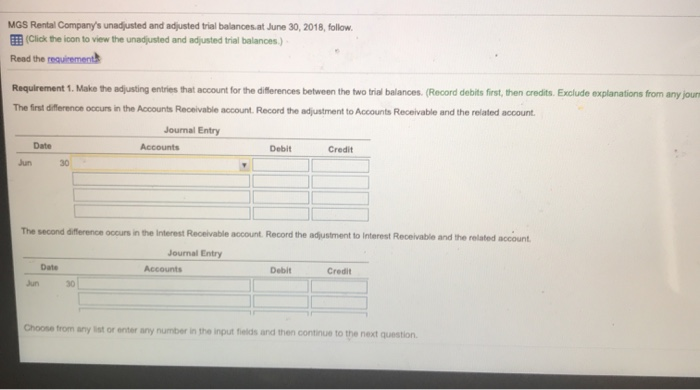

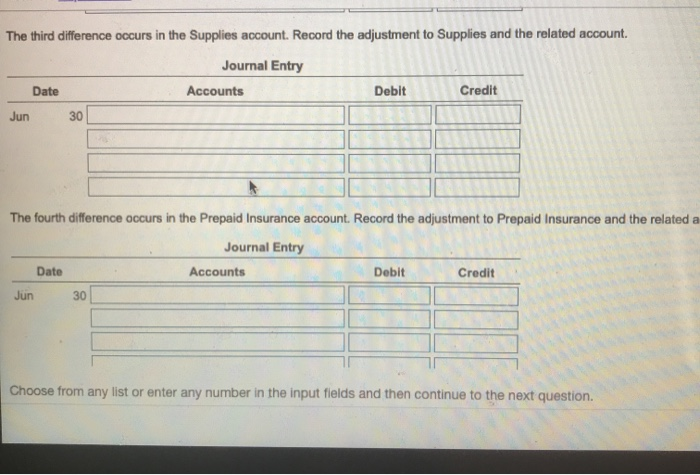

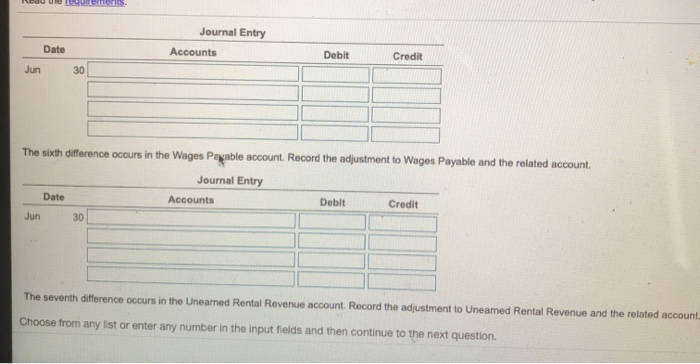

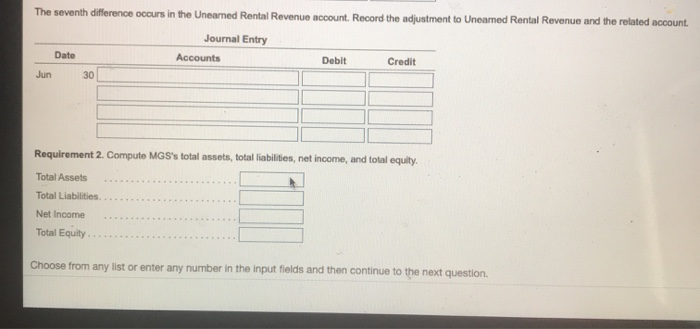

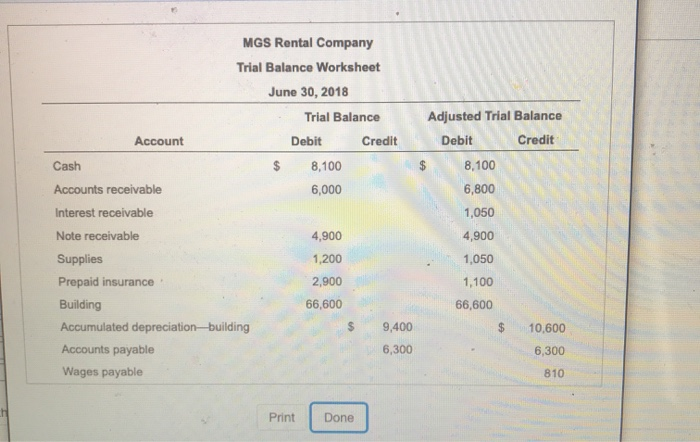

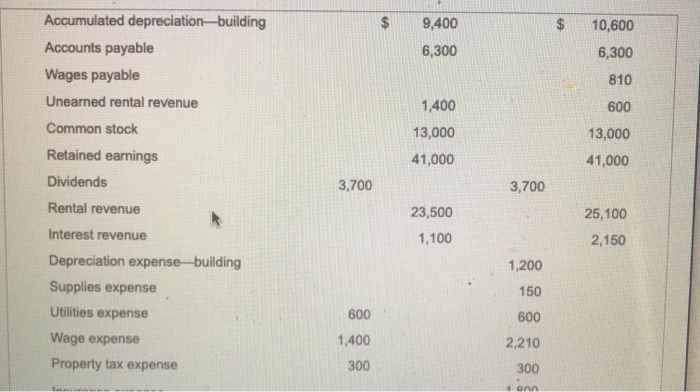

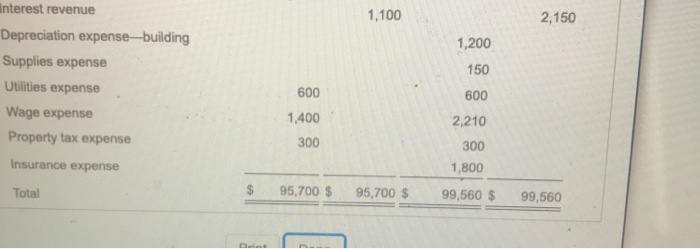

MGS Rental Company's unadjusted and adjusted trial balances at June 30, 2018, follow. (Click the icon to view the unadjusted and adjusted trial balances) Read the requirements Requirement 1. Make the adjusting entries that account for the differences between the two trial balances. (Record debits first, then credits. Exclude explanations from any jour The first difference occurs in the Accounts Receivable account. Record the adjustment to Accounts Receivable and the related account. Journal Entry Credit Accounts Debit Date Jun 30 The second difference occurs in the Interest Receivable account. Record the adjustment to interest Receivable and the related account Journal Entry Date Accounts Debit Credit Sun 30 Choose from any it or enter any number in the input fields and then continue to the next question The third difference occurs in the Supplies account. Record the adjustment to Supplies and the related account. Journal Entry Accounts Date Debit Credit Jun 30 The fourth difference occurs in the Prepaid Insurance account. Record the adjustment to Prepaid Insurance and the related a Journal Entry Date Accounts Debit Credit Jun 30 Choose from any list or enter any number in the input fields and then continue to the next question. ents Journal Entry Accounts Date Debit Credit Jun 30 The sixth difference occurs in the Wages Payable account. Record the adjustment to Wages Payable and the related account. Journal Entry Accounts Debit Credit Date Jun 30 The seventh difference occurs in the Unearned Rental Revenue account. Record the adjustment to Uneamed Rental Revenue and the related account. Choose from any list or enter any number in the input fields and then continue to the next question. The seventh difference occurs in the Uneared Rental Revenue account. Record the adjustment to Unoamed Rental Revenue and the related account. Journal Entry Credit Date Accounts Debit Jun 30 Requirement 2. Compute MGS's total assets, total liabilities, net income, and total equity. Total Assets Total Liabilities Net Income Total Equity Choose from any list or enter any number in the input fields and then continue to the next question. Adjusted Trial Balance Debit Credit 8,100 MGS Rental Company Trial Balance Worksheet June 30, 2018 Trial Balance Account Debit Credit Cash $ 8,100 Accounts receivable 6,000 Interest receivable Note receivable 4,900 Supplies 1,200 Prepaid insurance 2.900 Building 66,600 Accumulated depreciation-building 9,400 Accounts payable 6,300 Wages payable 6,800 1,050 4,900 1,050 1,100 66,600 10.600 6,300 810 Print Done GA 9,400 6,300 10,600 6,300 810 Accumulated depreciation-building Accounts payable Wages payable Unearned rental revenue Common stock Retained earnings Dividends 1,400 13,000 41,000 600 13,000 41,000 3,700 3,700 25,100 23,500 1,100 2,150 Rental revenue Interest revenue Depreciation expense-building Supplies expense Utilities expense Wage expense Property tax expense 1,200 150 600 600 1,400 2,210 300 300 on 1,100 2,150 1,200 150 Interest revenue Depreciation expense-building Supplies expense Utilities expense Wage expense Property tax expense Insurance expense 600 600 2,210 1,400 300 300 1,800 Total 95,700 $ 95,700 $ 99,560 $ 99,560