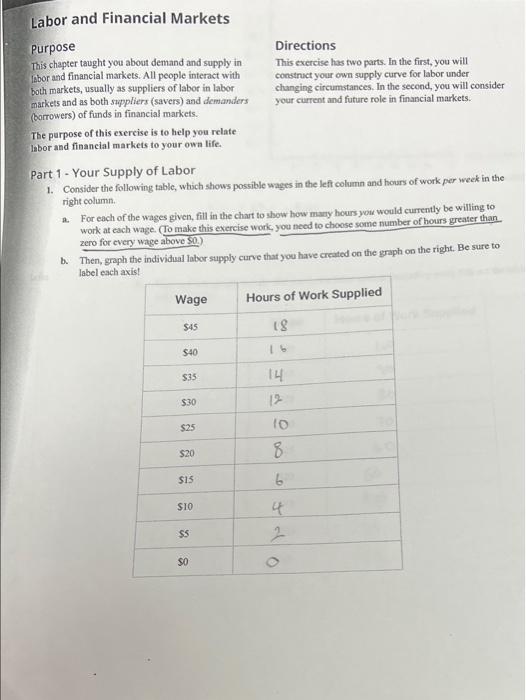

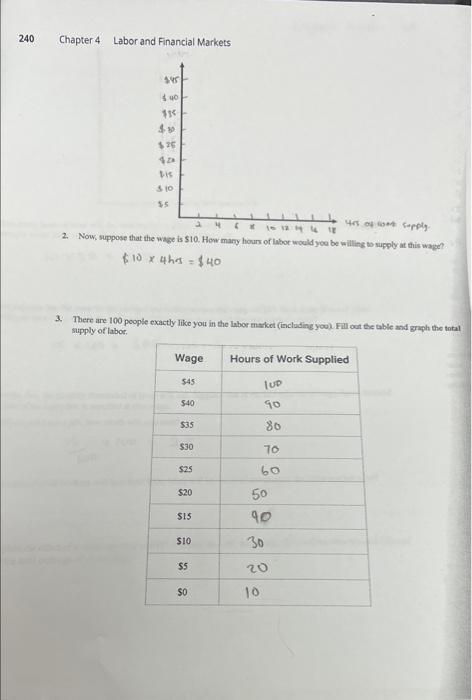

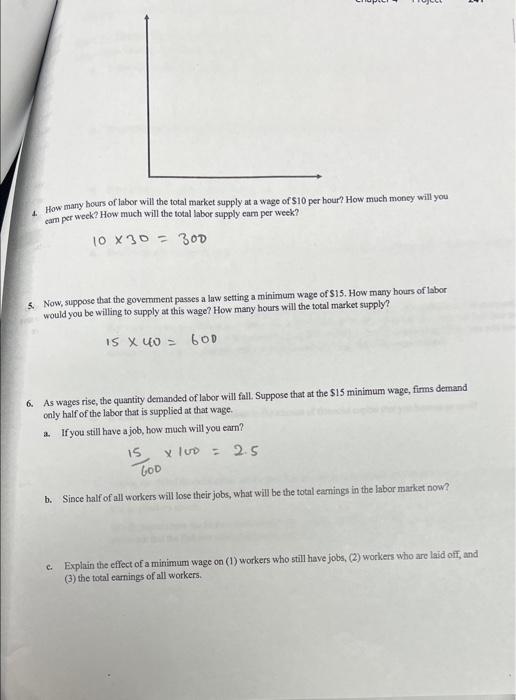

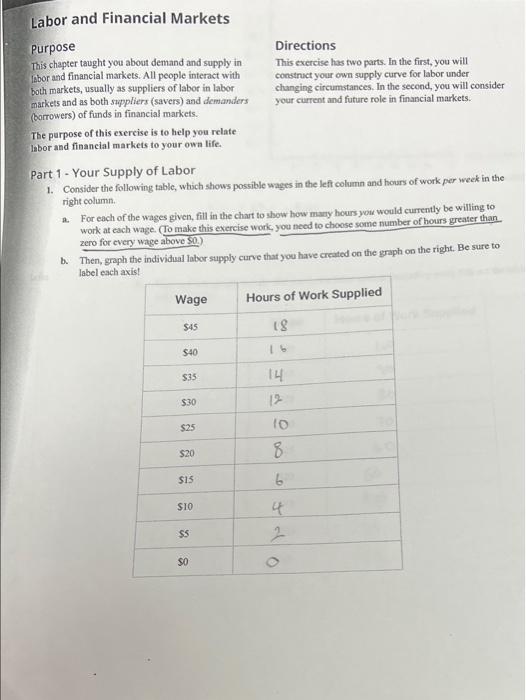

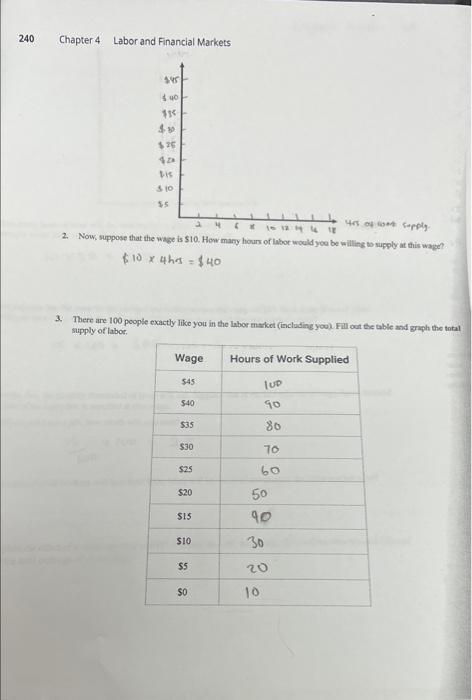

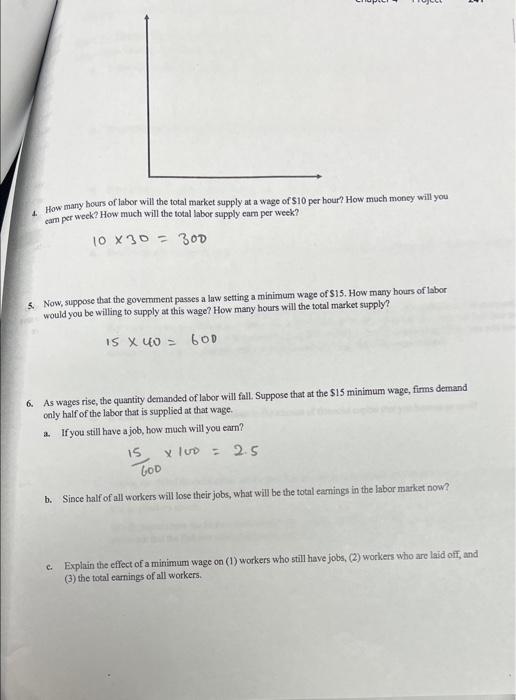

Labor and Financial Markets Purpose Directions This chapter taught you about demand and supply in This exercise has two parts. In the first, you will labor and financial markets. All people interact with construct your own supply curve for labor under both markets, usually as suppliers of labor in labor changing circumstances. In the second, you will consider markets and as both suppliers (savers) and demanders your current and future role in financial markets. (borrowers) of funds in financial markets. The purpose of this exercise is to help you relate hbor and financial markets to your own life. Part 1 - Your Supply of Labor 1. Consider the following table, which shows possible wages in the left column and hours of work per week in the right column 2. For each of the wages given, fill in the chart to show how many hours you would currently be willing to work at each wage. (To make this exercise work, you need to choose some number of hours greater than zero for every wage above SO.) b. Then, sraph the individual labor supply curve that you have created on the graph on the right. Be sure to label ench axist Wage Hours of Work Supplied $45 18 $40 I $35 14. 12 $30 $25 10 S20 8 SIS 6. SIO 2 ss so 240 Chapter 4 Labor and Financial Markets sel $90 31 $10 $25 $10 55 apples 2. Now, suppose that the wape is SIO How many hours of labor would you be willing to supply at this way? $ 10 x 4hs = $40 3. There are 100 people exactly like you in the labor market (including you fill out the table and graph the total supply of labor Wage Hours of Work Supplied 545 TUD $40 535 80 $30 70 $25 60 $20 50 $15 40 SIO 30 SS 20 SO 10 How many hours of labor will the total market supply at a wage of $10 per hour? How much money will you car per week? How much will the total labor supply eam per week? 10 X30 = 300 5. Now, suppose that the government passes a low setting a minimum wage of $15. How many hours of labor would you be willing to supply at this wage? How many hours will the total market supply? is Xuo = 6. As wages rise, the quantity demanded of labor will fall. Suppose that at the S15 minimum wage, firms demand only half of the labor that is supplied at that wage. 2. If you still have a job, how much will you earn? - 2.5 Y luo 15 GOD b. Since half of all workers will lose their jobs, what will be the total earnings in the labor market now? c. Explain the effect of a minimum wage on (1) workers who still have jobs. (2) workers who are laid off, and (3) the total earnings of all workers. 142 Chapter 4 Labor and Financial Markets Part 2 - Exploring Financial Markets Most college students take out some student loans. 1. In financial markets, are students the demanders or suppliers of financial capital? 2. If interest rates rise, are students likely to take out more or fewer student loans? 3. If the return on a college degree falls, are students likely to take out more or fewer student loans? 4. Briefly explain the difference between (2) and (3) above in terms of what has happened in financial markets. 5 Most young people are borrowers in financial markets because their camings are relatively low as compared to their future carings, and they need things like cars and education and houses that they have not had time to save up for. As you get older and your income rises, your income may exceed your spending. Then, you will have savings. At that point in your life, will you be a demander or supplier of financial capital? 6. If interest rates fall, what will happen to the amount of financial capital that you borrow or save? 7. During the global financial crisis, the Federal Reserve decreased interest rates to close to zero. One reason why . the Fed did this was to encourage firms 10 borrow funds to expand and to hire more workers. However, this also had an effect on savers. Briefly explain how the Fed's actions would affect you if you were a borrower and if you were a saver. Why do you think that the Fed was willing to take this action? Labor and Financial Markets Purpose Directions This chapter taught you about demand and supply in This exercise has two parts. In the first, you will labor and financial markets. All people interact with construct your own supply curve for labor under both markets, usually as suppliers of labor in labor changing circumstances. In the second, you will consider markets and as both suppliers (savers) and demanders your current and future role in financial markets. (borrowers) of funds in financial markets. The purpose of this exercise is to help you relate hbor and financial markets to your own life. Part 1 - Your Supply of Labor 1. Consider the following table, which shows possible wages in the left column and hours of work per week in the right column 2. For each of the wages given, fill in the chart to show how many hours you would currently be willing to work at each wage. (To make this exercise work, you need to choose some number of hours greater than zero for every wage above SO.) b. Then, sraph the individual labor supply curve that you have created on the graph on the right. Be sure to label ench axist Wage Hours of Work Supplied $45 18 $40 I $35 14. 12 $30 $25 10 S20 8 SIS 6. SIO 2 ss so 240 Chapter 4 Labor and Financial Markets sel $90 31 $10 $25 $10 55 apples 2. Now, suppose that the wape is SIO How many hours of labor would you be willing to supply at this way? $ 10 x 4hs = $40 3. There are 100 people exactly like you in the labor market (including you fill out the table and graph the total supply of labor Wage Hours of Work Supplied 545 TUD $40 535 80 $30 70 $25 60 $20 50 $15 40 SIO 30 SS 20 SO 10 How many hours of labor will the total market supply at a wage of $10 per hour? How much money will you car per week? How much will the total labor supply eam per week? 10 X30 = 300 5. Now, suppose that the government passes a low setting a minimum wage of $15. How many hours of labor would you be willing to supply at this wage? How many hours will the total market supply? is Xuo = 6. As wages rise, the quantity demanded of labor will fall. Suppose that at the S15 minimum wage, firms demand only half of the labor that is supplied at that wage. 2. If you still have a job, how much will you earn? - 2.5 Y luo 15 GOD b. Since half of all workers will lose their jobs, what will be the total earnings in the labor market now? c. Explain the effect of a minimum wage on (1) workers who still have jobs. (2) workers who are laid off, and (3) the total earnings of all workers. 142 Chapter 4 Labor and Financial Markets Part 2 - Exploring Financial Markets Most college students take out some student loans. 1. In financial markets, are students the demanders or suppliers of financial capital? 2. If interest rates rise, are students likely to take out more or fewer student loans? 3. If the return on a college degree falls, are students likely to take out more or fewer student loans? 4. Briefly explain the difference between (2) and (3) above in terms of what has happened in financial markets. 5 Most young people are borrowers in financial markets because their camings are relatively low as compared to their future carings, and they need things like cars and education and houses that they have not had time to save up for. As you get older and your income rises, your income may exceed your spending. Then, you will have savings. At that point in your life, will you be a demander or supplier of financial capital? 6. If interest rates fall, what will happen to the amount of financial capital that you borrow or save? 7. During the global financial crisis, the Federal Reserve decreased interest rates to close to zero. One reason why . the Fed did this was to encourage firms 10 borrow funds to expand and to hire more workers. However, this also had an effect on savers. Briefly explain how the Fed's actions would affect you if you were a borrower and if you were a saver. Why do you think that the Fed was willing to take this action