Question

Michael Chan purchased 100% of the issued shares of Quality Rest Inc., a Canadian-controlled private corporation, which owns and operates an assisted-living retirement home in

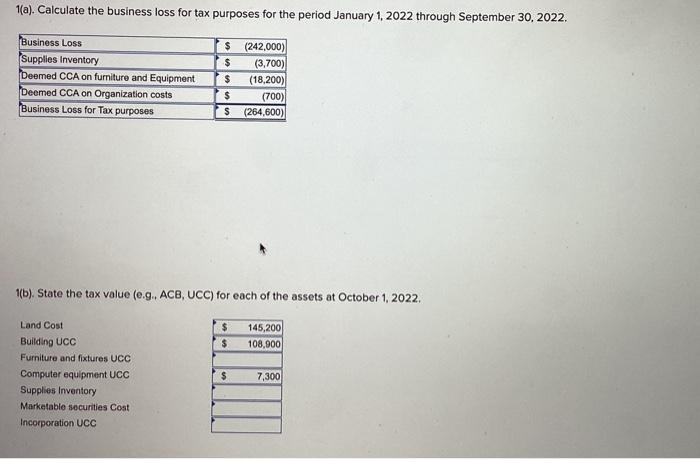

Michael Chan purchased 100% of the issued shares of Quality Rest Inc., a Canadian-controlled private corporation, which owns and operates an assisted-living retirement home in Ontario. Quality Rest has a December 31 fiscal year end. The transaction closed on October 1, 2022. At that time, the values of certain assets owned by Quality Rest were as follows:

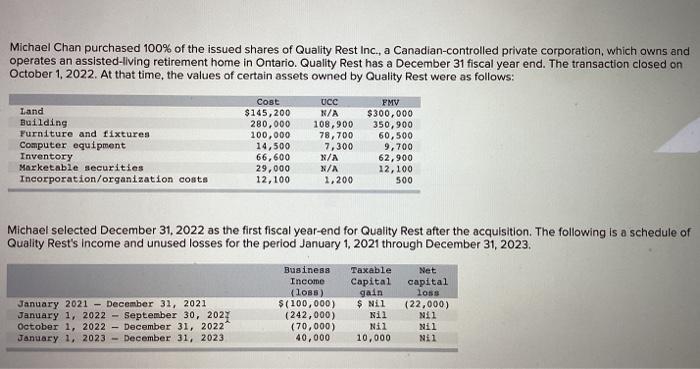

| Cost | UCC | FMV | |||

| Land | $ | 145,200 | N/A | $ | 300,000 |

| Building | 280,000 | 108,900 | 350,900 | ||

| Furniture and fixtures | 100,000 | 78,700 | 60,500 | ||

| Computer equipment | 14,500 | 7,300 | 9,700 | ||

| Inventory | 66,600 | N/A | 62,900 | ||

| Marketable securities | 29,000 | N/A | 12,100 | ||

| Incorporation/organization costs | 12,100 | 1,200 | 500 | ||

Michael selected December 31, 2022 as the first fiscal year-end for Quality Rest after the acquisition. The following is a schedule of Quality Rest's income and unused losses for the period January 1, 2021 through December 31, 2023.

| Business Income (loss) | Taxable Capital gain | Net capital loss | ||

| January 2021 December 31, 2021 | $ | (100,000) | $ Nil | (22,000) |

| January 1, 2022 September 30, 2022 | (242,000) | Nil | Nil | |

| October 1, 2022 December 31, 2022 | (70,000) | Nil | Nil | |

| January 1, 2023 December 31, 2023 | 40,000 | 10,000 | Nil | |

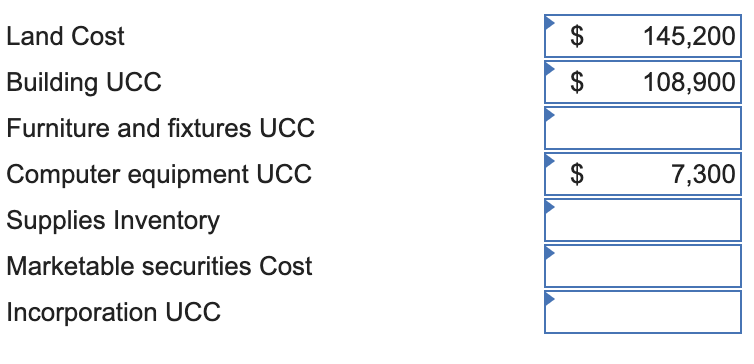

Required: Assuming Quality Rest does not make an election to recognize accrued gains or recapture under paragraph 111(4)(e) of the Income Tax Act

State the tax value (e.g., ACB, UCC) for each of the assets at October 1, 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started