Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Michigan Medical Technologies has two production departments, Assembly and Finishing. This assignment focuses on the Finishing Department. Roughly assembled products are transferred from Assembly

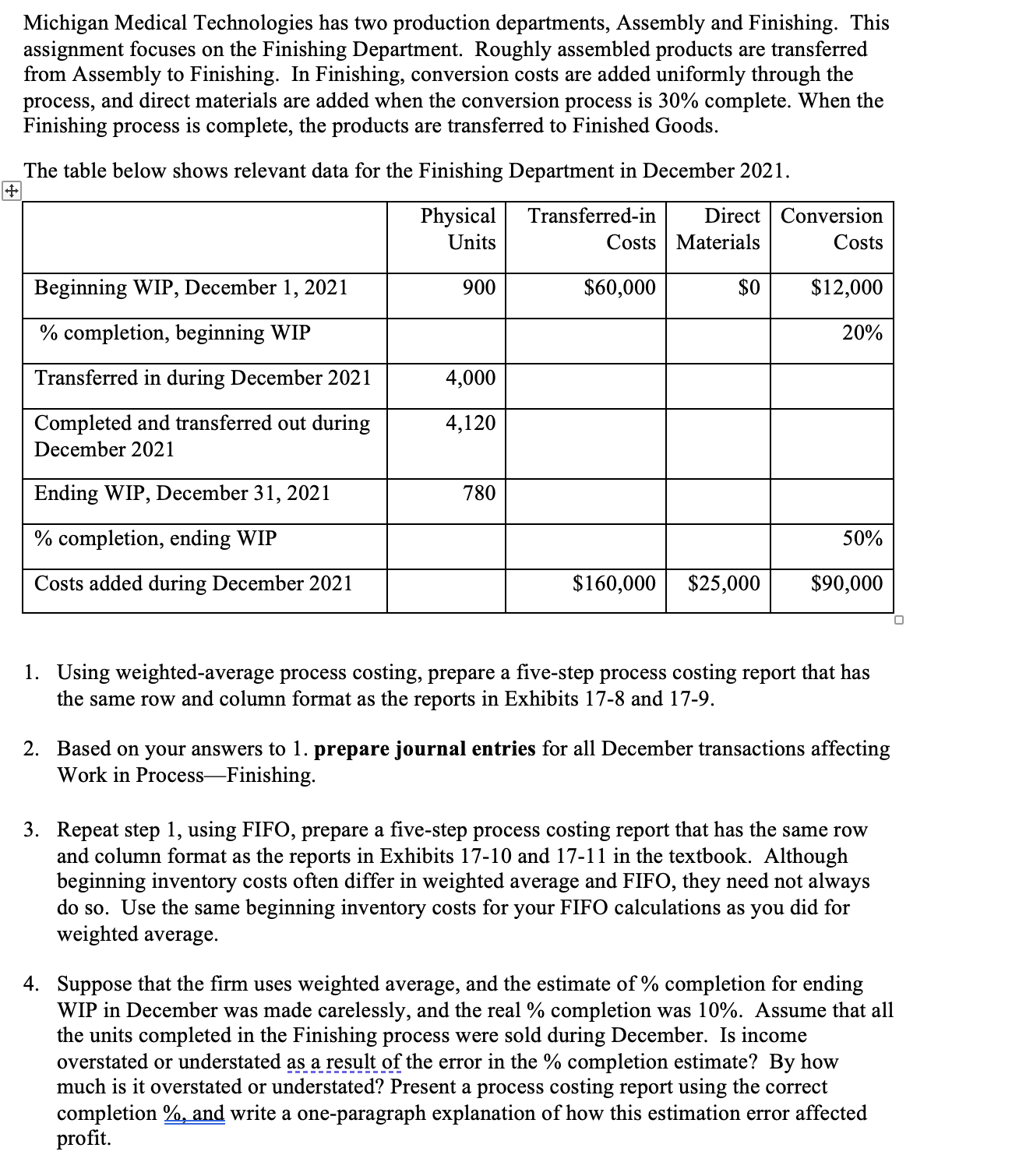

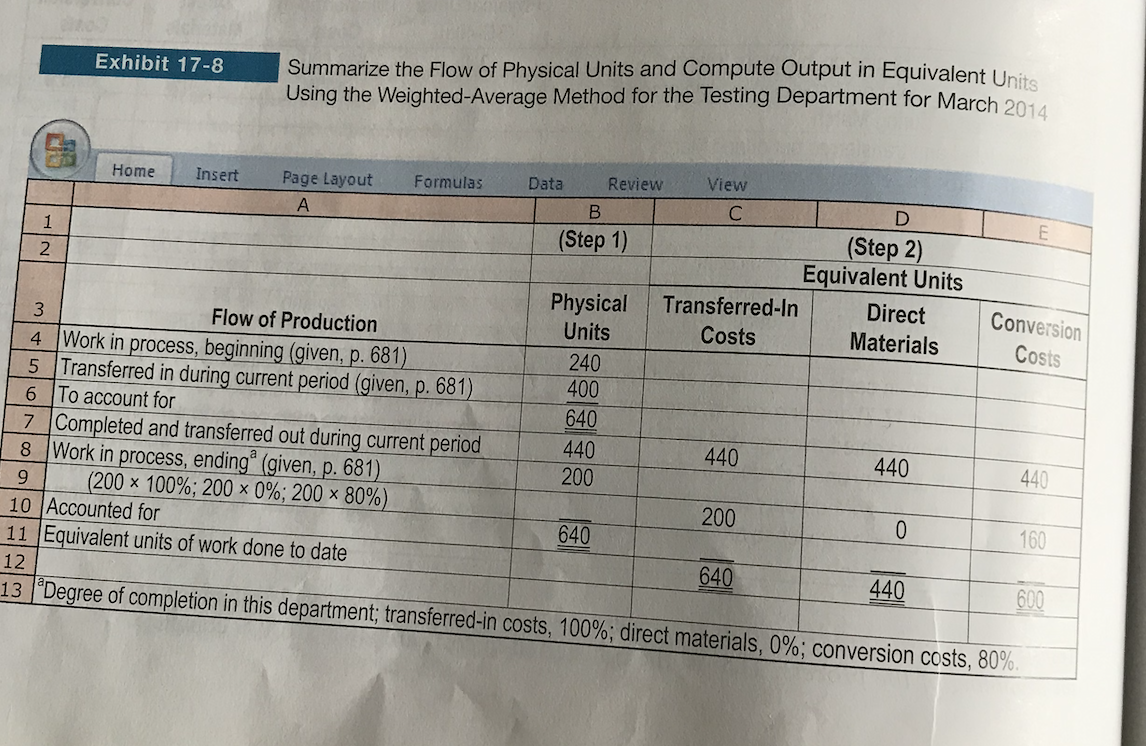

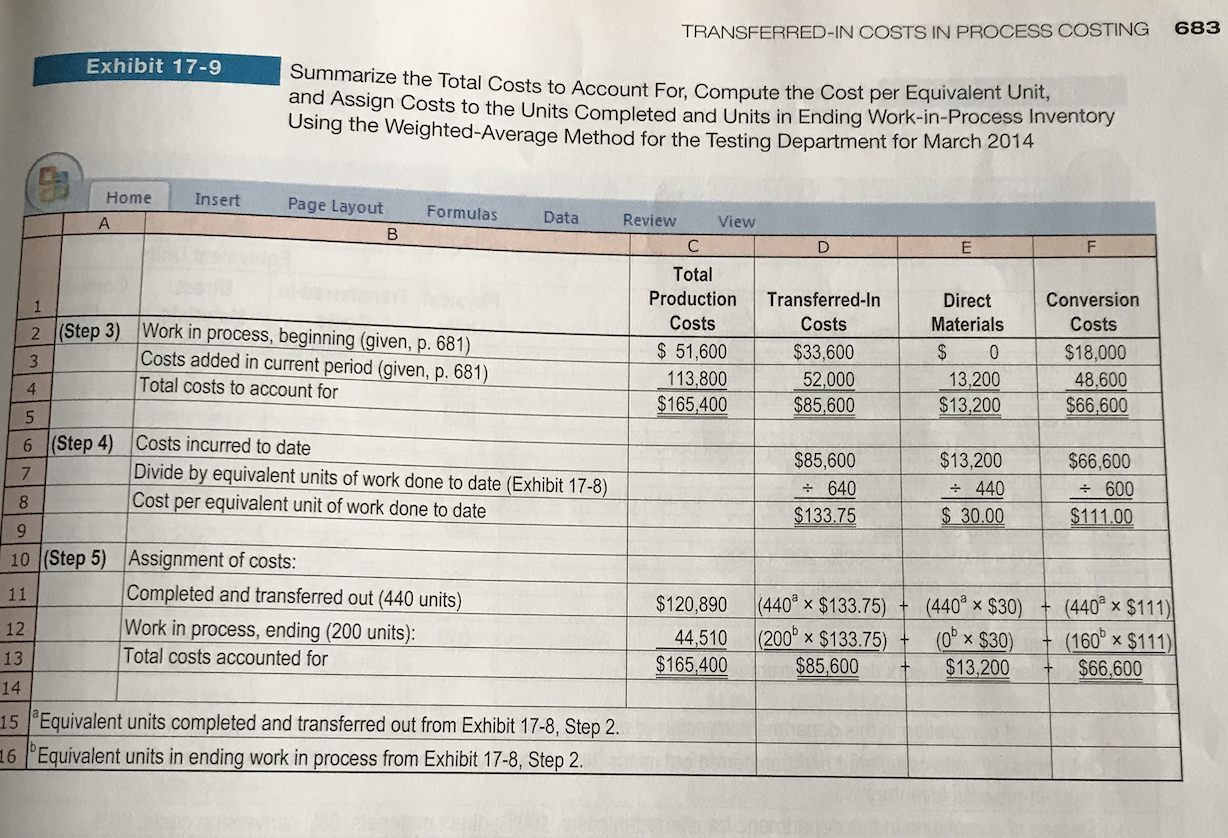

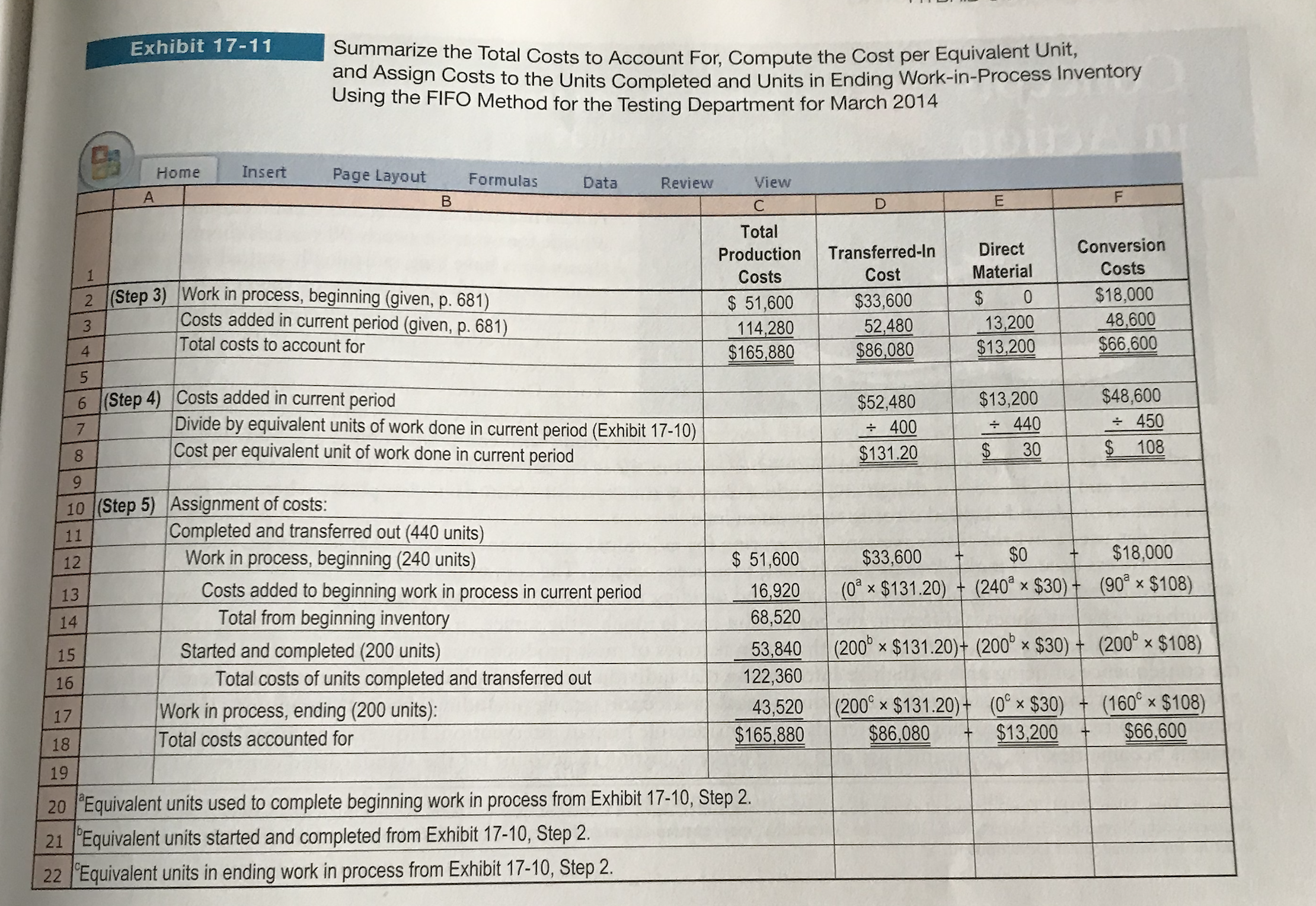

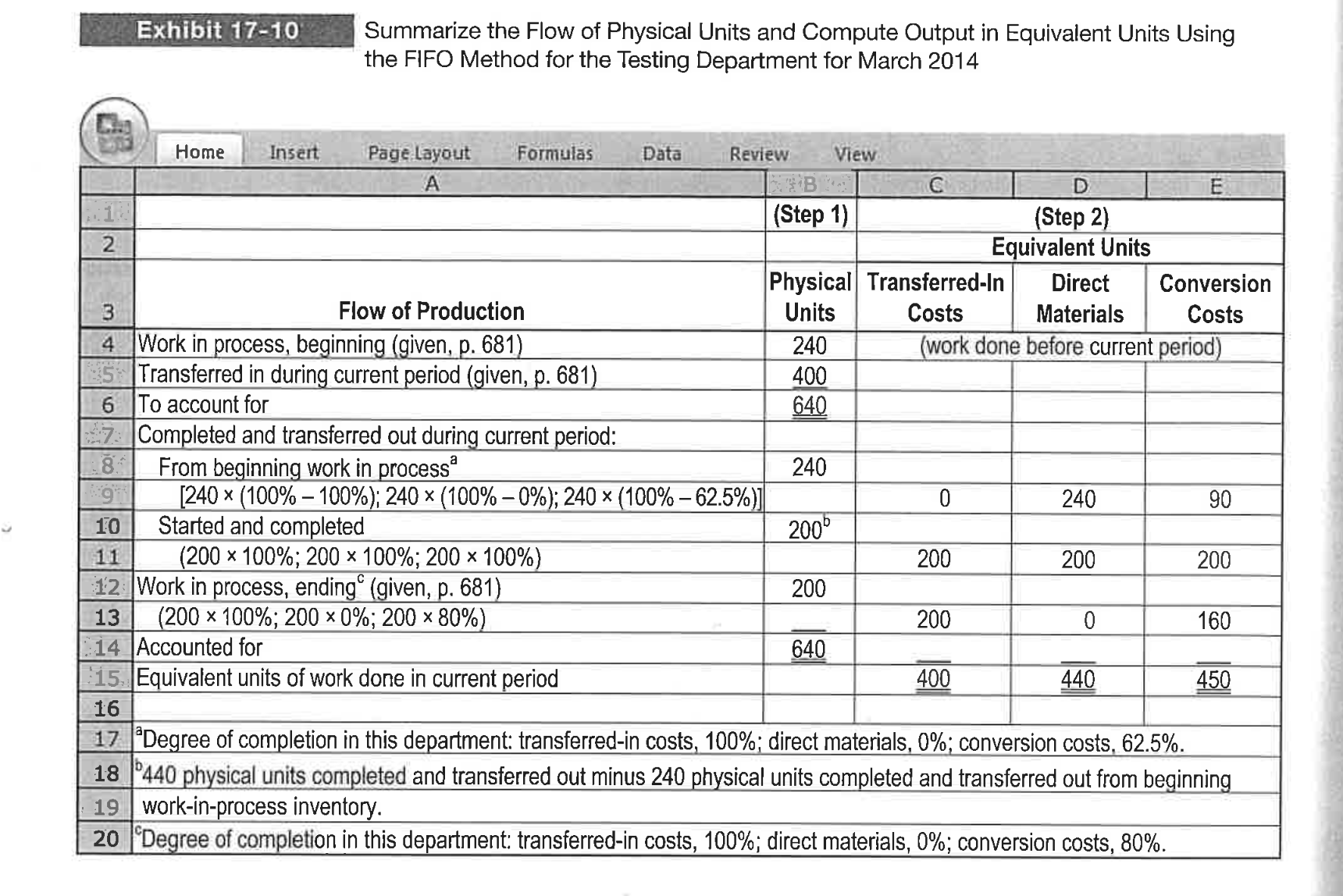

Michigan Medical Technologies has two production departments, Assembly and Finishing. This assignment focuses on the Finishing Department. Roughly assembled products are transferred from Assembly to Finishing. In Finishing, conversion costs are added uniformly through the process, and direct materials are added when the conversion process is 30% complete. When the Finishing process is complete, the products are transferred to Finished Goods. The table below shows relevant data for the Finishing Department in December 2021. Beginning WIP, December 1, 2021 Physical Units Transferred-in Direct Costs Materials Conversion Costs 900 $60,000 $0 $12,000 20% % completion, beginning WIP Transferred in during December 2021 4,000 Completed and transferred out during 4,120 December 2021 Ending WIP, December 31, 2021 780 % completion, ending WIP Costs added during December 2021 50% $160,000 $25,000 $90,000 1. Using weighted-average process costing, prepare a five-step process costing report that has the same row and column format as the reports in Exhibits 17-8 and 17-9. 2. Based on your answers to 1. prepare journal entries for all December transactions affecting Work in Process-Finishing. 3. Repeat step 1, using FIFO, prepare a five-step process costing report that has the same row and column format as the reports in Exhibits 17-10 and 17-11 in the textbook. Although beginning inventory costs often differ in weighted average and FIFO, they need not always do so. Use the same beginning inventory costs for your FIFO calculations as you did for weighted average. 4. Suppose that the firm uses weighted average, and the estimate of % completion for ending WIP in December was made carelessly, and the real % completion was 10%. Assume that all the units completed in the Finishing process were sold during December. Is income overstated or understated as a result of the error in the % completion estimate? By how much is it overstated or understated? Present a process costing report using the correct completion %, and write a one-paragraph explanation of how this estimation error affected profit. Exhibit 17-8 Summarize the Flow of Physical Units and Compute Output in Equivalent Units Using the Weighted-Average Method for the Testing Department for March 2014 Home Insert Page Layout Formulas A Data Review View B C D E 1 2 (Step 1) (Step 2) Equivalent Units Physical Transferred-In Direct Conversion 3 Flow of Production Units Costs Materials Costs 4 Work in process, beginning (given, p. 681) 240 5 Transferred in during current period (given, p. 681) 400 6 To account for 640 7 Completed and transferred out during current period 440 440 440 440 8 Work in process, ending (given, p. 681) 200 9 (200 x 100%; 200 x 0%; 200 80%) 200 0 10 Accounted for 160 640 11 Equivalent units of work done to date 640 440 12 600 13 Degree of completion in this department; transferred-in costs, 100%; direct materials, 0%; conversion costs, 80%. TRANSFERRED-IN COSTS IN PROCESS COSTING 683 Exhibit 17-9 Summarize the Total Costs to Account For, Compute the Cost per Equivalent Unit, and Assign Costs to the Units Completed and Units in Ending Work-in-Process Inventory Using the Weighted-Average Method for the Testing Department for March 2014 Home Insert Page Layout Formulas Data Review View A B C D E F Total Production Transferred-In 1 Costs Costs Direct Materials Conversion Costs 2 (Step 3) Work in process, beginning (given, p. 681) $ 51,600 $33,600 $ 0 $18,000 3 Costs added in current period (given, p. 681) 113,800 52,000 13,200 48,600 4 Total costs to account for $165,400 $85,600 $13,200 $66,600 5 6 (Step 4) Costs incurred to date $85,600 $13,200 $66,600 7 8 Divide by equivalent units of work done to date (Exhibit 17-8) +640 440 +600 $133.75 $ 30.00 $111.00 Cost per equivalent unit of work done to date 9 10 (Step 5) Assignment of costs: 11 Completed and transferred out (440 units) 12 Work in process, ending (200 units): 13 Total costs accounted for 14 15 Equivalent units completed and transferred out from Exhibit 17-8, Step 2. 16 Equivalent units in ending work in process from Exhibit 17-8, Step 2. $120,890 (440 x $133.75) + (440 x $30) (440 x $111) 44,510 $165,400 (200 x $133.75)+ $85,600 (0x $30) (160 x $111) $13,200 $66,600 Exhibit 17-11 Summarize the Total Costs to Account For, Compute the Cost per Equivalent Unit, and Assign Costs to the Units Completed and Units in Ending Work-in-Process Inventory Using the FIFO Method for the Testing Department for March 2014 1 3 4 5 6 (Step 4) Costs added in current period 7 8 Cost per equivalent unit of work done in current period Home Insert Page Layout Formulas Data Review A B View C D E F Total Production Costs Transferred-In Cost Direct Material Conversion Costs 2(Step 3) Work in process, beginning (given, p. 681) Costs added in current period (given, p. 681) Total costs to account for $ 51,600 $33,600 $ 0 $18,000 114,280 52,480 13,200 48,600 $165,880 $86,080 $13,200 $66.600 $52,480 $13,200 $48,600 Divide by equivalent units of work done in current period (Exhibit 17-10) 400 440 450 $131.20 $ 30 $ 108 9 10 (Step 5) Assignment of costs: 11 Completed and transferred out (440 units) 12 Work in process, beginning (240 units) $ 51,600 $33,600 13 Costs added to beginning work in process in current period 16,920 (0 x $131.20) $0 (240 x $30) $18,000 (90 x $108) 14 Total from beginning inventory 68,520 16 17 18 5698 15 Started and completed (200 units) 53,840 (200 x $131.20) (200 x $30) + (200 x $108) Total costs of units completed and transferred out 122,360 Work in process, ending (200 units): 43,520 (200 x $131.20) Total costs accounted for $165,880 $86,080 (0 x $30) $13,200 (160 x $108) $66,600 19 20 Equivalent units used to complete beginning work in process from Exhibit 17-10, Step 2. 21 Equivalent units started and completed from Exhibit 17-10, Step 2. 22 Equivalent units in ending work in process from Exhibit 17-10, Step 2. Exhibit 17-10 Summarize the Flow of Physical Units and Compute Output in Equivalent Units Using the FIFO Method for the Testing Department for March 2014 Home Insert Page Layout Formulas Data Review View A BO C D (Step 1) (Step 2) 2 Equivalent Units Physical Transferred-In Direct 3 Flow of Production Units Costs Materials Conversion Costs 4 Work in process, beginning (given, p. 681) 240 (work done before current period) 5 Transferred in during current period (given, p. 681) 400 6 To account for 640 7 Completed and transferred out during current period: 8 From beginning work in process 240 971 [240 (100% 100%); 240 (100% 0%); 240 (100% - 62.5%)]| 0 240 90 10 Started and completed 200b 11 (200 100%; 200 100%; 200 100%) 200 200 200 C 12 Work in process, ending (given, p. 681) 13 14 Accounted for 200 (200 100%; 200 0%; 200 80%) 200 0 160 640 15 Equivalent units of work done in current period 400 440 450 16 17 Degree of completion in this department: transferred-in costs, 100%; direct materials, 0%; conversion costs, 62.5%. 18 440 physical units completed and transferred out minus 240 physical units completed and transferred out from beginning 19 work-in-process inventory. 20 Degree of completion in this department: transferred-in costs, 100%; direct materials, 0%; conversion costs, 80%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started