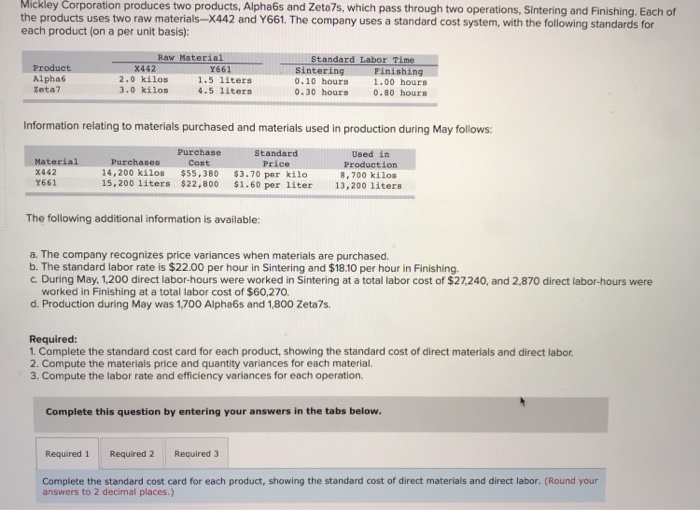

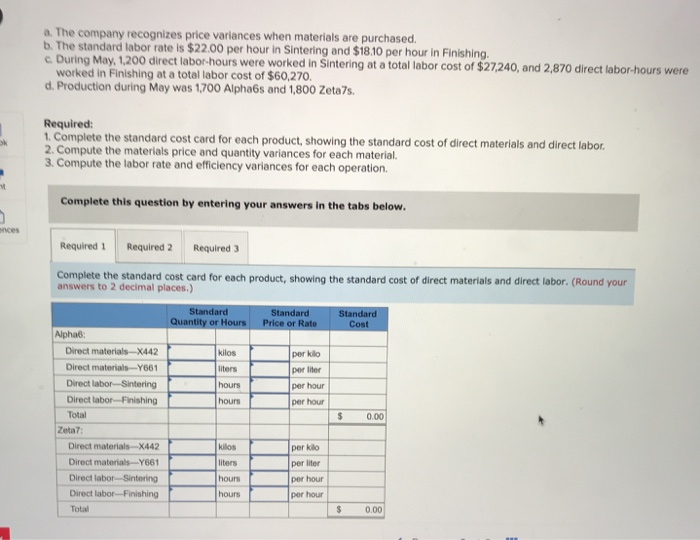

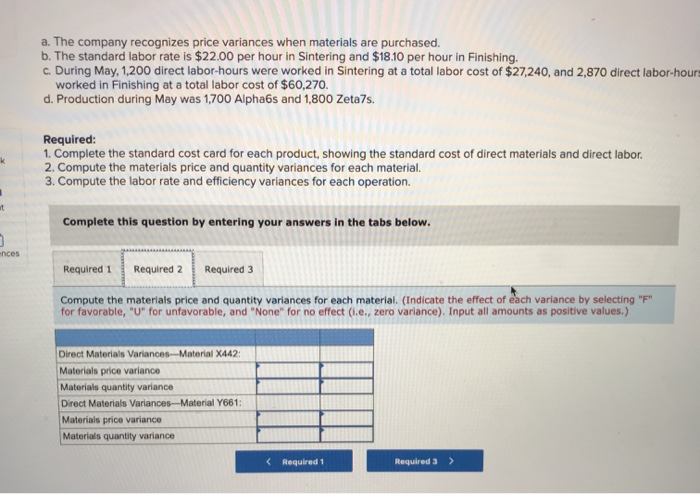

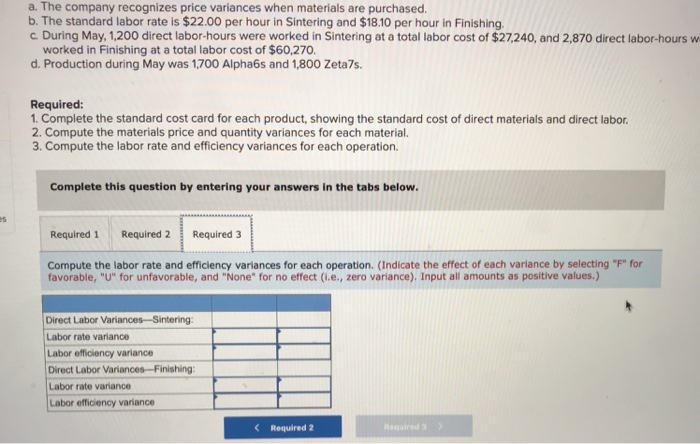

Mickley Corporation produces two products, Alpha6s and Zeta7s, which pass through two operations, Sintering and Finishing. Each of the products uses two raw materials-X442 and Y661. The company uses a standard cost system, with the following standards for each product (on a per unit basis): Raw Material Standard Labor Time Product X442 Finishing 1.00 hours Y661 1.5 1iters Sintering 0.10 hours Alpha6 Zeta7 2.0 kilos 3.0 kilos 4.5 liters 0.30 hours 0.80 hours Information relating to materials purchased and materials used in production during May follows: Purchase Standard Price $3.70 per kilo Used in Material Purchases Cost Production X442 14,200 kilos 15,200 1iters $22,800 $55,380 8,700 kilos 13,200 liters Y661 $1.60 per liter The following additional information is available: a. The company recognizes price variances when materials are purchased. b. The standard labor rate is $22.00 per hour in Sintering and $18.10 per hour in Finishing. c. During May, 1,200 direct labor-hours were worked in Sintering at a total labor cost of $27,240, and 2,870 direct labor-hours were worked in Finishing at a total labor cost of $60,270. d. Production during May was 1,700 Alpha6s and 1,800 Zeta7s. Required: 1. Complete the standard cost card for each product, showing the standard cost of direct materials and direct labor 2. Compute the materials price and quantity variances for each material. 3. Compute the labor rate and efficiency variances for each operation. Complete this question by entering your answers in the tabs below. Required 3 Required 1 Required 2 Complete the standard cost card for each product, showing the standard cost of direct materials and direct labor. (Round your answers to 2 decimal places.) a. The company recognizes price variances when materials are purchased b. The standard labor rate is $22.00 per hour in Sintering and $18.10 per hour in Finishing. c During May, 1,200 direct labor-hours were worked in Sintering at a total labor cost of $27,240, and 2,870 direct labor-hours were worked in Finishing at a total labor cost of $60,270. d. Production during May was 1,700 Alpha6s and 1,800 Zeta7s Required: 1. Complete the standard cost card for each product, showing the standard cost of direct materials and direct labor. 2. Compute the materials price and quantity variances for each material. 3. Compute the labor rate and efficiency variances for each operation. Complete this question by entering your answers in the tabs below. ences Required 1 Required 2 Required 3 Complete the standard cost card for each product, showing the standard cost of direct materials and direct labor. (Round your answers to 2 decimal places.) Standard Standard Price or Rate Standard Quantity or Hours Cost Alpha6: Direct materials-X442 kilos per kilo Direct materials-Y661 liters per liler Direct labor-Sintering hours per hour Direct labor-Finishing hours per hour Total 0.00 Zeta7: kilos Direct materials-X442 per kilo Direct materials-Y661 liters per liter Direct labor-Sintering hours per hour Direct labor-Finishing per hour hours Total 0.00 a. The company recognizes price variances when materials are purchased b. The standard labor rate is $22.00 per hour in Sintering and $18.10 per hour in Finishing. c. During May, 1,200 direct labor-hours were worked in Sintering at a total labor cost of $27,240, and 2,870 direct labor-hours worked in Finishing at a total labor cost of $60,270. d. Production during May was 1,700 Alpha6s and 1,800 Zeta7s. Required: 1. Complete the standard cost card for each product, showing the standard cost of direct materials and direct labor 2. Compute the materials price and quantity variances for each material. 3. Compute the labor rate and efficiency variances for each operation. t Complete this question by entering your answers in the tabs below. nces Required 2 Required 1 Required 3 Compute the materials price and quantity variances for each material. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Direct Materials Variances-Material X442: Materials price variance Materials quantity variance Direct Materials Variances-Material Y661: Materials price variance Materials quantity variance Required 1 Required 3 > a. The company recognizes price variances when materials are purchased. b. The standard labor rate is $22.00 per hour in Sintering and $18.10 per hour in Finishing. c. During May, 1,200 direct labor-hours were worked in Sintering at a total labor cost of $27,240, and 2,870 direct labor-hours w worked in Finishing at a total labor cost of $60,270. d. Production during May was 1,700 Alpha6s and 1,800 Zeta7s. Required: 1. Complete the standard cost card for each product, showing the standard cost of direct materials and direct labor 2. Compute the materials price and quantity variances for each material. 3. Compute the labor rate and efficiency variances for each operation. Complete this question by entering your answers in the tabs below Required 2 Required 1 Required 3 Compute the labor rate and efficiency variances for each operation. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Direct Labor Variances-Sintering: Labor rate variance Labor efficiency variance Direct Labor Variances-Finishing: Labor rate variance Labor efficiency variance Required 3 Required 2