Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Michell converted Michelle Converted her personal residence to rental Property Question 14 of 75 Michelle converted her personal residence to rental property in 2018. She

Michell converted

Michelle Converted her personal residence to rental Property

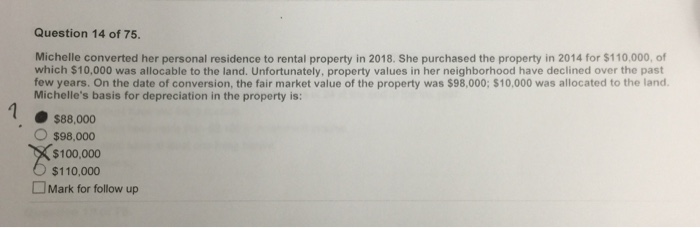

Question 14 of 75 Michelle converted her personal residence to rental property in 2018. She purchased the property in 2014 for $110,000, of which $10,000 was allocable to the land. Unfortunately, property values in her neighborhood have declined over the past few years. On the date of conversion, the fair market value of the property was $98,000; $10,000 was allocated to the land. Michelle's basis for depreciation in the property is: 1 $88,000 $98,000 $100,000 $110,000 Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started