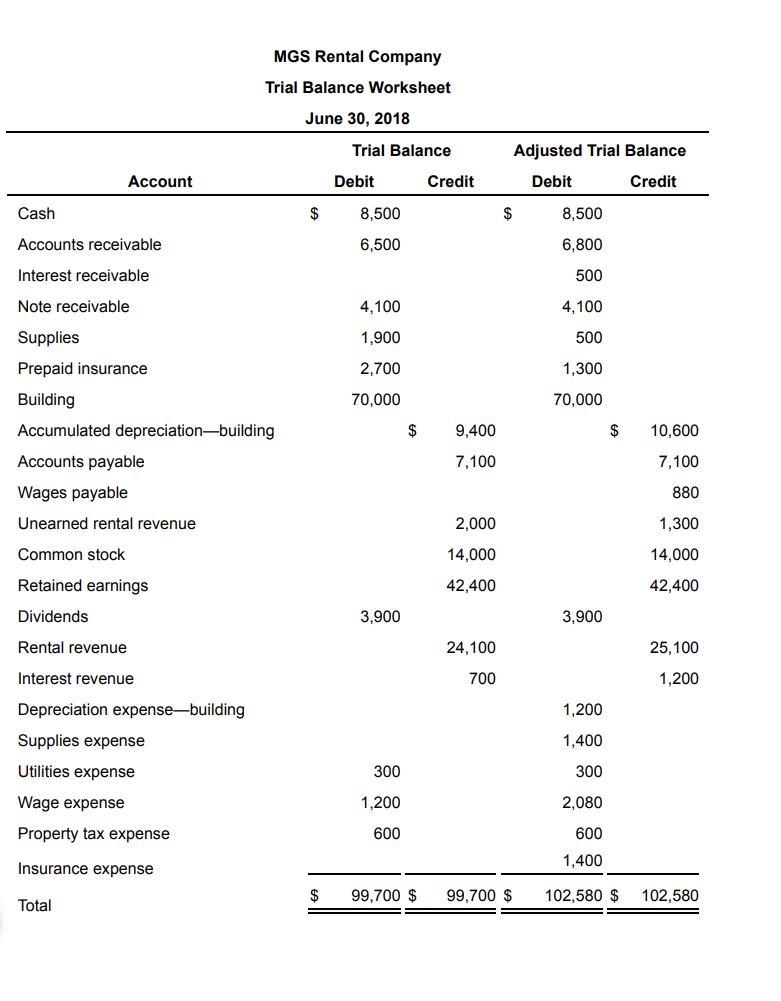

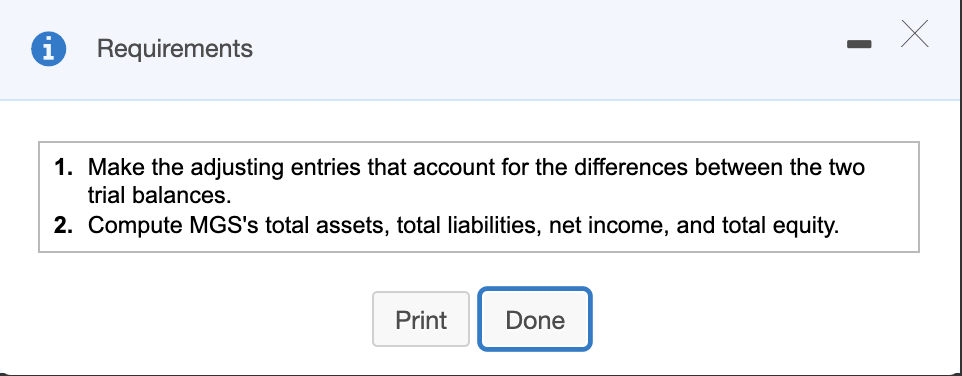

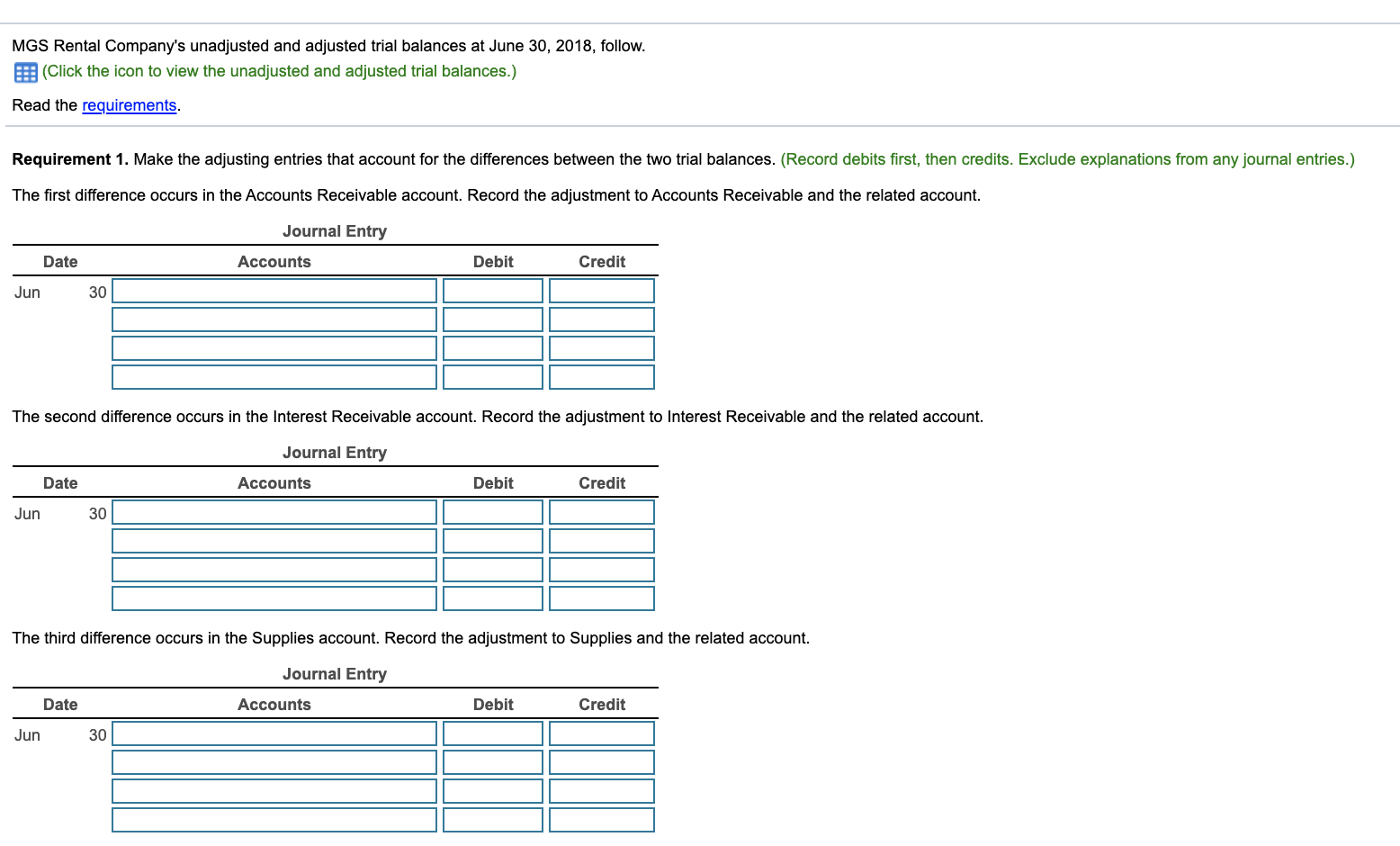

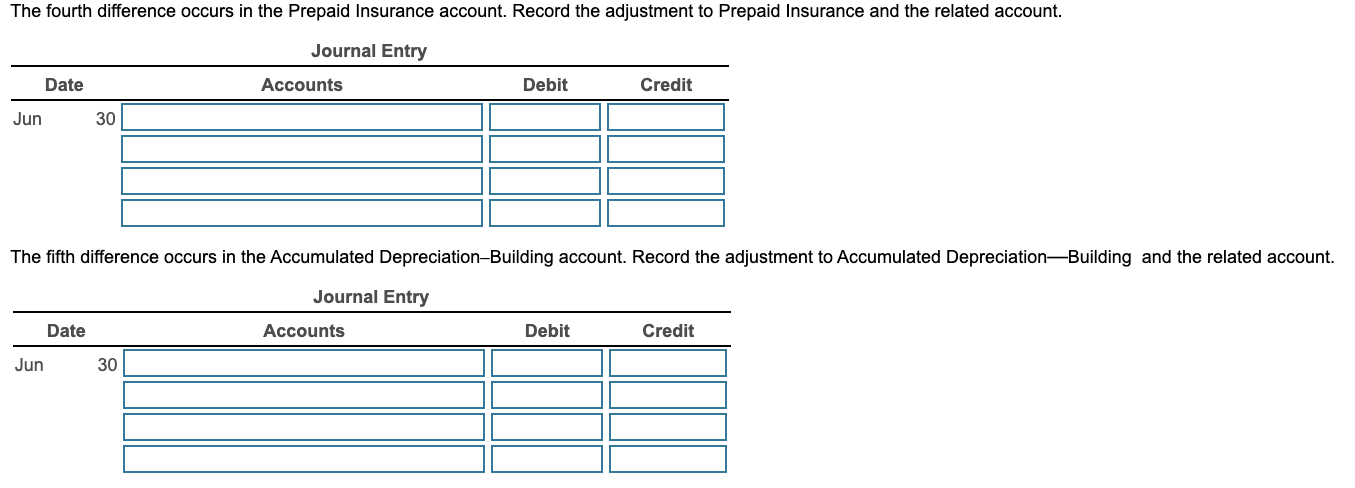

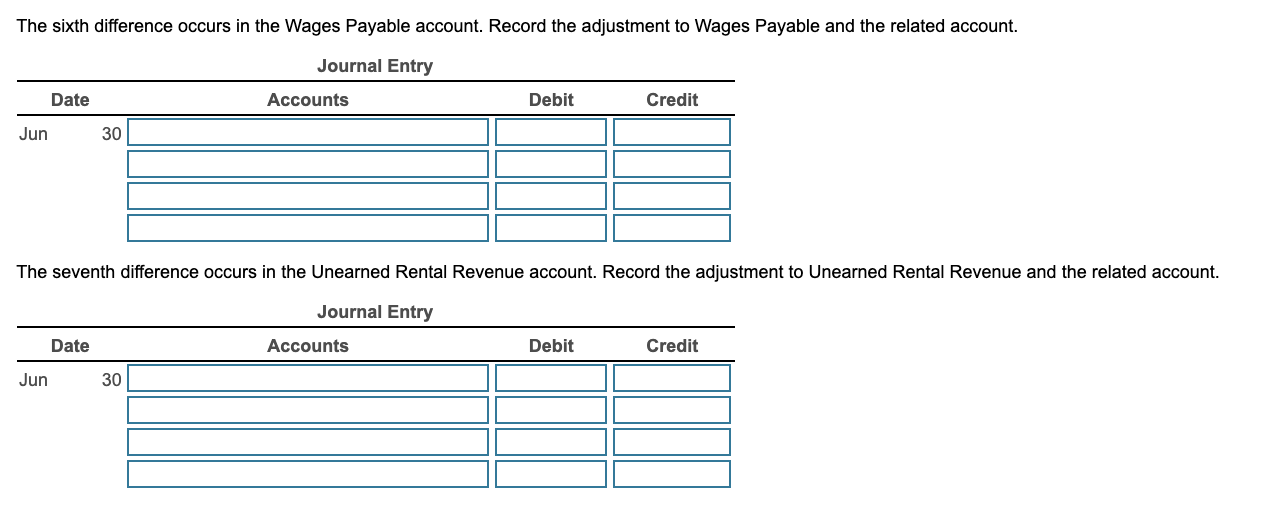

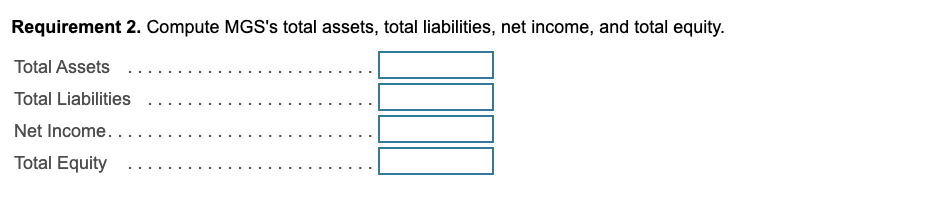

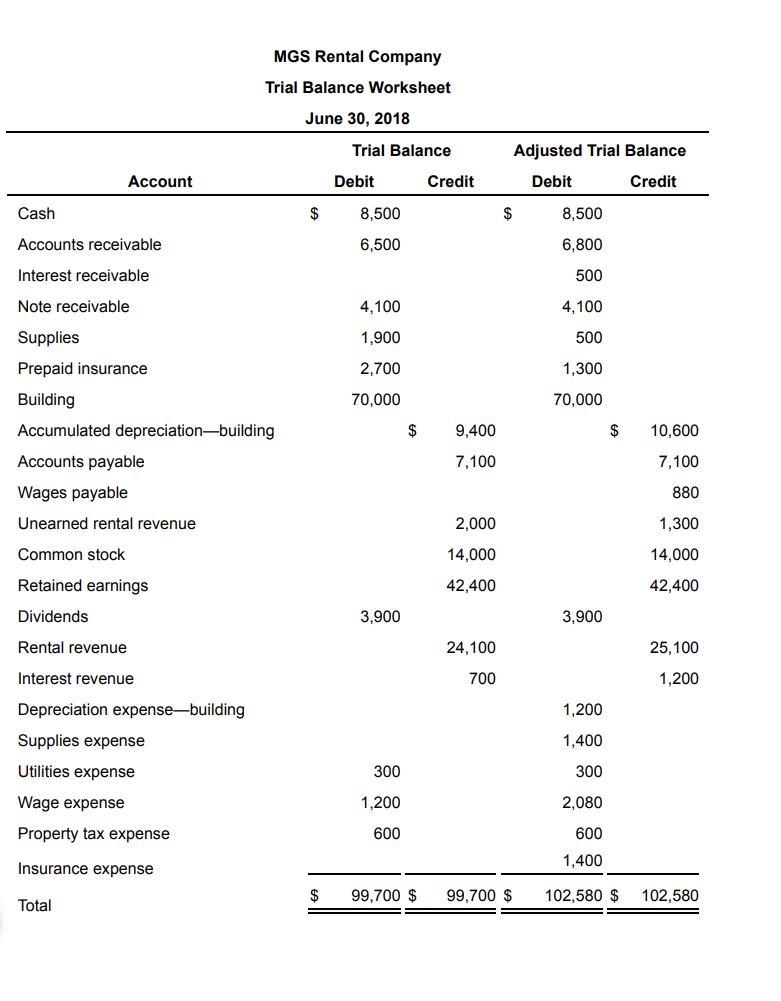

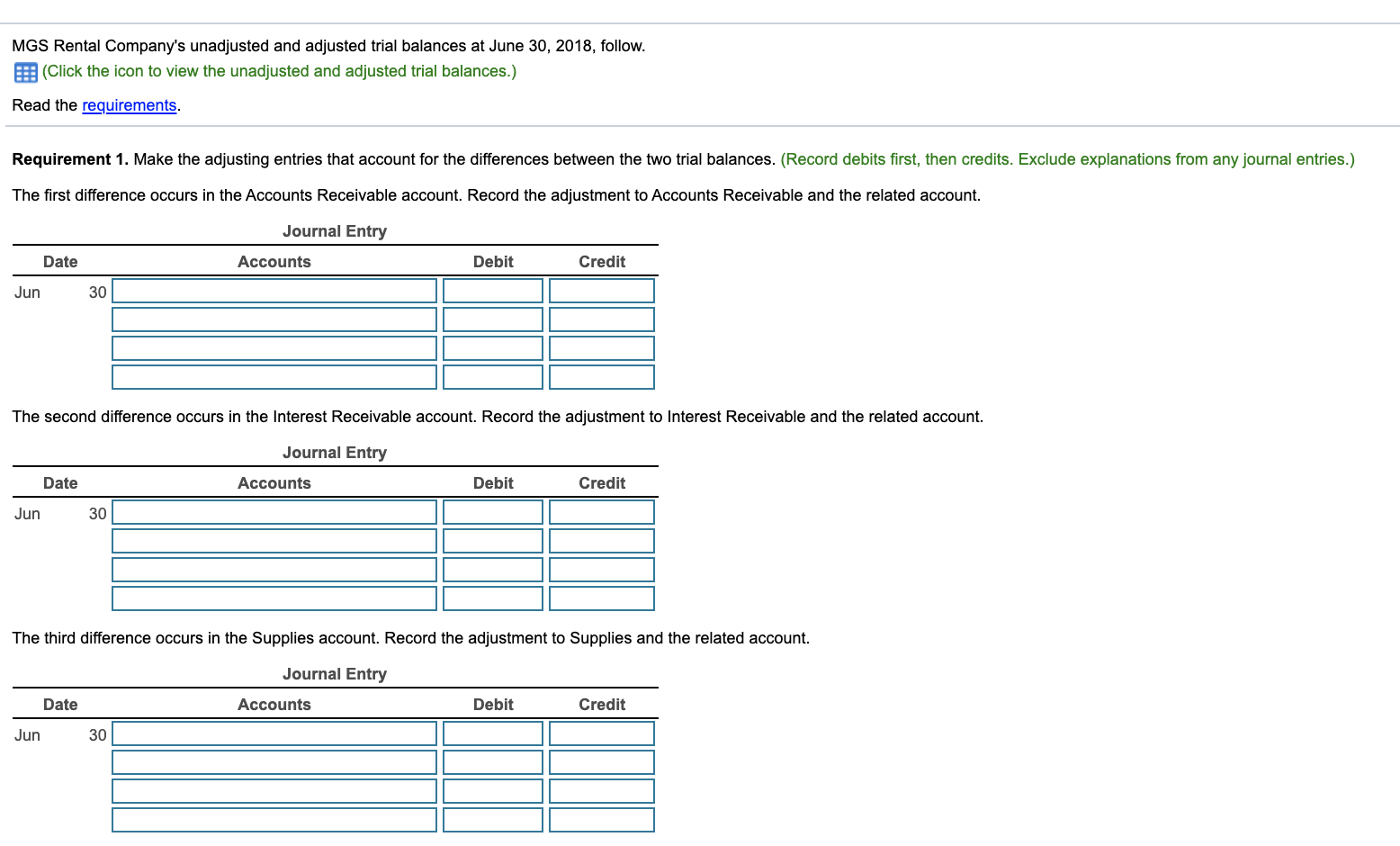

MGS Rental Company Trial Balance Worksheet June 30, 2018 Trial Balance Adjusted Trial Balance Account Debit Credit Debit Credit Cash $ 8,500 $ 8,500 Accounts receivable 6,500 6,800 Interest receivable 500 Note receivable 4,100 4,100 1,900 500 2,700 1,300 70,000 70,000 Supplies Prepaid insurance Building Accumulated depreciationbuilding Accounts payable Wages payable Unearned rental revenue $ 9,400 $ 10,600 7,100 7,100 880 2,000 1,300 Common stock 14,000 14,000 Retained earnings 42,400 42,400 Dividends 3,900 3,900 Rental revenue 24,100 25,100 Interest revenue 700 1,200 1,200 Depreciation expensebuilding Supplies expense 1,400 Utilities expense 300 300 1,200 2,080 Wage expense Property tax expense 600 600 1,400 Insurance expense $ 99,700 $ Total 99,700 $ 102,580 $ 102,580 Requirements 1. Make the adjusting entries that account for the differences between the two trial balances. 2. Compute MGS's total assets, total liabilities, net income, and total equity. Print Done MGS Rental Company's unadjusted and adjusted trial balances at June 30, 2018, follow. (Click the icon to view the unadjusted and adjusted trial balances.) Read the requirements. Requirement 1. Make the adjusting entries that account for the differences between the two trial balances. (Record debits first, then credits. Exclude explanations from any journal entries.) The first difference occurs in the Accounts Receivable account. Record the adjustment to Accounts Receivable and the related account. Journal Entry Date Accounts Debit Credit Jun 30 The second difference occurs the Interest Receivable account. Record the adjustment to Receivable and the related count. Journal Entry Date Accounts Debit Credit Jun 30 The third difference occurs in the Supplies account. Record the adjustment to Supplies and the related account. Journal Entry Date Accounts Debit Credit Jun 30 The fourth difference occurs in the Prepaid Insurance account. Record the adjustment to Prepaid Insurance and the related account. Journal Entry Date Accounts Debit Credit Jun 30 The fifth difference occurs in the Accumulated Depreciation-Building account. Record the adjustment to Accumulated DepreciationBuilding and the related account. Journal Entry Date Accounts Debit Credit Jun 30 The sixth difference occurs in the Wages Payable account. Record the adjustment to Wages Payable and the related account. Journal Entry Date Accounts Debit Credit Jun 30 The seventh difference occurs in the Unearned Rental Revenue account. Record the adjustment to Unearned Rental Revenue and the related account. Journal Entry Date Accounts Debit Credit Jun 30 Requirement 2. Compute MGS's total assets, total liabilities, net income, and total equity. Total Assets Total Liabilities Net Income.. Total Equity