Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MGMT 3135 Minimum Wage Increase It is 2020. The US government has passed a new federal minimum wage of $11.00/hour. It will go into effect

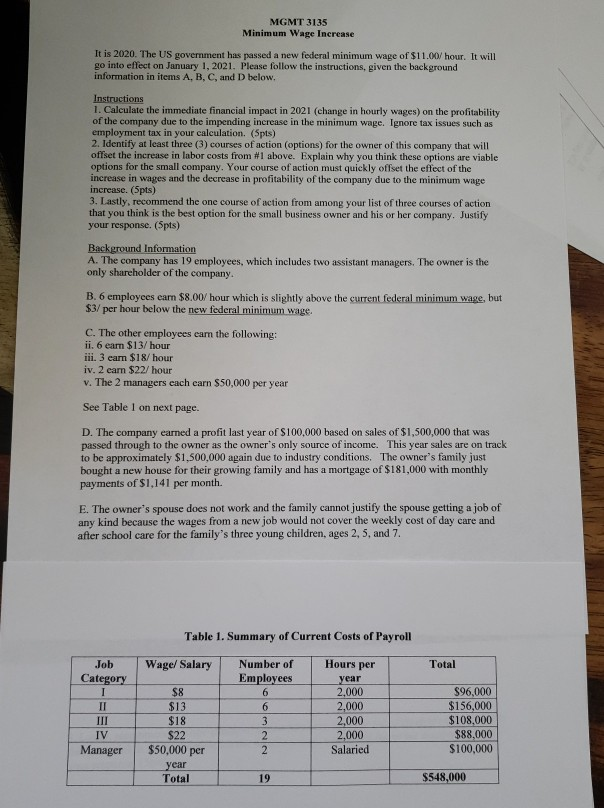

MGMT 3135 Minimum Wage Increase It is 2020. The US government has passed a new federal minimum wage of $11.00/hour. It will go into effect on January 1, 2021. Please follow the instructions, given the background information in items A, B, C, and D below. Instructions 1. Calculate the immediate financial impact in 2021 (change in hourly wages) on the profitability of the company due to the impending increase in the minimum wage. Ignore tax issues such as employment tax in your calculation. (5pts) 2. Identify at least three (3) courses of action (options) for the owner of this company that will offset the increase in labor costs from #1 above. Explain why you think these options are viable options for the small company. Your course of action must quickly offset the effect of the increase in wages and the decrease in profitability of the company due to the minimum wage increase. (5pts) 3. Lastly, recommend the one course of action from among your list of three courses of action that you think is the best option for the small business owner and his or her company. Justify your response. (Spts) Background Information A. The company has 19 employees, which includes two assistant managers. The owner is the only shareholder of the company. B. 6 employees earn $8.00/hour which is slightly above the current federal minimum wage, but $3/ per hour below the new federal minimum wage. C. The other employees eam the following: ii. 6 eam $13/hour iii. 3 earn $18/ hour iv. 2 cam $22/ hour v. The 2 managers each earn $50,000 per year See Table I on next page. D. The company earned a profit last year of $100,000 based on sales of $1,500,000 that was passed through to the owner as the owner's only source of income. This year sales are on track to be approximately $1,500,000 again due to industry conditions. The owner's family just bought a new house for their growing family and has a mortgage of $181,000 with monthly payments of $1,141 per month. E. The owner's spouse does not work and the family cannot justify the spouse getting a job of any kind because the wages from a new job would not cover the weekly cost of day care and after school care for the family's three young children, ages 2, 5, and 7. Table 1. Summary of Current Costs of Payroll Job Category Wage/ Salary Total Number of Employees Il III IV Manager 3 Hours per year 2.000 2.000 2,000 2,000 Salaried $8 $13 $18 $22 $50,000 per year Total $96,000 $156,000 $108,000 $88.000 $100,000 $548,000 MGMT 3135 Minimum Wage Increase It is 2020. The US government has passed a new federal minimum wage of $11.00/hour. It will go into effect on January 1, 2021. Please follow the instructions, given the background information in items A, B, C, and D below. Instructions 1. Calculate the immediate financial impact in 2021 (change in hourly wages) on the profitability of the company due to the impending increase in the minimum wage. Ignore tax issues such as employment tax in your calculation. (5pts) 2. Identify at least three (3) courses of action (options) for the owner of this company that will offset the increase in labor costs from #1 above. Explain why you think these options are viable options for the small company. Your course of action must quickly offset the effect of the increase in wages and the decrease in profitability of the company due to the minimum wage increase. (5pts) 3. Lastly, recommend the one course of action from among your list of three courses of action that you think is the best option for the small business owner and his or her company. Justify your response. (Spts) Background Information A. The company has 19 employees, which includes two assistant managers. The owner is the only shareholder of the company. B. 6 employees earn $8.00/hour which is slightly above the current federal minimum wage, but $3/ per hour below the new federal minimum wage. C. The other employees eam the following: ii. 6 eam $13/hour iii. 3 earn $18/ hour iv. 2 cam $22/ hour v. The 2 managers each earn $50,000 per year See Table I on next page. D. The company earned a profit last year of $100,000 based on sales of $1,500,000 that was passed through to the owner as the owner's only source of income. This year sales are on track to be approximately $1,500,000 again due to industry conditions. The owner's family just bought a new house for their growing family and has a mortgage of $181,000 with monthly payments of $1,141 per month. E. The owner's spouse does not work and the family cannot justify the spouse getting a job of any kind because the wages from a new job would not cover the weekly cost of day care and after school care for the family's three young children, ages 2, 5, and 7. Table 1. Summary of Current Costs of Payroll Job Category Wage/ Salary Total Number of Employees Il III IV Manager 3 Hours per year 2.000 2.000 2,000 2,000 Salaried $8 $13 $18 $22 $50,000 per year Total $96,000 $156,000 $108,000 $88.000 $100,000 $548,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started