July 2017 Only 80% of the issue was subscribed for by the shareholders with a payment being made on the due date. On 30th November 2017 Company decided to make a bonus issue of shares at par by utilising the entire balance of securities premium account Prepare the equity share capital account and the securities premium account of the company for the year ended 31st December 2017. A share holder who had subscribed initially for 140 shares had subsequently taken up 80% of the right issue and then received the bonus shares to which he was entitled. Calculate the ultimate number of shares owned by him and the total price paid by him for those shares.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started