Answered step by step

Verified Expert Solution

Question

1 Approved Answer

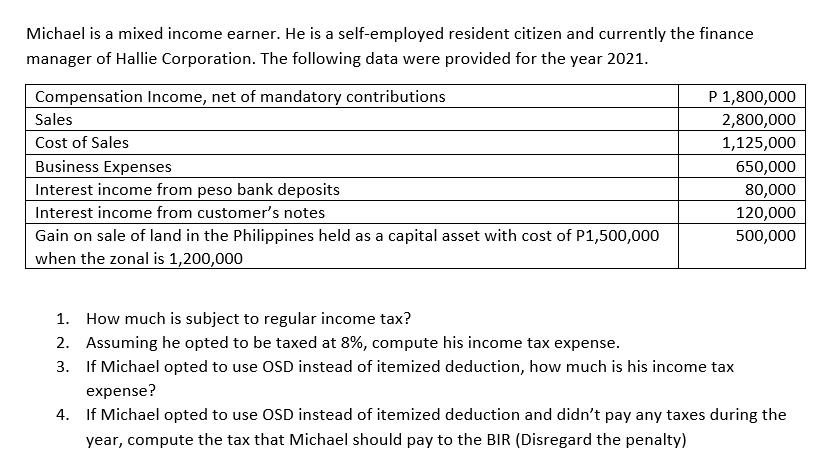

Michael is a mixed income earner. He is a self-employed resident citizen and currently the finance manager of Hallie Corporation. The following data were

Michael is a mixed income earner. He is a self-employed resident citizen and currently the finance manager of Hallie Corporation. The following data were provided for the year 2021. Compensation Income, net of mandatory contributions Sales Cost of Sales Business Expenses Interest income from peso bank deposits Interest income from customer's notes Gain on sale of land in the Philippines held as a capital asset with cost of P1,500,000 when the zonal is 1,200,000 P 1,800,000 2,800,000 1,125,000 650,000 80,000 120,000 500,000 1. How much is subject to regular income tax? 2. Assuming he opted to be taxed at 8%, compute his income tax expense. 3. If Michael opted to use OSD instead of itemized deduction, how much is his income tax expense? 4. If Michael opted to use OSD instead of itemized deduction and didn't pay any taxes during the year, compute the tax that Michael should pay to the BIR (Disregard the penalty)

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine the income tax liability of Michael we need to calculate his taxable income first Heres how we can calculate it 1 Calculate Gross Income Compensation Income P1800000 Sales P2800000 Intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started