Answered step by step

Verified Expert Solution

Question

1 Approved Answer

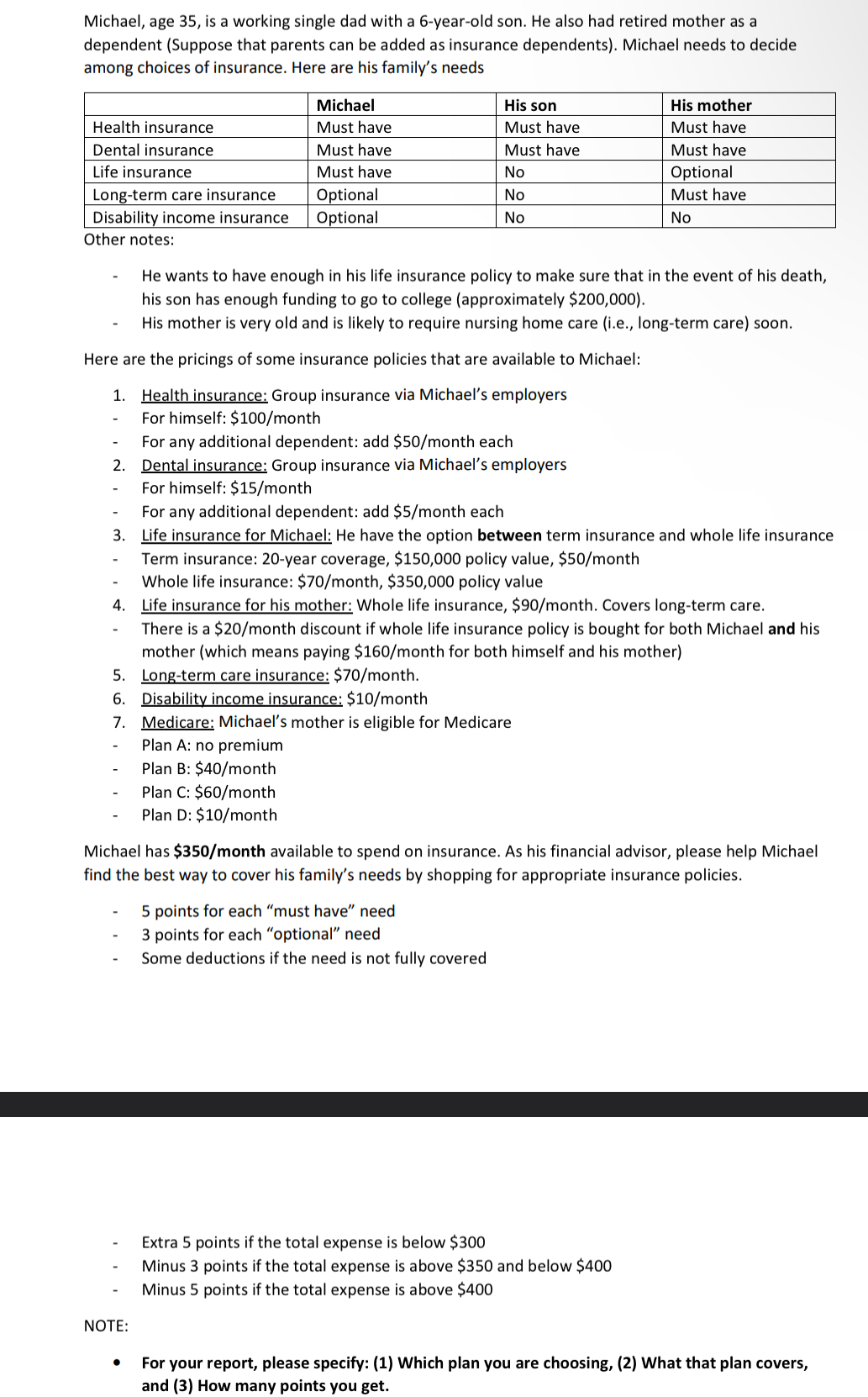

Michael, age 3 5 , is a working single dad with a 6 - year - old son. He also had retired mother as a

Michael, age is a working single dad with a yearold son. He also had retired mother as a dependent Suppose that parents can be added as insurance dependents Michael needs to decide among choices of insurance. Here are his family's needs

tableMichael,His son,His motherHealth insurance,Must have,Must have,Must haveDental insurance,Must have,Must have,Must haveLife insurance,Must have,NoOptionalLongterm care insurance,Optional,NoMust haveDisability income insurance,Optional,NoNo

Other notes:

He wants to have enough in his life insurance policy to make sure that in the event of his death, his son has enough funding to go to college approximately $

His mother is very old and is likely to require nursing home care ie longterm care soon.

Here are the pricings of some insurance policies that are available to Michael:

Health insurance: Group insurance via Michael's employers

For himself: $ month

For any additional dependent: add $ month each

Dental insurance: Group insurance via Michael's employers

For himself: $ month

For any additional dependent: add $ month each

Life insurance for Michael: He have the option between term insurance and whole life insurance

Term insurance: year coverage, $ policy value, $ month

Whole life insurance: $ month, $ policy value

Life insurance for his mother: Whole life insurance, $ month. Covers longterm care.

There is a $ month discount if whole life insurance policy is bought for both Michael and his mother which means paying $ month for both himself and his mother

Longterm care insurance: $ month.

Disability income insurance: $ month

Medicare: Michael's mother is eligible for Medicare

Plan A: no premium

Plan B: $ month

Plan C: $ month

Plan D: $ month

Michael has $ month available to spend on insurance. As his financial advisor, please help Michael find the best way to cover his family's needs by shopping for appropriate insurance policies.

points for each "must have" need

points for each "optional" need

Some deductions if the need is not fully covered

Extra points if the total expense is below $

Minus points if the total expense is above $ and below $

Minus points if the total expense is above $

NOTE:

For your report, please specify: Which plan you are choosing, What that plan covers, and How many points you get.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started