Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Michael Lee has been operating Lee Management Consulting as a proprietorship but is planning to expand operations in the near future. In Chapter 12, Michael

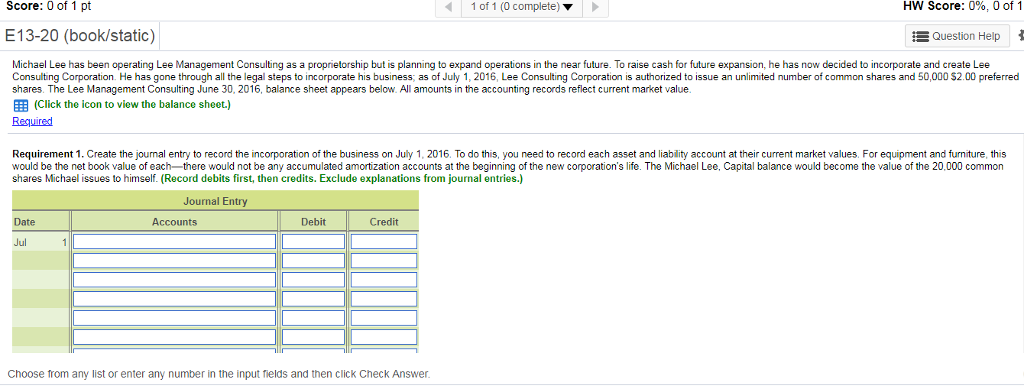

Michael Lee has been operating Lee Management Consulting as a proprietorship but is planning to expand operations in the near future. In Chapter 12, Michael had considered taking on a partner, but decided not to form a partnership after all. To raise cash for future expansion, he has now decided to incorporate and create Lee Consulting Corporation. He has gone through all the legal steps to incorporate his business; as of August 1, 2016, Lee Consulting Corporation is authorized to issue an unlimited number of common shares and 50,000 $2.00 preferred shares. The Lee Management Consulting July 31, 2016, balance sheet appears below, adjusted to reflect all amounts at current market value:

Need the journal entries assets and liabitlies are followed ...assets -

CASH - $21,650

Accounts Receivable- $5,900

Inventory- $2,713

Supplies- $100

Prepaid Rent- $6,000

Equipment- 1,000

Accumulated amort Equipment - (75)

Furniture- 5,000

Accum amort- furniture- (267)

Total assets- 42,021

Liabilities and equity

Accounts Payble- 9,600

Salary Payble- 1,000

Unearned Service revenue- 1,200

Notes Payable- 0

Michael Lee ,capital- $30,221

Total liabilites and capital - $42,021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started