Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mick Ronalds is a fast-food establishment that is considering replacing its fryolators. The cost of the new plant is $200,000. For tax purposes, depreciation

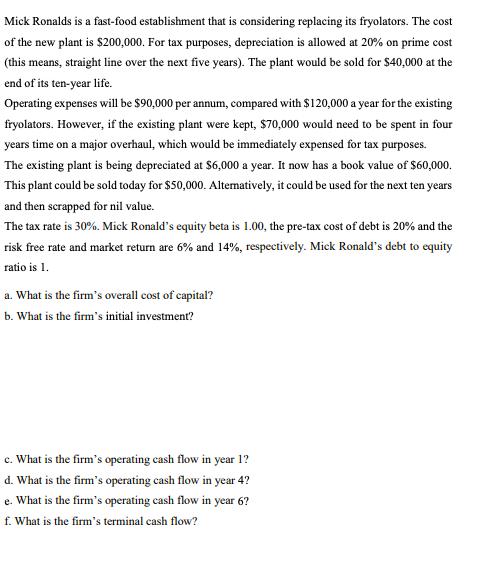

Mick Ronalds is a fast-food establishment that is considering replacing its fryolators. The cost of the new plant is $200,000. For tax purposes, depreciation is allowed at 20% on prime cost (this means, straight line over the next five years). The plant would be sold for $40,000 at the end of its ten-year life. Operating expenses will be $90,000 per annum, compared with $120,000 a year for the existing fryolators. However, if the existing plant were kept, $70,000 would need to be spent in four years time on a major overhaul, which would be immediately expensed for tax purposes. The existing plant is being depreciated at $6,000 a year. It now has a book value of $60,000. This plant could be sold today for $50,000. Alternatively, it could be used for the next ten years and then scrapped for nil value. The tax rate is 30%. Mick Ronald's equity beta is 1.00, the pre-tax cost of debt is 20% and the risk free rate and market return are 6% and 14%, respectively. Mick Ronald's debt to equity ratio is 1. a. What is the firm's overall cost of capital? b. What is the firm's initial investment? c. What is the firm's operating cash flow in year 1? d. What is the firm's operating cash flow in year 4? e. What is the firm's operating cash flow in year 6? f. What is the firm's terminal cash flow?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Part a Wd DD E 11 1 05 We 1 Wd 1 05 05 Ke Rf beta x Rm Rf 6 1 x 14 6 1400 the firms overall cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started