Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.2. Assume you worked as the CEO in Zaid Ibrahim & Co, one of the leading law firms in Kuala Lumpur, Malaysia over the

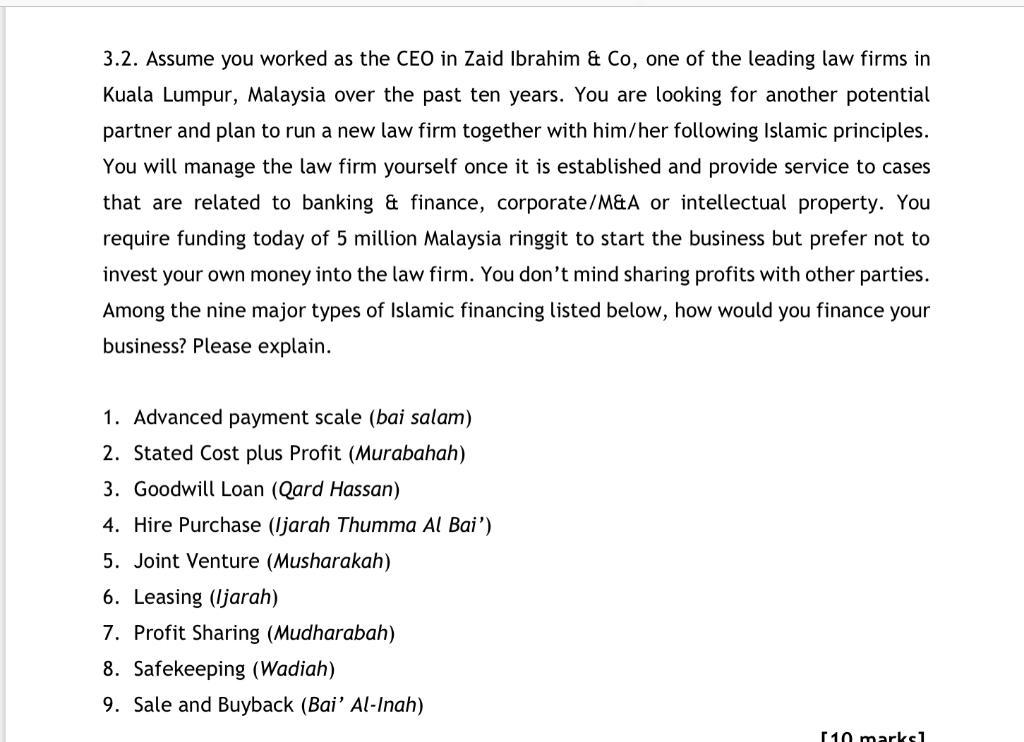

3.2. Assume you worked as the CEO in Zaid Ibrahim & Co, one of the leading law firms in Kuala Lumpur, Malaysia over the past ten years. You are looking for another potential partner and plan to run a new law firm together with him/her following Islamic principles. You will manage the law firm yourself once it is established and provide service to cases that are related to banking & finance, corporate/M&A or intellectual property. You require funding today of 5 million Malaysia ringgit to start the business but prefer not to invest your own money into the law firm. You don't mind sharing profits with other parties. Among the nine major types of Islamic financing listed below, how would you finance your business? Please explain. 1. Advanced payment scale (bai salam) 2. Stated Cost plus Profit (Murabahah) 3. Goodwill Loan (Qard Hassan) 4. Hire Purchase (Ijarah Thumma Al Bai') 5. Joint Venture (Musharakah) 6. Leasing (Ijarah) 7. Profit Sharing (Mudharabah) 8. Safekeeping (Wadiah) 9. Sale and Buyback (Bai' Al-Inah) [10 marks]

Step by Step Solution

★★★★★

3.56 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

I would finance my business with a joint venture musharakah In a joint venture two or more parties a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started