Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You meet with Una, a prospective client, for a discussion about insurance, After a thorough needs analysis, you recommend that tna purchase a cancellable

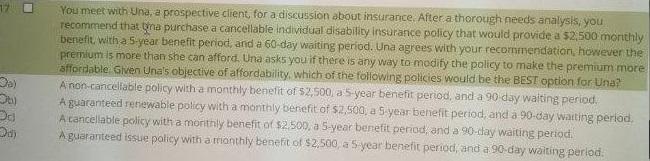

You meet with Una, a prospective client, for a discussion about insurance, After a thorough needs analysis, you recommend that tna purchase a cancellable individual disability insurance policy that would provide a $2,500 monthly benefit, with a 5-year benefit period, and a 60-day waiting period. Una agrees with your recommendation, however the premium is more than she can afford. Una asks you if there is any way to modify the policy to make the premium more affordable. Given Una's objective of affordability, which of the following policies would be the BEST option for Una? A non-cancellable policy with a monthly benefit of $2,500, a 5-year benefit period, and a 90 day waiting period. A guaranteed renewable policy with a monthly benefit of $2,500, a S-year benefit period, and a 90-day waiting period. A cancellable policy with a morithly benefit of $2.500, a 5-year benefit period, and a 90-day waiting period A guaranteed issue policy with a monthly benefit of $2,500, a S-year benefit period, and a 90-day waiting period. 17.

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer A This is because a noncancellable policy will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started