Question

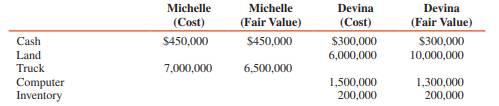

Michelle and Devina are forming a partnership. Both of them agree to have equal capital interest. Below are the initial investments for the partnership: Arn,

Michelle and Devina are forming a partnership. Both of them agree to have equal capital interest. Below are the initial investments for the partnership: Arn, Bev, and Car are partners who share profits and losses 30:30:40, respectively, after Bev, who manages the partnership, receives a bonus of 10 percent of income, net of the bonus. Partnership income for the year is $198,000.

REQUIRED

1. Calculate the capital balances for Michelle and Devina using the bonus approach.

2. Calculate the capital balances for Michelle and Devina using the goodwill approach.

3. Under the goodwill approach, what is the amount of goodwill that should be recognized by thepartnership?

Michelle Michelle Devina Devina (Cost) (Fair Value) (Cost) (Fair Value) S300,000 10,000,000 Cash $450,000 $450,000 $300,000 Land 6,000,000 Truck 7,000,000 6,500,000 Computer Inventory 1,500,000 200,000 1,300,000 200,000

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the capital balances for Michelle and Devina using t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started