Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harry and Colleen are in their late 40s and married. They are both employed in the computer industry, Colleen working on a Help Desk

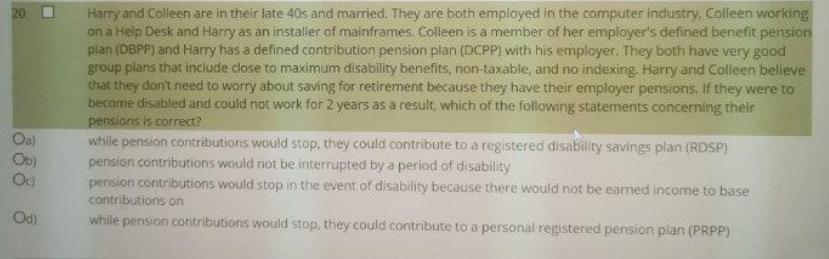

Harry and Colleen are in their late 40s and married. They are both employed in the computer industry, Colleen working on a Help Desk and Harry as an instalier of mainframes. Colleen is a member of her employer's defined benefit pension plan (DBPP) and Harry has a defined contribution pension plan (DCPP) with his employer. They both have very good group plans that include dlose to maximum disability benefits, non-taxable, and no indexing. Harry and Colleen believe that they don't need to worry about saving for retirement because they have their employer pensions. If they were to become disabled and could not work for 2 years as a result, which of the following statements concerning their pensions is correct? while pension contributions would stop, they could contribute to a registered disability savings plan (RDSP) pension contributions would not be interrupted by a period of disbility pension contributions would stop in the event of disability because there would not be eamed income to base contributions on while pension contributions would stop, they could contribute to a personal registered pension plan (PRPP) 20 0 Oa) Ob) Oc Od)

Step by Step Solution

★★★★★

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

First of all understand the basic type of insurance plan which is used in questions A defined contri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started