Question

Michael W. Smith Inc. had the following information available at the end of 2015: COMPARATIVE BALANCE SHEET As of December 31, 2015 and 2014 .....................

Michael W. Smith Inc. had the following information available at the end of 2015:

COMPARATIVE BALANCE SHEET

As of December 31, 2015 and 2014

| ..................... Cash Accounts receivable Short-term investments (available-for-sale) Prepaid insurance Merchandise inventory Office supplies Long-term investments (equity) Land Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Goodwill Total assets Accounts payable Taxes payable Accrued liabilities Dividends payable Long-term notes payable Bonds payable Discount on bonds payable Preferred stock Contributed capital, preferred stock Common stock Contributed capital, common stock Retained earnings Treasury stock (common, at cost) Total liabilities and equity | 12/31/15 $ 46,000 330,000 360,000 16,000 400,000 4,000 775,000 665,000 1,300,000 (400,000) 500,000 (155,000) 63,000 $3,904,000 $ 95,000 26,000 47,000 0 45,000 1,000,000 (50,750) 600,000 135,000 600,000 550,000 876,750 (20,000) $3,904,000 | 12/31/14 $ 30,000 296,000 325,000 22,000 350,000 7,000 700,000 500,000 1,300,000 (360,000) 550,000 (135,000) 65,000 $3,650,000 $ 70,000 15,000 40,000 80,000 50,000 1,000,000 (64,630) 500,000 100,000 600,000 550,000 749,630 (40,000) $3,650,000 |

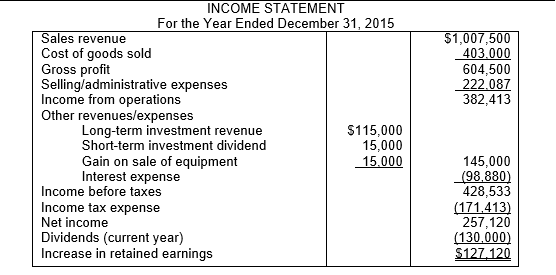

INCOME STATEMENT

For the Year Ended December 31, 2015

Additional information:

1. In early January, equipment with a book value of $45,000 was sold for a gain.

2. Long-term investments are carried under the equity method; Smiths share of investee income totaled $115,000 in 2015. Smith received dividends from its long-term investment totaling $40,000 during 2015. (Note: The corporation earned $115,000 in 2015 for its share of the subsidiary's net income AND received dividends of $40,000, You must remember that the $40,000 is not reported as "dividend income," but rather as a return of the corporation's investment in the subsidiary. Thus the NET change in the equity account is added back to net income under the indirect method (1.e., $75,000), not the $115,000 that was earned.)

3. No unrealized gains or losses on available-for-sale securities occurred during the year.

Required: Prepare a statement of cash flows using the indirect method. Show all work (T-Charts, etc..) at arriving at your answer.

Michael W. Smith Inc. had the following information available at the end of 2015: COMPARATIVE BALANCE SHEET As of December 31, 2015 and 2014 ..................... Cash Accounts receivable Short-term investments (available-for-sale) Prepaid insurance Merchandise inventory Office supplies Long-term investments (equity) Land Building Accumulated depreciation-building Equipment Accumulated depreciation-equipment Goodwill Total assets Accounts payable Taxes payable Accrued liabilities Dividends payable Long-term notes payable Bonds payable Discount on bonds payable Preferred stock Contributed capital, preferred stock Common stock Contributed capital, common stock Retained earnings Treasury stock (common, at cost) Total liabilities and equity 12/31/15 $46,000 330,000 360,000 16,000 400,000 4,000 775,000 665,000 1,300,000 (400,000) 500,000 (155,000) 63,000 $3,904,000 $95,000 26,000 47,000 0 45,000 1,000,000 (50,750) 600,000 135,000 600,000 550,000 876,750 (20,000) $3,904,000 12/31/14 $30,000 296,000 325,000 22,000 350,000 7,000 700,000 500,000 1,300,000 (360,000) 550,000 (135,000) 65,000 $3,650,000 $70,000 15,000 40,000 80,000 50,000 1,000,000 (64,630) 500,000 100,000 600,000 550,000 749,630 (40,000) $3,650,000 INCOME STATEMENT For the Year Ended December 31, 2015Additional information: 1.In early January, equipment with a book value of $45,000 was sold for a gain. 2.Long-term investments are carried under the equity method; Smith s share of investee income totaled $115,000 in 2015. Smith received dividends from its long-term investment totaling $40,000 during 2015. (Note: The corporation earned $115,000 in 2015 for its share of the subsidiary's net income AND received dividends of $40,000, You must remember that the $40,000 is not reported as ''dividend income,'' but rather as a return of the corporation's investment in the subsidiary. Thus the NET change in the equity account is added back to net income under the indirect method (1.e., $75,000), not the $115,000 that was earned.)3.No unrealized gains or losses on available-for-sale securities occurred during the year. Required: Prepare a statement of cash flows using the indirect method. Show all work (T-Charts, etc..) at arriving at yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started