Microeconomics. Solve these.

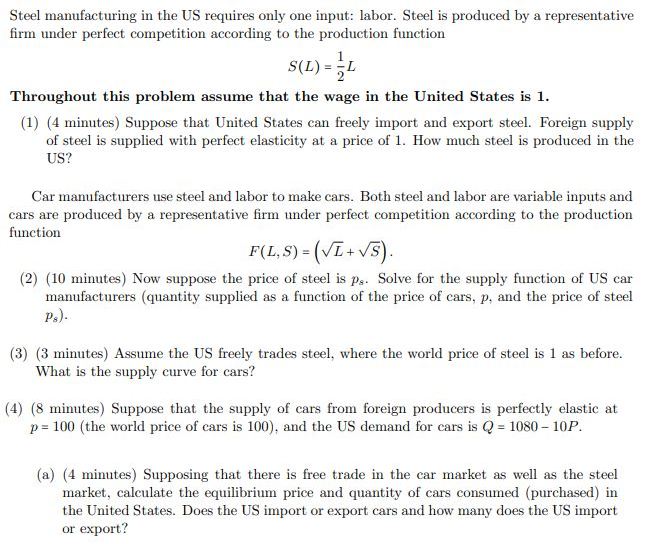

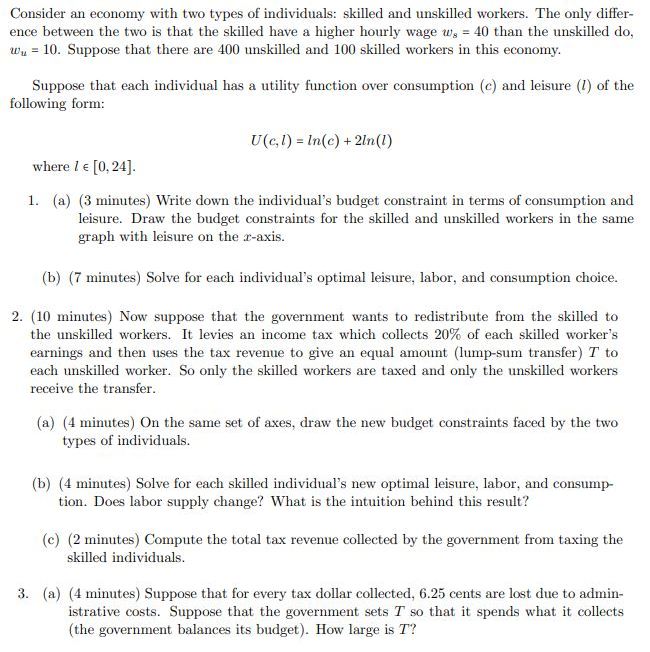

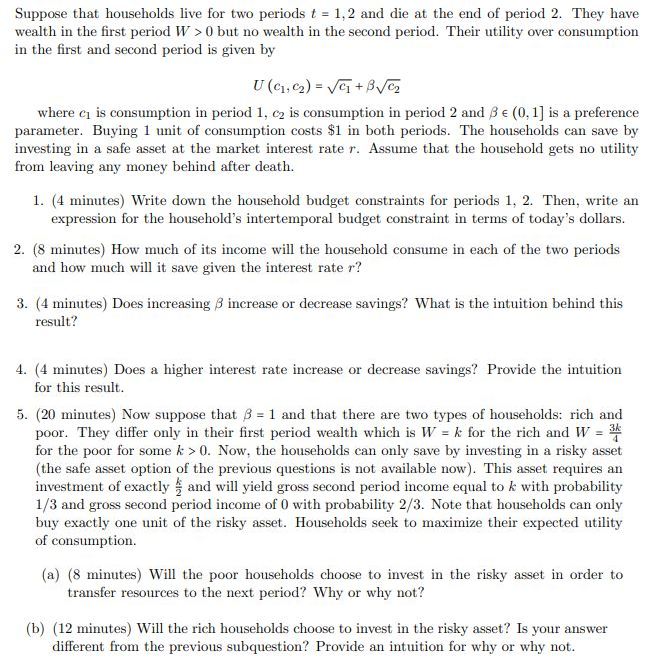

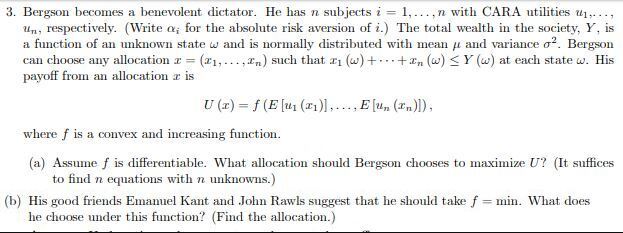

Steel manufacturing in the US requires only one input: labor. Steel is produced by a representative rm under perfect competition according to the production function 1 L = L St ) 2 Throughout this problem assume that the wage in the United States is 1. {1} {4 minuta) Suppose that United States can freely import and expert steel. Foreign supply of steel is supplied with perfect elasticity at a price of 1. How much steel is produced in the US\"? Car manufacturers use steel and labor to make cars. Both steel and labor are variable inputs and cars are produced by a. representative firm under perfect competition according to the production function F[L,S) = \"3+ vi?) {2) {1D minutes} Now suppose the price of steel is p3. Solve for the supply function of US car manufacturers [quantity supplied as a function of the price of cars, is... and the price of steel a)- {3} {3 minutes} Assume the US freely trades steel, where the world price of steel is 1 as before. 1What is the supply curve for cars? {4] {3 minutes] Suppose that the supply of cars from foreign producers is perfectly elastic at p = lll {the world price of cars is Hill}7 and the US demand for cars is Q = lS lP. {a} {4 minutes] Supposing that there is free trade in the car market as well as the steel market, calculate the equilibrium price and quantity of cars consumed {purchased} in the United States. Does the US imp-ort- orerport cars andhow many ow the US import or export? Consider an economy with two types of individuals: skilled and unskilled workers. The only differ- ence between the two is that the skilled have a higher hourly wage w. = 40 than the unskilled do, wu = 10. Suppose that there are 400 unskilled and 100 skilled workers in this economy. Suppose that each individual has a utility function over consumption (c) and leisure (1) of the following form: U(c, 1) = In(c) + 2In(1) where I E [0, 24]. 1. (a) (3 minutes) Write down the individual's budget constraint in terms of consumption and leisure. Draw the budget constraints for the skilled and unskilled workers in the same graph with leisure on the r-axis. (b) (7 minutes) Solve for each individual's optimal leisure, labor, and consumption choice. 2. (10 minutes) Now suppose that the government wants to redistribute from the skilled to the unskilled workers. It levies an income tax which collects 20% of each skilled worker's earnings and then uses the tax revenue to give an equal amount (lump-sum transfer) T to each unskilled worker. So only the skilled workers are taxed and only the unskilled workers receive the transfer. (a) (4 minutes) On the same set of axes, draw the new budget constraints faced by the two types of individuals. (b) (4 minutes) Solve for each skilled individual's new optimal leisure, labor, and consump- tion. Does labor supply change? What is the intuition behind this result? (c) (2 minutes) Compute the total tax revenue collected by the government from taxing the skilled individuals. 3. (a) (4 minutes) Suppose that for every tax dollar collected, 6.25 cents are lost due to admin- istrative costs. Suppose that the government sets 7 so that it spends what it collects (the government balances its budget). How large is T"?Suppose that households live for two periods t = 1,2 and die at the end of period 2. They have wealth in the rst period W 2- [l but no wealth in the second period. Their utility over consumption in the first and semnd period is given by Ui1521= EE'I-v where c1 is consumption in period 1, cg is consumption in period 2 and 13 E [i]. l] is a preference parameter. Buying 1 unit of consumption costs $1 in both periods. The households can save by investing in a safe asset at the market interest rate 1*. Assume that the household gets no utility from leaving any money behind after death. 1. {4 minutes) Write down the household budget constraints for periods 1. 2. Then, write an expression for the household's intertemporal budget constraint in terms of today's dollars. 2. {3 minutm} How much of its immme will the household consume in each of the two periods and how much will it save given the interest rate r? 3. (4 rninutm} Does increasing ,5 increase or decrease savings? What is the intuition behind this result? cl. {4 minutes} Does a higher interest rate increase or decrease savings? Provide the intuition for this result. 5. {20 minutes} Now suppose that 13 = 1 and that there are two types of households: rich and poor. They differ only in their rst period wealth which is W = Jr for the rich and W = for the poor for some It 2: [1. Now. the households can only save by investing in a risky asset {the safe asset option of the previous questions is not available now]. This asset requires an investment of exactly '3' and will yield gross second period income equal to l: with probability US and gross second period income oil] with probability 2H. Note that households can only buy exactly one unit of the risky asset. Households seek to maximise their expected utility of consumption. {a} {3 minutes] Will the poor households choose to invest in the risky asset in order to transfer resources to the next period? Why or why not? (b) {12 minutes] 1Will the rich households choose to invat in the risky asset? Is your answer different from the previous subqution? Provide an intuition for why or why not. \f