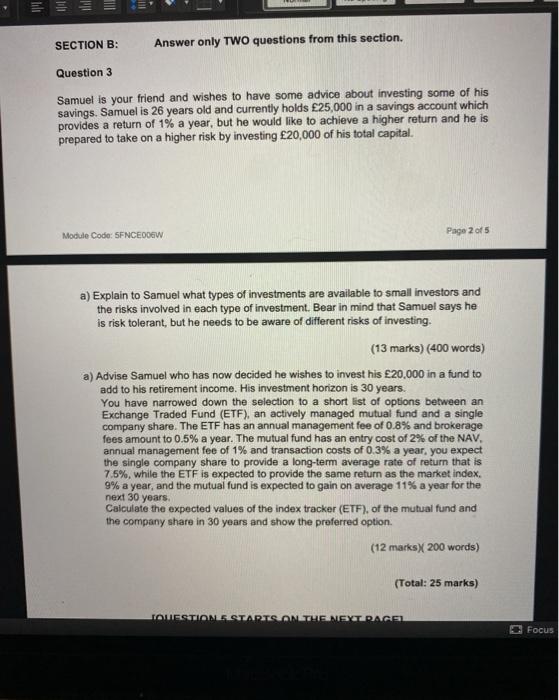

MI SECTION B: Answer only TWO questions from this section. Question 3 Samuel is your friend and wishes to have some advice about investing some of his savings. Samuel is 26 years old and currently holds 25,000 in a savings account which provides a return of 1% a year, but he would like to achieve a higher return and he is prepared to take on a higher risk by investing 20,000 of his total capital. Module Code: SFNCEDOSW Page 2 of 5 a) Explain to Samuel what types of investments are available to small investors and the risks involved in each type of investment. Bear in mind that Samuel says he is risk tolerant, but he needs to be aware of different risks of investing. (13 marks) (400 words) a) Advise Samuel who has now decided he wishes to invest his 20,000 in a fund to add to his retirement income. His investment horizon is 30 years. You have narrowed down the selection to a short list of options between an Exchange Traded Fund (ETF), an actively managed mutual fund and a single company share. The ETF has an annual management fee of 0.8% and brokerage fees amount to 0.5% a year. The mutual fund has an entry cost of 2% of the NAV, annual management fee of 1% and transaction costs of 0.3% a year, you expect the single company share to provide a long-term average rate of return that is 7.5%, while the ETF is expected to provide the same return as the market index. 9% a year, and the mutual fund is expected to gain on average 11% a year for the next 30 years Calculate the expected values of the index tracker (ETF), of the mutual fund and the company share in 30 years and show the preferred option (12 marksX 200 words) (Total: 25 marks) TOUESTIONLESTARISONTLE NEYTRAGS Focus MI SECTION B: Answer only TWO questions from this section. Question 3 Samuel is your friend and wishes to have some advice about investing some of his savings. Samuel is 26 years old and currently holds 25,000 in a savings account which provides a return of 1% a year, but he would like to achieve a higher return and he is prepared to take on a higher risk by investing 20,000 of his total capital. Module Code: SFNCEDOSW Page 2 of 5 a) Explain to Samuel what types of investments are available to small investors and the risks involved in each type of investment. Bear in mind that Samuel says he is risk tolerant, but he needs to be aware of different risks of investing. (13 marks) (400 words) a) Advise Samuel who has now decided he wishes to invest his 20,000 in a fund to add to his retirement income. His investment horizon is 30 years. You have narrowed down the selection to a short list of options between an Exchange Traded Fund (ETF), an actively managed mutual fund and a single company share. The ETF has an annual management fee of 0.8% and brokerage fees amount to 0.5% a year. The mutual fund has an entry cost of 2% of the NAV, annual management fee of 1% and transaction costs of 0.3% a year, you expect the single company share to provide a long-term average rate of return that is 7.5%, while the ETF is expected to provide the same return as the market index. 9% a year, and the mutual fund is expected to gain on average 11% a year for the next 30 years Calculate the expected values of the index tracker (ETF), of the mutual fund and the company share in 30 years and show the preferred option (12 marksX 200 words) (Total: 25 marks) TOUESTIONLESTARISONTLE NEYTRAGS Focus