Microeconomics. Provide solutions for these.

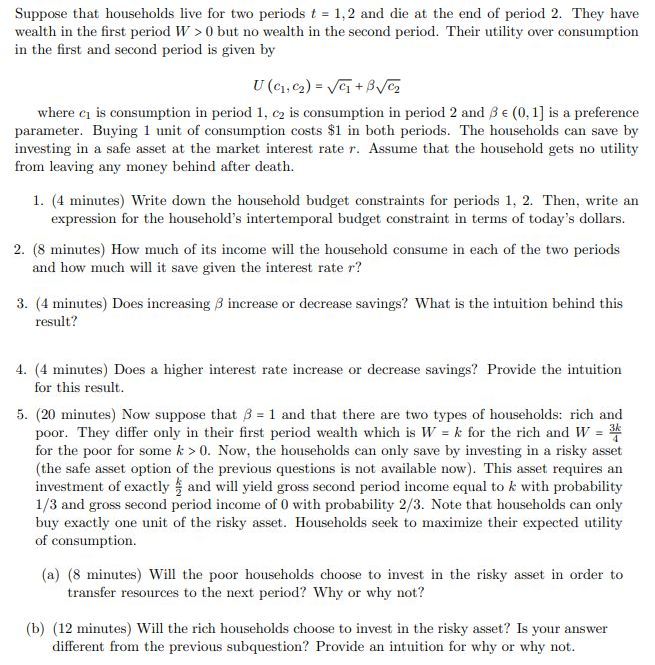

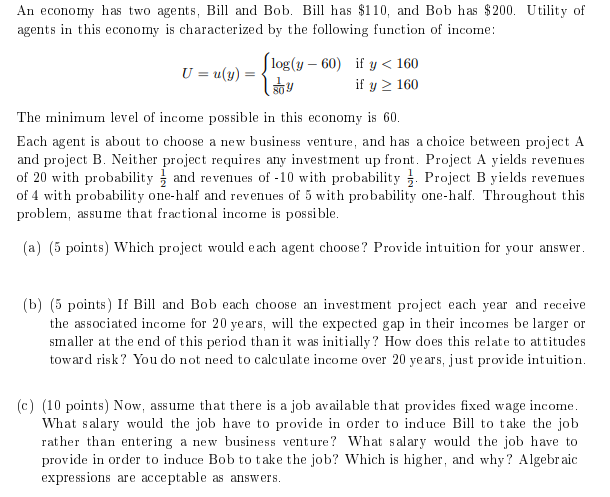

Suppose that households live for two periods t = 1,2 and die at the end of period 2. They have wealth in the rst period W 2- [l but no wealth in the second period. Their utility over consumption in the first and semnd period is given by Ui1521= EE'I-v where c1 is consumption in period 1, cg is consumption in period 2 and 13 E [i]. l] is a preference parameter. Buying 1 unit of consumption costs $1 in both periods. The households can save by investing in a safe asset at the market interest rate 1*. Assume that the household gets no utility from leaving any money behind after death. 1. {4 minutes) Write down the household budget constraints for periods 1. 2. Then, write an expression for the household's intertemporal budget constraint in terms of today's dollars. 2. {3 minutm} How much of its immme will the household consume in each of the two periods and how much will it save given the interest rate r? 3. (4 rninutm} Does increasing ,5 increase or decrease savings? What is the intuition behind this result? cl. {4 minutes} Does a higher interest rate increase or decrease savings? Provide the intuition for this result. 5. {20 minutes} Now suppose that 13 = 1 and that there are two types of households: rich and poor. They differ only in their rst period wealth which is W = Jr for the rich and W = for the poor for some It 2: [1. Now. the households can only save by investing in a risky asset {the safe asset option of the previous questions is not available now]. This asset requires an investment of exactly '3' and will yield gross second period income equal to l: with probability US and gross second period income oil] with probability 2H. Note that households can only buy exactly one unit of the risky asset. Households seek to maximise their expected utility of consumption. {a} {3 minutes] Will the poor households choose to invest in the risky asset in order to transfer resources to the next period? Why or why not? (b) {12 minutes] 1Will the rich households choose to invat in the risky asset? Is your answer different from the previous subqution? Provide an intuition for why or why not. \fAn economy has two agents, Bill and Bob. Bill has $110, and Bob has $200. Utility of agents in this economy is characterized by the following function of income: U = u(y) = [ log(y - 60) if y 160 The minimum level of income possible in this economy is 60. Each agent is about to choose a new business venture, and has a choice between project A and project B. Neither project requires any investment up front. Project A yields revenues of 20 with probability = and revenues of -10 with probability -. Project B yields revenues of 4 with probability one-half and revenues of 5 with probability one-half. Throughout this problem, assume that fractional income is possible. (a) (5 points) Which project would each agent choose? Provide intuition for your answer. (b) (5 points ) If Bill and Bob each choose an investment project each year and receive the associated income for 20 years, will the expected gap in their incomes be larger or smaller at the end of this period than it was initially ? How does this relate to attitudes toward risk? You do not need to calculate income over 20 years, just provide intuition. (c) (10 points) Now, assume that there is a job available that provides fixed wage income. What salary would the job have to provide in order to induce Bill to take the job rather than entering a new business venture? What salary would the job have to provide in order to induce Bob to take the job? Which is higher, and why? Algebraic expressions are acceptable as answers.\f