Question

Michael wants to understand how the project will be analyzed. He knows there are three methods that can be used payback period, net present value,

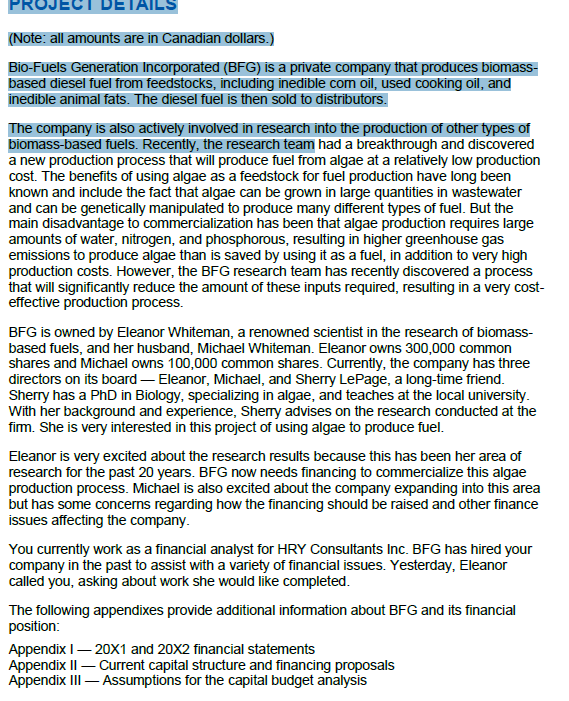

- Michael wants to understand how the project will be analyzed. He knows there are three methods that can be used payback period, net present value, and internal rate of return. He would like to understand their similarities and differences between there three methods and receive a conclusion on what method would be the best concerning the algaee project?

- As a first step in preparing the capital budget for the algae project, we need to understand what sunk costs and opportunity costsare. Based on the assumptions provided, are there any sunk costs or opportunity costs,and if so, how should these be treated in the analysis?

Info for the Case is below

- Michael wants to understand how the project will be analyzed. He knows there are three methods that can be used payback period, net present value, and internal rate of return. He would like to understand their similarities and differences between there three methods and receive a conclusion on what method would be the best concerning the algaee project?

- As a first step in preparing the capital budget for the algae project, we need to understand what sunk costs and opportunity costsare. Based on the assumptions provided, are there any sunk costs or opportunity costs,and if so, how should these be treated in the analysis?

Info for the Case is below

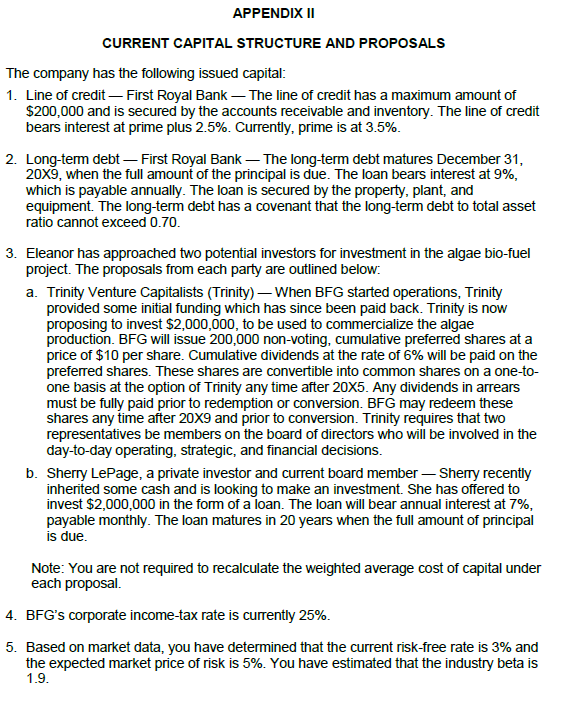

APPENDIX II CURRENT CAPITAL STRUCTURE AND PROPOSALS The company has the following issued capital: 1. Line of credit - First Royal Bank - The line of credit has a maximum amount of $200,000 and is secured by the accounts receivable and inventory. The line of credit bears interest at prime plus 2.5%. Currently, prime is at 3.5%. 2. Long-term debt-First Royal Bank - The long-term debt matures December 31, 20X9, when the full amount of the principal is due. The loan bears interest at 9%, which is payable annually. The loan is secured by the property, plant, and equipment. The long-term debt has a covenant that the long-term debt to total asset ratio cannot exceed 0.70. 3. Eleanor has approached two potential investors for investment in the algae bio-fuel project. The proposals from each party are outlined below: a. Trinity Venture Capitalists (Trinity) - When BFG started operations, Trinity provided some initial funding which has since been paid back. Trinity is now proposing to invest $2,000,000, to be used to commercialize the algae production. BFG will issue 200,000 non-voting, cumulative preferred shares at a price of $10 per share. Cumulative dividends at the rate of 6% will be paid on the preferred shares. These shares are convertible into common shares on a one-to- one basis at the option of Trinity any time after 20X5. Any dividends in arrears must be fully paid prior to redemption or conversion. BFG may redeem these shares any time after 20X9 and prior to conversion. Trinity requires that two representatives be members on the board of directors who will be involved in the day-to-day operating, strategic, and financial decisions. b. Sherry LePage, a private investor and current board member - Sherry recently inherited some cash and is looking to make an investment. She has offered to invest $2,000,000 in the form of a loan. The loan will bear annual interest at 7%, payable monthly. The loan matures in 20 years when the full amount of principal is due. Note: You are not required to recalculate the weighted average cost of capital under each proposal. 4. BFG's corporate income-tax rate is currently 25%. 5. Based on market data, you have determined that the current risk-free rate is 3% and the expected market price of risk is 5%. You have estimated that the industry beta is 1.9.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started